Billionaire investor Mark Cuban has recently made a push for the US Securities and Exchange Commission (SEC) to make modifications to Form S-1 in order to make it easier for token-based companies to register with the authorities. This move comes in response to a footnote from SEC Commissioner Mark Uyeda, who criticized the current approach to crypto disclosure filings as “problematic.”

Form S-1 is a crucial registration statement that domestic issuers must file to offer new securities publicly. It contains vital company information such as business operations, risk factors, and other key details about product offerings. Companies looking to trade their security shares on national exchanges like the New York Stock Exchange must submit this form. Uyeda pointed out that many crypto issuers have unique characteristics that may not align with the information currently required in Form S-1.

In light of these concerns, Uyeda suggested that the SEC permit variations for Form S-1 filings of crypto digital assets, akin to those allowed for funds, insurance products, and other securities. This approach aims to provide offerings with more relevant material information for the crypto industry and its issuers. Uyeda believes that by adopting this strategy, investor protection and remedies under the Securities Act could be enhanced.

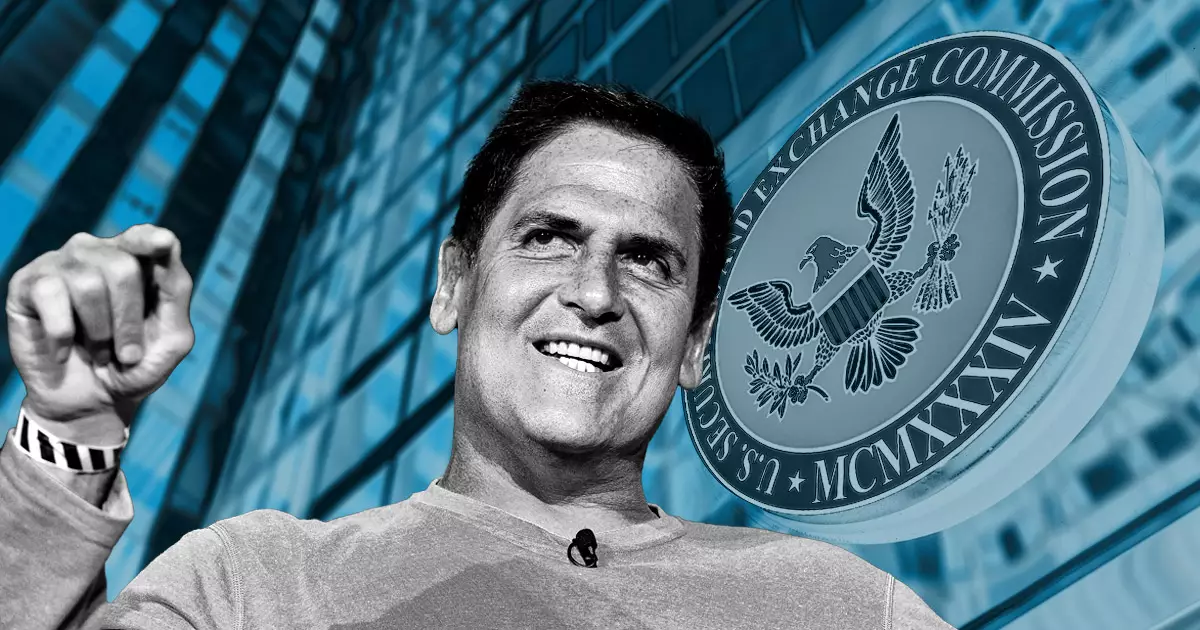

Mark Cuban expressed his support for Uyeda’s perspective in a social media post on July 2. Cuban emphasized that the challenge lies not in the unwillingness of crypto companies to register, but rather in the mismatch between their nature and the requirements of Form S-1. This mismatch, according to Cuban, is why there are currently no registered and operating token-based companies in the market. Additionally, the US Blockchain Association lauded Uyeda’s statement as a step in the right direction for constructive engagement by the industry.

Mark Cuban’s advocacy for SEC reform to accommodate token-based companies reflects a growing recognition of the evolving landscape of the crypto industry. As digital assets continue to gain prominence, regulatory frameworks must adapt to ensure a balance between capital formation and investor protection. By exploring alternative approaches to disclosure filings, the SEC can foster a more conducive environment for innovation and growth within the crypto space.