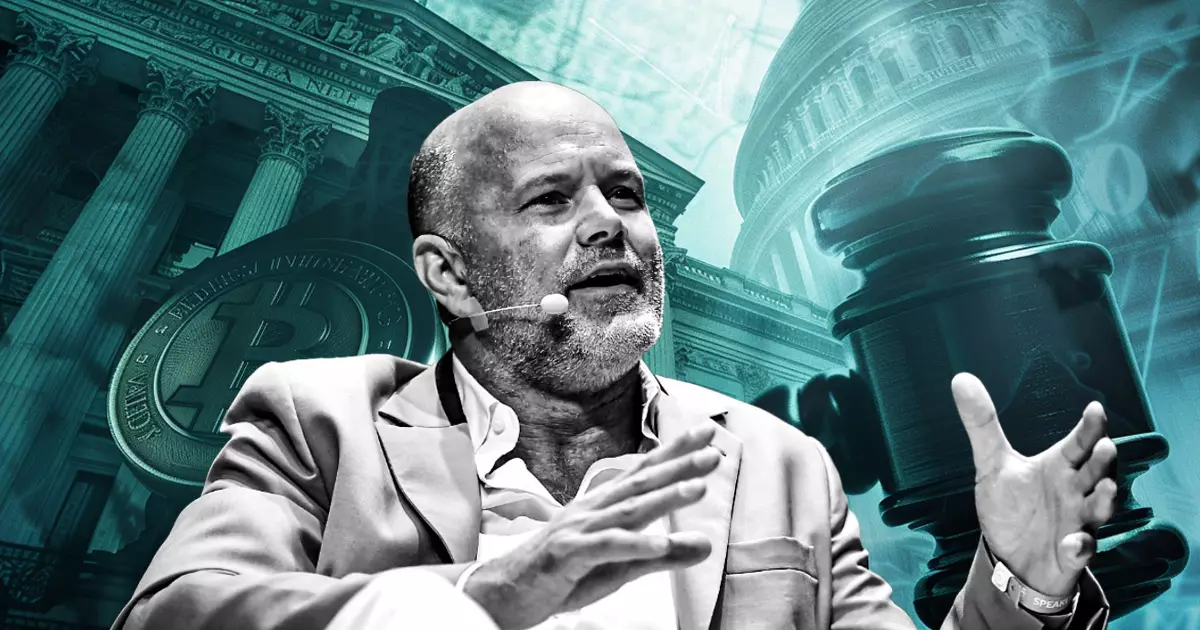

Galaxy Digital CEO, Mike Novogratz, recently shared his views on the future regulatory environment for cryptocurrencies in the US, emphasizing the importance of bipartisan support. According to Novogratz, fostering a bipartisan approach towards crypto is crucial. He believes that having both parties on board is essential for the growth and development of the industry. While there may be pockets of opposition, particularly from figures like Senator Elizabeth Warren, Novogratz remains optimistic about the overall support for innovation in the crypto space.

Optimism Amidst Uncertainties

Despite the regulatory uncertainties that currently characterize the crypto market, Novogratz remains bullish about the future. He confidently stated that positive crypto legislation is inevitable, regardless of the outcome of the next presidential election. This optimism is rooted in the shifting attitudes of US politicians towards the industry, with an increasing number of lawmakers expressing favorable views on innovation and crypto. Novogratz’s stance reflects a broader sentiment within the community that regulatory clarity and support are on the horizon.

The growing significance of cryptocurrencies in the US political landscape is evident, with recent surveys indicating that voters who are involved in the crypto space are more likely to support candidates who are crypto-friendly. This shift in voter preferences underscores the increasing importance of digital assets and blockchain technology in shaping political discourse. As cryptocurrencies continue to gain mainstream acceptance, their impact on policy decisions and electoral outcomes is only expected to grow.

In addition to discussing the regulatory outlook for cryptocurrencies, Novogratz also touched upon Bitcoin’s recent market performance. He highlighted the surge in Bitcoin’s price following the approval of Bitcoin ETFs, which propelled the leading cryptocurrency to a new all-time high of over $73,000 in March. While acknowledging the volatility of the market, Novogratz expressed confidence in Bitcoin’s long-term potential, emphasizing the need for patience amidst price fluctuations. He reiterated his belief in Bitcoin as a key component of investment portfolios, especially in the face of mounting government debt and spending.

As of the latest data available, Bitcoin is trading at around $62,000, reflecting a 9% decline over the past month but boasting a 44% increase year-to-date and a 102% rise over the past year. Despite recent fluctuations, Bitcoin remains the top cryptocurrency by market capitalization, with a total market cap of $1.22 trillion and a 24-hour trading volume of $20.18 billion. The broader crypto market is valued at $2.3 trillion, with Bitcoin dominance standing at 53.22%.

Mike Novogratz’s insights shed light on the evolving regulatory landscape for cryptocurrencies in the US. His optimism about the future of the industry, coupled with the increasing bipartisan support and growing influence of digital assets, signals a promising trajectory for crypto adoption and integration into mainstream financial systems. As the market continues to mature and regulatory frameworks take shape, the role of cryptocurrencies in shaping the future of finance is set to become more prominent.