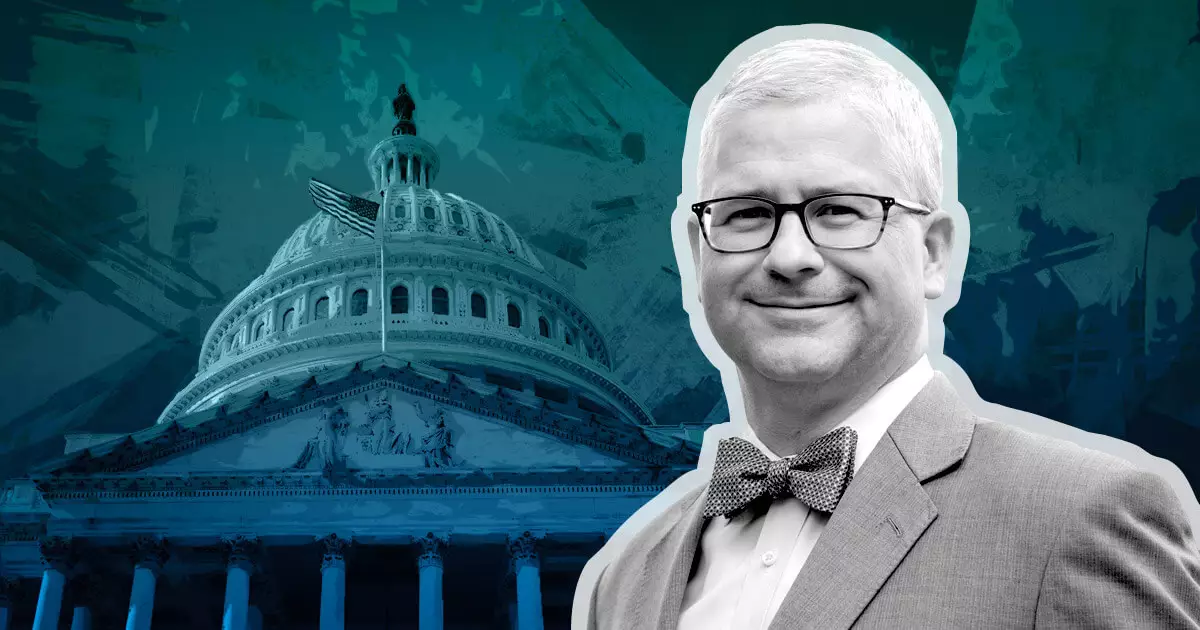

In a recent development, three prominent U.S. representatives have voiced their concerns over the stablecoin and crypto rules proposed by the Federal Reserve. This objection comes from the Republican party members, namely Patrick McHenry, Chairman of the House Financial Services Committee; French Hill, Chairman of the Committee on Financial Services Subcommittee on Digital Assets; and Bill Huizenga, Chairman of the Committee on Financial Services Subcommittee on Digital Assets, Financial Technology and Inclusion.

Objections and Concerns

The lawmakers expressed their concern that these proposed rules may hinder the progress made by Congress in establishing a regulatory framework for payment stablecoins. According to them, the rules put forward by the Federal Reserve can discourage financial institutions from participating in the digital asset ecosystem, impeding innovation and growth.

The objections specifically revolve around two rules: the “Supervisory Nonobjection Process for State Member Banks Seeking to Engage in Certain Activities Involving Dollar Tokens” and the “Novel Activities Supervision Program.” These rules, announced on August 8, set out requirements for banks dealing with cryptocurrencies. The first rule necessitates banks to obtain written approval from the Federal Reserve before issuing, holding, or transacting stablecoins. The second rule mandates banks to engage in an overall crypto supervision program.

One of the major issues raised by the representatives is the belief that these rules effectively prohibit banks from participating in the payment stablecoin or digital asset ecosystem, irrespective of any compliance instructions outlined within the rules themselves. They argue that the rules were not issued in accordance with the Administrative Procedure Act, urging the Federal Reserve to provide more information and clarification.

A Call for Regulation with Clarity

While the representatives raise concerns about the current rules, it is worth highlighting that they do acknowledge the necessity of regulations in this space. To address the existing issues and provide a clear path forward, they have put forth the Clarity for Payment Stablecoins Act. This bipartisan bill, supported by Representative Patrick McHenry, serves as an alternative proposal to ensure that regulatory measures facilitate innovation and growth rather than hinder it.

The concerns raised by these U.S. representatives shed light on the potential drawbacks and unintended consequences of the stablecoin and crypto rules proposed by the Federal Reserve. While it is imperative to establish a regulatory framework to ensure the safety and stability of the digital asset ecosystem, it is equally important to avoid stifling innovation and impeding progress. Striking the right balance between regulation and growth is crucial for the future of cryptocurrencies and stablecoins.