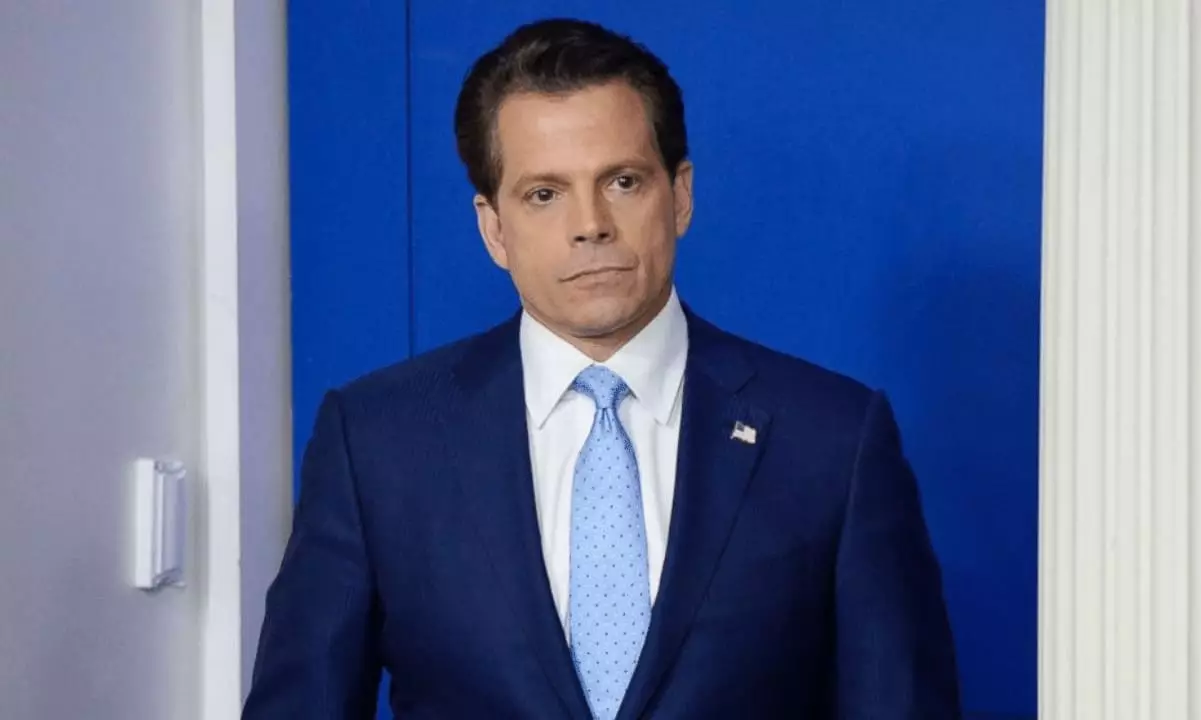

In a recent interview with CNBC, Anthony Scaramucci, the founder and CEO of SkyBridge Capital, shared his prediction that Bitcoin (BTC) would reach its all-time high before the end of 2024. Scaramucci’s optimism stems from the United States Securities and Exchange Commission’s (SEC) approval of spot Bitcoin exchange-traded funds (ETFs), which he believes will fuel BTC’s upward trajectory.

The SEC’s decision to greenlight 11 spot Bitcoin ETFs for listing and trading on prominent exchanges such as Nasdaq, the New York Stock Exchange (NYSE), and the Chicago Board Options Exchange (CBOE) has been long-awaited by the crypto community. This approval is seen as a significant milestone for Bitcoin and marks a breakthrough for digital assets as a whole. Retail investors now have easier access to BTC, which could potentially reshape the current financial system and accelerate crypto adoption.

Scaramucci’s Prediction

Scaramucci enthusiastically states that Bitcoin will not only break its all-time high set in November 2021 but also surpass it before the year ends. He further predicts that BTC’s momentum will continue into the following year, reaching new heights by January 2025. The CEO’s optimism is rooted in the belief that the SEC’s approval is a pivotal moment for Bitcoin and digital assets, signifying their increasing acceptance and legitimacy within the financial industry.

During the bear market period in 2022, Bitcoin, along with the entire crypto market, experienced a significant price downturn. However, in 2023, the leading cryptocurrency made a remarkable recovery. Riding on the excitement surrounding the spot Bitcoin ETF approval and upcoming events like the fourth Bitcoin halving, BTC’s price surged by 150%. This resurgence positioned Bitcoin as a favorable investment for SkyBridge Capital, leading to a successful year for the firm.

Scaramucci acknowledges the SEC’s unusual endorsement of Bitcoin by allowing investors to add the cryptocurrency to their brokerage accounts. As a result, he sees the approval of Bitcoin ETFs as another step in endorsing BTC within the traditional financial system. When asked if he would personally purchase the ETFs, Scaramucci expressed his intention to be a ceremonial buyer, signaling his confidence in the potential of these investment products.

With the SEC’s approval of spot Bitcoin ETFs, Anthony Scaramucci foresees Bitcoin breaking its previous all-time high and reaching new peaks before the end of 2024. This landmark decision is expected to transform the crypto landscape, offering retail investors greater access to BTC and bolstering its adoption. Scaramucci’s bullish prediction aligns with the crypto community’s sentiment, positioning Bitcoin as a digital asset with substantial growth potential in the coming years.