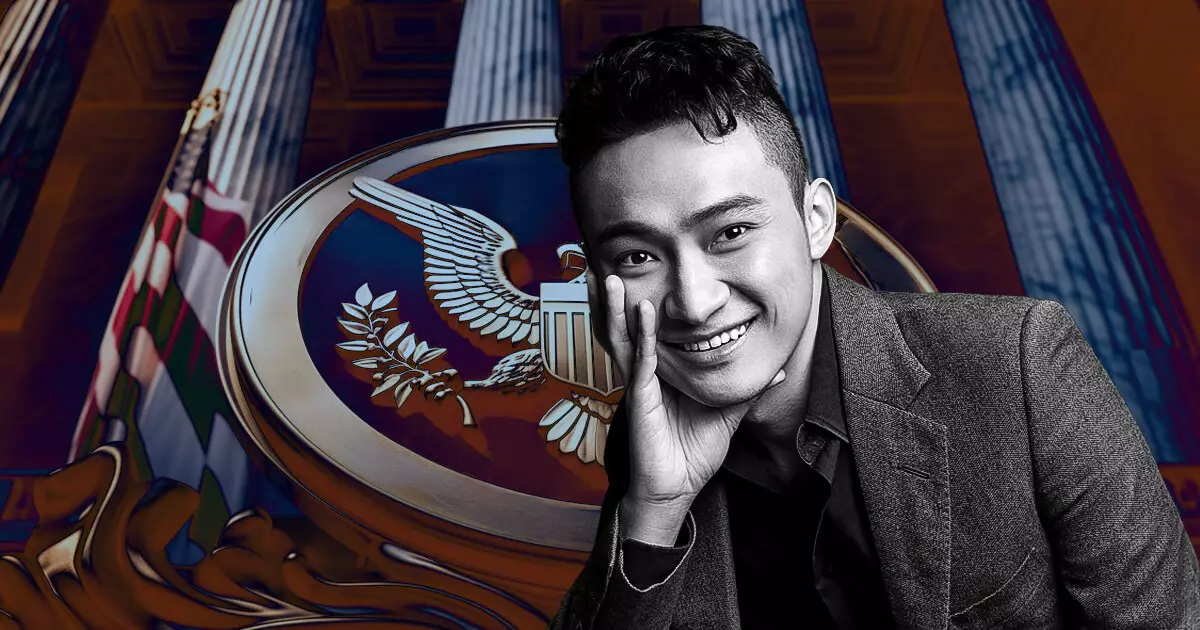

The recent amendment to the US SEC’s complaint against Justin Sun and other defendants has brought to light the regulator’s argument that Sun’s alleged visits to the US should establish the jurisdiction necessary to initiate legal proceedings. According to the SEC, Sun purportedly spent more than 380 days in the US between 2017 and 2019, conducting business trips to various major cities such as New York City, Boston, Massachusetts, and San Francisco on behalf of the Tron Foundation and the BitTorrent Foundation.

The SEC has also accused Sun and the companies associated with him of engaging in a wash trading scheme on the now-defunct crypto exchange, Bittrex. The amended complaint specifically points out that Bittrex, being a US-based exchange, provides the SEC with additional grounds for personal jurisdiction over Sun and the other defendants. The regulator further alleges that Sun directly communicated with Bittrex in 2018 to facilitate the listing of the TRX crypto, thereby linking him to the activities of the companies involved.

In response to Sun’s request to dismiss the case on the grounds of lack of personal jurisdiction, the SEC introduced new allegations that shed light on his extensive presence and involvement in the US market. Sun’s defense lawyers had argued that as a foreign national, he does not consider the US to be his primary place of residence. However, the recent allegations connect him closely to the operations and dealings that took place within the US jurisdiction, thereby strengthening the SEC’s case against him.

The SEC initially filed a lawsuit against Sun and the other defendants in March 2023, focusing on personal jurisdiction claims related to targeted investors in the Southern District of New York and the involvement of celebrity promoters in attracting US-based individuals. Subsequently, the SEC separately sued Bittrex in April 2023, leading to a settlement in August 2023, following which the company ceased its global operations toward the end of the same year.

The amended complaint filed by the SEC against Justin Sun and associated entities brings to light significant elements that strengthen the regulator’s case for personal jurisdiction and regulatory action in the US market. Sun’s alleged extensive travels and involvement in US-based activities, coupled with the accusations of a wash trading scheme, highlight the complexities of jurisdictional boundaries in the global crypto landscape. With legal proceedings unfolding, the outcome of this case will likely have far-reaching implications for both the individuals involved and the broader cryptocurrency industry as a whole.