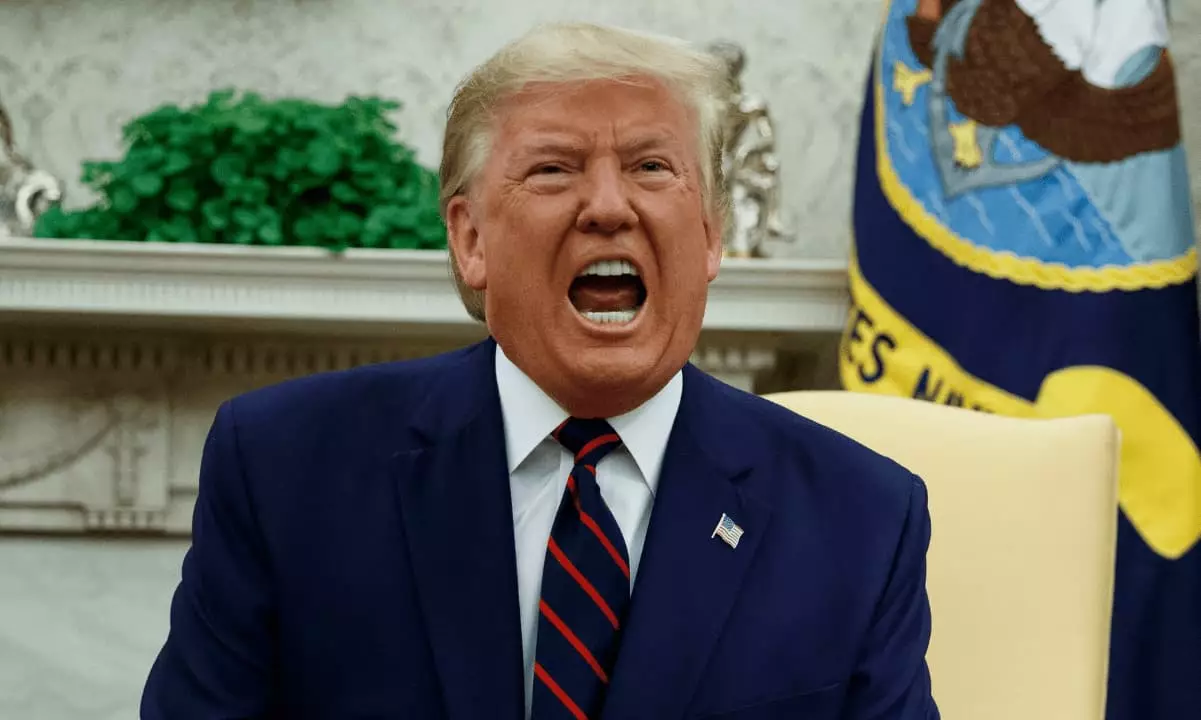

At the crux of a disturbing trend in American politics lies the intersection of cryptocurrency and political fundraising, a realm recently thrust into the spotlight due to investigations into former President Donald Trump’s financial ventures. Top Democrats in Congress, troubled by the implications of Trump’s forays into the crypto world, are taking decisive steps to uncover what they perceive as potential abuses of power. Their inquiry into various fundraising platforms linked to Trump reflects a deep-seated concern about the blend of politics and unregulated financial technology.

The specific focus lies on Trump’s connections to numerous political action committees, including those tied to familiar faces like Elon Musk. What raises eyebrows is not just the sheer volume of money exchanged but the opaque nature of these transactions. Lawmakers are combing through suspicious activity reports (SARs) to shed light on potentially illegal fundraising practices. The implications of using funds in innovative yet controversial ways cannot be overstated, as the ramifications could extend far beyond party lines.

Foreign Influence and the Ethics of Anonymity

There is an undeniable risk that lies within the anonymity that cryptocurrencies unveil. The inquiry takes a fraught turn as it unravels connections to foreign entities—some allegedly linked to China—tapping into the lucrative world of Trump’s fundraising. The Democrats’ memo points to a troubling narrative: foreign investors allegedly profiting at the expense of American citizens while engaging in activities that skirt the edges of integrity. The potential for foreign influence over U.S. policy through anonymous coin buyers poses a significant national security threat.

Interestingly, Trump’s entities have reportedly accrued a staggering $100 million in trading fees concerning meme coins that were also used as fundraising tools. With close to 80% of the supply of these tokens under the president’s control, the implications fall into murky waters of insider trading, a practice that many on the left denounce vehemently. The Democratic officials fear that this could lead to a “pump-and-dump” strategy benefiting only the insiders while leaving unsuspecting investors in the lurch.

The Business of Politics: A Thorny Relationship

It’s impossible to ignore the volatile nature of Trump’s business dealings in tandem with his political career. The planned launch of a stablecoin, dubbed USD1, underscores this precarious relationship steeped in ethical concerns. Supported by significant investments from entities in foreign nations, these developments raise questions about where the line between business and governance is drawn. Trump’s ability to orchestrate economic ventures while simultaneously navigating the murky the waters of governance presents a challenge to American political ethics.

The track record of Binance, a crypto exchange embroiled in regulatory scrutiny, further complicates this narrative. The recent $2 billion investment plan involving Trump’s proposed stablecoin illustrates an alarming trend where political figures engage with businesses notorious for violating anti-money-laundering laws. These cases prompt serious questions about potential conflicts of interest and the profound dangers of allowing personal financial gain to seep into the political sphere.

Legislative Pushback and the Call for Regulation

As the cloud of investigation looms, there is an accompanying wave of momentum within Congress for stricter regulations around cryptocurrency, especially its entanglement with political fundraising. A recent legislative proposal aimed at forbidding sitting presidents and members of Congress from profiting off cryptocurrencies signals a shot across the bow, attempting to take a stand for accountability. Even proposals that have been dismissed, such as the GENIUS Act addressing stablecoins, illustrate the rising tide of concern surrounding this issue.

However, the challenge remains: how to create regulations that are effective without stifling innovation in the fast-evolving cryptocurrency space? The answer might lie in transparency and accountability, two principles that seem out of reach in the current political landscape. With lawmakers like Ritchie Torres and Elizabeth Warren advocating for more oversight, it’s evident that the need for dedicated frameworks has never been more urgent.

The unfolding saga surrounding Trump’s crypto ventures is a vivid reminder of the thin veil between legality and corruption in American politics today. As we inch closer to a more regulated approach in the world of cryptocurrencies, the outcome of these inquiries will not only influence the political and economic landscape but could also redefine the moral compass guiding both sectors.