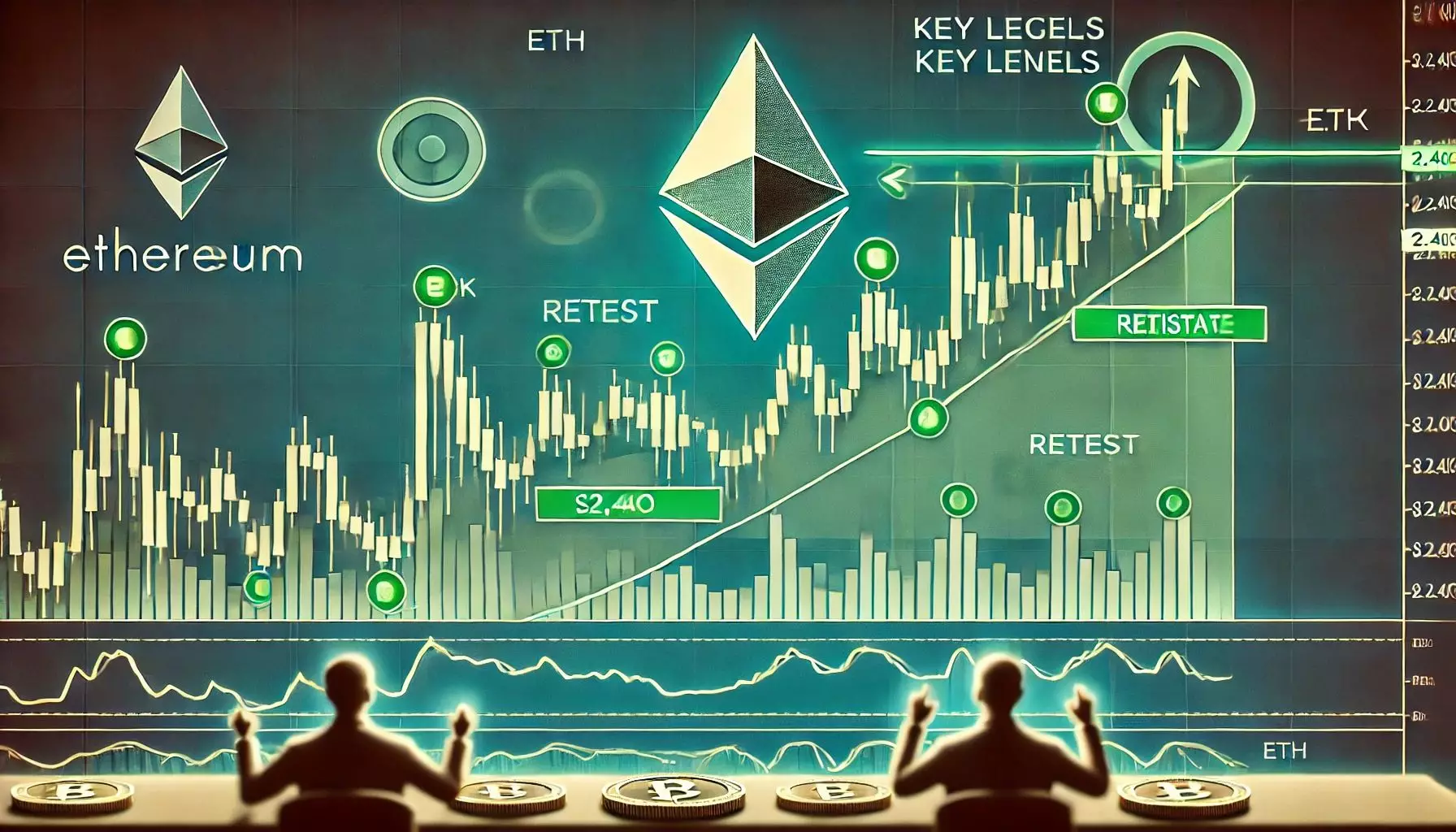

In an increasingly volatile digital asset landscape, Ethereum has emerged as a titan, recently capturing the attention of investors and analysts alike. After experiencing a mammoth surge of over 50%, the price of this cryptocurrency took a breather just shy of $2,740, a psychological and technical resistance point. But the question lingers: is Ethereum’s bull market solid, or is it teetering on the brink of a correction? The vital $2,400 threshold is where the answer to this question begins to unfold.

Past Performance: An Indicator of Future Trends

Historically, price action in the cryptocurrency realm often serves as a crucial indicator of future trends. Ethereum’s journey over the past few months has been characterized by relentless selling pressure, leading to skepticism about its resilience. The recent rally has been exhilarating but somewhat precarious, particularly as it breaks through significant resistance levels. A close look at these patterns can reveal an unsettling reality: rapid ascents are often followed by sharp corrections, and the potential for that to happen here appears high.

The recent analytical efforts have highlighted the crucial resistance at $2,740, which also corresponds to the psychological barriers in the trading community. This is the point where Ethereum needs to prove its robustness. A push past this level could signify a sustainable breakout, whereas a stall could spell trouble. The trading volume has also reflected indecision, suggesting that bulls need a convincing show of strength to maintain momentum.

A Cautionary Level: The Importance of $2,400

Daan, a prominent market analyst, suggests that the $2,400 mark is critical for Ethereum. He emphasizes the need to hold this level for any sustainability of the bullish trend. Why is this point so pivotal? It serves as a local support zone that could provide the necessary cushion for another attempt at higher ground. Notably, the $2,400 threshold has been psychologically significant not just for Ethereum, but for the entire altcoin market. Failure to maintain this level might set the stage for a sharper pullback to $2,200, a point that has garnered attention from traders scrutinizing risk.

At this juncture, the high levels of Open Interest in the ETH derivatives market raise red flags. The existence of leveraged positions can lead to abrupt market shifts—a reality that should not be overlooked. As Daan puts it, the wise move would be to wait for a flush out of some of this leverage before stepping back into long positions. This prudent strategy echoes a larger truth in trading: while fear of missing out can be a potent emotion, an even greater one should be caution.

Market Dynamics: The Costs of Indecision

The cryptocurrency ecosystem operates uniquely, wherein various altcoins often follow trends set by leaders like Ethereum. As anticipation builds within the broader altcoin market for what many are terming an “altseason,” market participants are keenly watching Ethereum. However, any notable pullback in ETH could stymie momentum across the board and lead to a period of stagnation for those dependent on Ethereum’s direction.

In this light, the market remains engulfed in a cycle of anxiety and anticipation. While optimism is palpable, the recent surge is tempered by the reality of trading dynamics. Among altcoins that have been severely underserved in the past, the pressure remains to deliver substantial returns, and Ethereum stands on the precipice of either igniting that or snuffing it out with a failed attempt to solidify above $2,700.

The Path Ahead: Defining the Future Range

Price action currently suggests a range-bound environment for ETH amid a consolidation phase between $2,400 and $2,700. For Ethereum bulls to capture an upward trajectory, they must successfully navigate this tight trading range. If Ethereum can clear the resistance posed by the 200-day Simple Moving Average (SMA), a further ascent to the $3,000–$3,100 zone seems feasible.

Yet, one cannot ignore the dark cloud hovering overhead: market skepticism rooted in the fear of another downturn. As the old trading axiom suggests, the longer the consolidation, the more powerful the breakout—or breakdown—can be. Thus, for traders looking for Hail Mary moments, engaging before Ethereum decisively breaks either of these critical levels is a gamble, albeit an enticing one.

In summation, Ethereum stands at a significant crossroads. Whether it can break through its immediate resistance or hold the crucial support at $2,400 will be indicative of not just its fate, but that of the entire altcoin market. The coming days are critical, as traders weigh risks and opportunities amid the volatility that defines the world of cryptocurrencies.