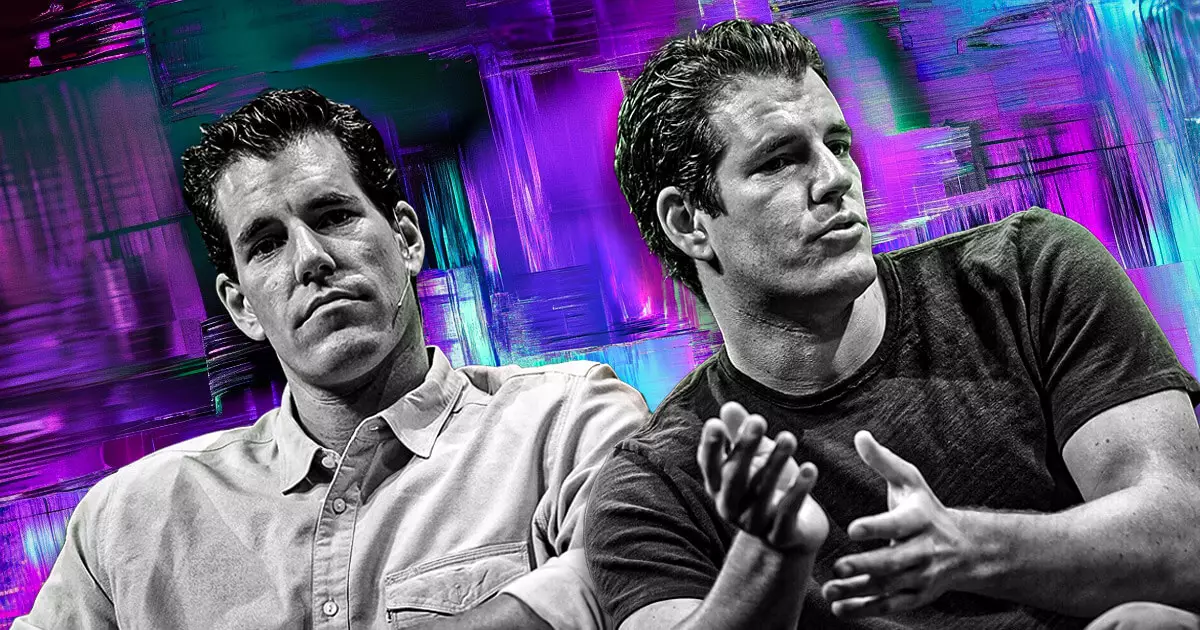

In a noteworthy development that indicates the evolving landscape of digital finance, Gemini, the popular cryptocurrency exchange operated by the Winklevoss twins, has discreetly submitted a draft registration statement to the U.S. Securities and Exchange Commission (SEC) for an initial public offering (IPO) of its Class A common stock. This initial step is not just a reflection of Gemini’s ambition; it embodies the larger trend of crypto firms seeking legitimacy and stability via public stock offerings. Their timing couldn’t be more serendipitous, with favorable market conditions and an increasing acceptance of digital assets by mainstream investors.

Regulatory Hurdles and Market Opportunities

While the path to becoming a publicly traded entity might seem auspicious, it’s fraught with regulatory scrutiny. Gemini must navigate the complexities of SEC comments, update its financials, and finalize share offering terms before it can initiate trading. However, this endeavor is more than just ticking boxes; it represents an opportunity for Gemini to establish itself as a credible player in an increasingly competitive market. The move can serve as a litmus test for how digital asset exchanges are perceived by regulatory bodies in an era where cryptocurrencies are gradually shedding their “Wild West” stigma.

The Domino Effect from Circle’s IPO

Gemini’s plans come on the heels of Circle’s successful debut on the New York Stock Exchange, which saw its shares soar initially and then stabilize at impressive heights. This IPO is not just important for Circle; it acts as a beacon for other crypto firms contemplating public listings. As noted by market analysts, the performance of Circle’s stock is a clear signal that sound revenue-generating models can attract significant interest from public investors. In a climate where skepticism around crypto remains prevalent, Circle’s favorable outing may embolden Gemini and other startups to pursue similar paths.

The Winds of Change for Crypto Regulations

Political winds seem to be shifting favorably towards digital assets, as industry experts note that a pro-crypto White House could open doors for more exchanges to access U.S. capital markets. This is an essential factor that could play a role in shaping Gemini’s strategy and final pricing for its IPO. The balance between understanding each regulatory nuance and seizing market opportunities creates a unique landscape rife with potential for savvy investors willing to engage in the cryptocurrency space.

A Catalyst for Future IPOs

Not only is Gemini’s public offering poised to be a game-changer for its own future, but it serves as a clarion call for other crypto platforms like Kraken, which is reportedly on the brink of its IPO journey. With giants like Goldman Sachs and JPMorgan potentially leading the charge for Kraken, we might be on the cusp of a domino effect in which a wave of digital asset companies transition into publicly traded entities. While this shift presents abundant opportunities for investment, it also emphasizes the responsibility these firms will hold in ensuring transparency and trust in their operations.

Engaging directly with investors and regulatory authorities may well define the success of this emerging sector. The potential influx of public interest due to IPOs could help reshape the dialogue around digital currencies and pave the way for broader acceptance. With Gemini setting the stage, the cryptocurrency market may not look the same in the coming years.