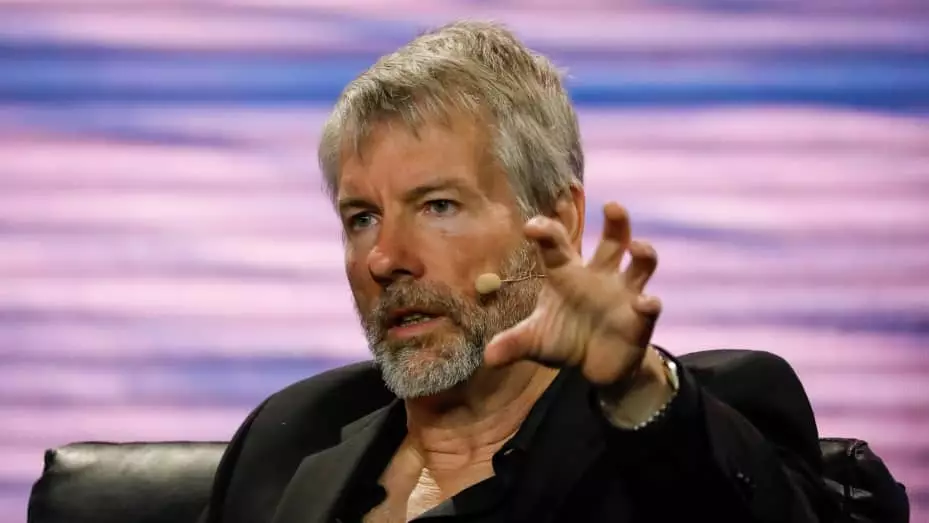

Michael Saylor, the co-founder and executive chairman of MicroStrategy, made headlines by announcing his plan to continue buying Bitcoin indefinitely. Despite holding a significant unrealized profit of around $4 billion in BTC, Saylor emphasized that both he and his firm have no intentions of selling their Bitcoin holdings. In an interview with Bloomberg, Saylor described Bitcoin as the ultimate exit strategy and the strongest asset in the current financial landscape.

Saylor pointed out that Bitcoin has emerged as a trillion-dollar asset, standing shoulder to shoulder with tech giants like Apple, Google, and Microsoft. However, unlike traditional companies, Bitcoin competes with established asset classes such as gold and the S&P stock market index. Saylor highlighted the limited capacity of top companies to accommodate trillions of dollars in capital, making Bitcoin a formidable contender for store-of-value assets.

According to Saylor, Bitcoin’s technical superiority over gold, stocks, and real estate will continue to attract capital inflows into the digital currency. He firmly believes that selling Bitcoin to acquire less promising assets would be a misguided decision. Saylor’s unwavering support for Bitcoin stems from his conviction that it is the ultimate winner in the competitive financial landscape.

Saylor’s advocacy for Bitcoin is not new, as he began accumulating BTC in 2020, setting MicroStrategy on a path to becoming the first publicly traded company to invest in Bitcoin on a large scale. With MicroStrategy’s latest purchase of 850 BTC in January, the company now holds 190,000 BTC, acquired at an average price of $31,224 per coin. This investment is currently valued at over $10 billion, underscoring the company’s bullish stance on Bitcoin.

Looking ahead, Saylor predicted a surge in Bitcoin demand by 2024, a forecast that appears to be unfolding with the introduction of spot Bitcoin exchange-traded funds (ETFs). These ETFs have attracted nearly ten times the demand compared to the available supply from miners, signaling a growing interest in Bitcoin among institutional and retail investors alike. Saylor’s foresight and relentless pursuit of Bitcoin have positioned MicroStrategy as a trailblazer in the evolving financial landscape.