In a significant development, Senator Elizabeth Warren’s bipartisan cryptocurrency anti-money laundering bill is gaining support from an increasing number of senators across party lines. The bill, known as the Digital Asset Anti-Money Laundering Act, aims to enhance regulatory oversight within the emerging cryptocurrency industry. It seeks to address existing loopholes and align the digital asset ecosystem more closely with established anti-money laundering and countering the financing of terrorism (AML/CFT) frameworks that govern the broader financial system.

According to a recent Politico report, nine additional senators have thrown their support behind the bill, including influential committee chairs. Some of the key figures supporting the bill are Homeland Security Chair Gary Peters (D-Mich.) and Judiciary Chair Dick Durbin (D-Ill.), along with Senators Tina Smith (D-Minn.), Angus King (I-Maine), Michael Bennet (D-Colo.), Bob Casey (D-Pa.), Catherine Cortez Masto (D-Nev.), Jeanne Shaheen (D-N.H.), and Richard Blumenthal (D-Conn.). This brings the total number of senators supporting the bill to 12, with Senator Roger Marshall (R-Kansas) serving as the lead co-sponsor. Senator Joe Manchin (D-W.Va.) and Senator Lindsey Graham (R-S.C.) are also among the lawmakers backing the bill.

Lawmakers have highlighted the significant rise in illicit digital asset usage, with transactions amounting to $20 billion, and approximately 44% of these transactions being linked to sanctioned entities in the past year. In response to these concerning trends, Senator Warren and other lawmakers are pushing to expand the scope of the Bank Secrecy Act and implement know-your-customer (KYC) requirements for digital asset wallet providers, miners, and other participants within cryptocurrency networks.

Enhancing Security Measures

Senator Manchin emphasized that this legislation aims to mitigate security risks associated with cryptocurrency platforms by compelling them to adhere to the same AML regulations as traditional banks. By enforcing stricter regulations and enhancing oversight, the bill intends to hold cryptocurrency networks accountable for their role in preventing money laundering and supporting terrorist financing.

Support From Stakeholders

The Digital Asset Anti-Money Laundering Act has gained notable support, including an endorsement from the AARP, conveyed through a letter to the lawmakers in July. This endorsement underscores the importance of addressing the vulnerabilities within the cryptocurrency industry and strengthening the safeguards against illicit activities.

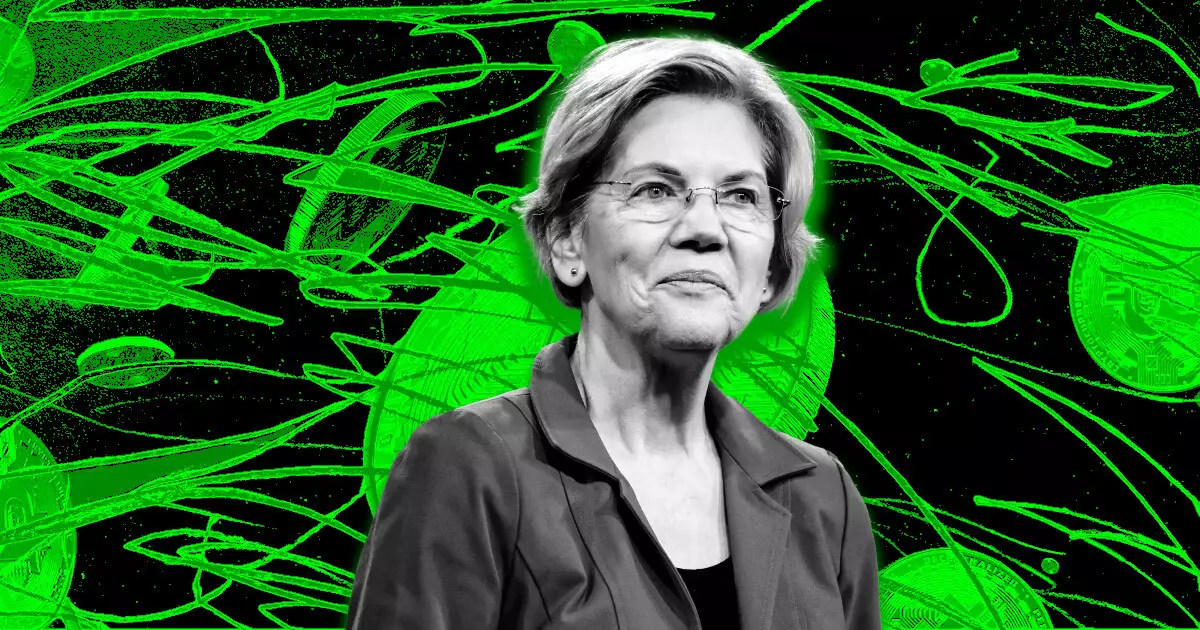

Senator Warren has long been an advocate for increased regulation in the cryptocurrency space. She has previously described crypto as a “method of choice” utilized by sanctioned countries like Iraq and Russia. Moreover, during her re-election campaign in March, she emphasized her intention to “build an anti-crypto army” in the United States.

Senator Elizabeth Warren’s cryptocurrency anti-money laundering bill is gaining momentum and support from influential senators. The Digital Asset Anti-Money Laundering Act aims to close loopholes in cryptocurrency regulation, enhance security measures, and align the digital asset ecosystem with established AML/CFT frameworks. With the backing of prominent committee chairs and stakeholders, this bill seeks to address the significant rise in illicit digital asset usage and protect the integrity of the financial system.