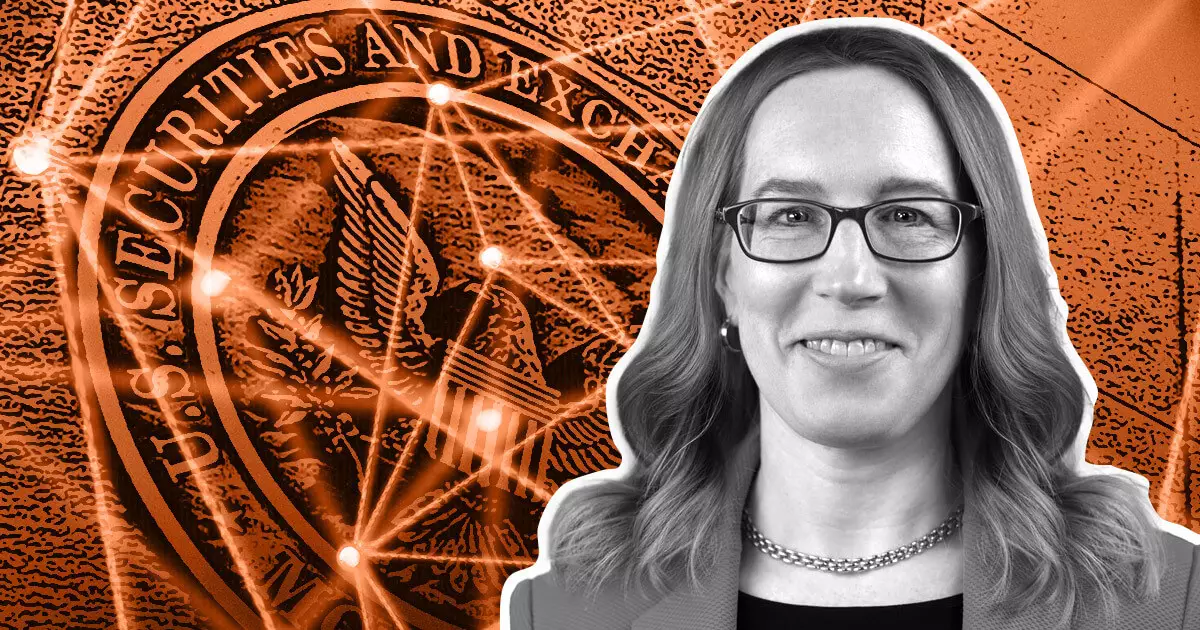

The discussion surrounding spot Bitcoin exchange-traded funds (ETFs) continues to gain momentum, with major asset managers like BlackRock and Fidelity now entering the fray. SEC Commissioner Hester Peirce recently shared her thoughts on this development, highlighting the growing interest from both firms and investors. However, she also cautioned against making assumptions about regulatory decisions and emphasized the need for a careful approach.

Peirce acknowledged that the increasing number of applications for spot Bitcoin ETFs reflects the belief that the public has a genuine interest in these products. With more firms exploring their potential and investors expressing curiosity, it is clear that the demand for such investment vehicles is on the rise. However, Peirce urged caution in interpreting these developments, as it is impossible to predict how regulatory agencies will ultimately respond.

While Peirce refrained from commenting on the SEC’s readiness to approve a spot Bitcoin ETF, she revealed her longstanding support for such investment vehicles since 2018. Her personal stance emphasizes her belief in the merit and viability of spot Bitcoin ETFs. Nevertheless, recent court rulings against the SEC have had a significant impact on the regulatory landscape, adding complexity to the decision-making process.

In August, a court ruling mandated the SEC to review a Bitcoin ETF application from Grayscale. This ruling and subsequent events indicate that the SEC will not pursue an appeal. Peirce acknowledged the influence of these legal developments and recognized their potential to reshape regulatory decisions. Additionally, recent events, such as the collapse of FTX and Coinbase’s expansion overseas, have not positively contributed to the image of the crypto industry.

Peirce advocated for regulators to consider alternative approaches to cultivate a conducive environment for crypto companies in the United States. She emphasized the importance of creating workable regulations and highlighted a growing interest among lawmakers, particularly in Congress, to address cryptocurrency-related issues. Peirce’s stance on regulation centers on a liberal perspective that seeks to enable choice and investment freedom for individuals, with the SEC’s role being primarily focused on providing disclosures rather than approving specific investments.

While Peirce maintains a favorable outlook on spot Bitcoin ETFs, she encouraged investors to exercise caution and be skeptical about their investment choices. This advice aligns with the need for thorough due diligence and critical analysis, considering the volatility and risks associated with the crypto market. Peirce’s emphasis on investor empowerment underscores the importance of individual responsibility and decision-making.

Peirce has consistently voiced her disagreement with the SEC’s cryptocurrency-related decisions, dissenting against individual enforcement actions and criticizing broader policy proposals. Her dissenting views focus on areas such as asset safeguarding and expanded exchange definitions. This commitment to challenging prevailing opinions within her agency reflects Peirce’s dedication to promoting a diversified and inclusive approach to regulation.

The discussion surrounding spot Bitcoin ETFs continues to garner attention from prominent asset managers and investors. SEC Commissioner Hester Peirce’s insights shed light on the increasing interest in these investment vehicles and highlight the need for a careful and considered approach from both regulators and market participants. As the regulatory landscape evolves, it is crucial to strike a balance between fostering innovation and ensuring investor protection.