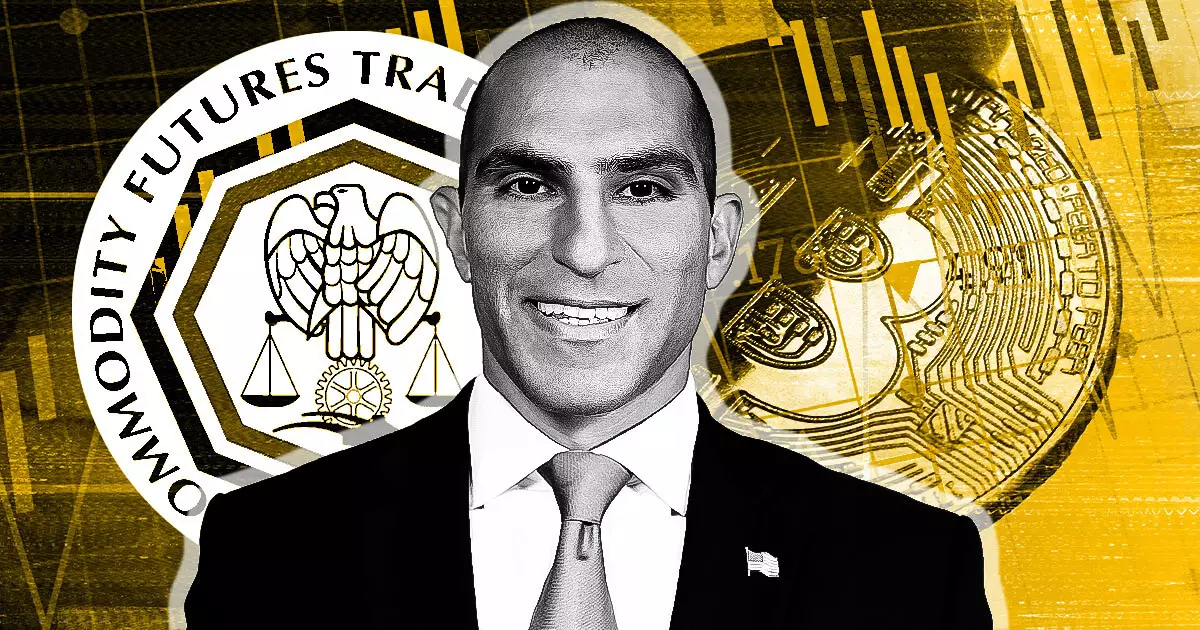

During a recent Senate Agriculture Committee hearing on digital commodities oversight, CFTC chair Rostin Behnam expressed the agency’s willingness to potentially become the primary regulator for cryptocurrencies. The discussion, which took place on July 10, revolved around the CFTC’s request for expanded regulatory authority in the realm of digital assets. Senator Roger Marshall questioned Behnam about the feasibility of making the CFTC the primary regulator for cryptocurrencies while leaving a limited number of responsibilities for the SEC to manage.

Capacity and Expertise

In response to Marshall’s inquiry, Behnam stated that he believes the CFTC is well-equipped to take on the role of a primary regulator for digital assets. He emphasized the agency’s capacity, expertise, and experience in the financial markets. However, Behnam highlighted the need for adjustments to the definitions of securities and commodities if the CFTC were to assume primary regulatory authority in the crypto space.

When asked about the SEC’s role in determining the jurisdiction of assets, Behnam expressed reservations about the SEC making unilateral decisions. He underscored the importance of collaboration between the two regulatory bodies, noting that they have a history of working together to clarify asset classifications that fall into grey areas. Behnam acknowledged the potential for legal challenges regarding conflicting asset designations but emphasized the value of cooperation between the CFTC and SEC in addressing novel legal questions.

Behnam emphasized the significance of introducing tokens and contracts into regulated markets promptly to mitigate risks for investors. He argued that a substantial portion of the crypto market should come under the CFTC’s oversight, particularly as many crypto assets do not fit into traditional securities classifications. Behnam revealed that a considerable percentage (70% to 80%) of the crypto market lacks direct federal oversight, necessitating regulatory intervention to protect market participants.

Financial Resources and Urgency

In outlining the financial requirements for establishing a regulatory framework, Behnam stated that the CFTC would need a minimum of $30 million in the first year and $50 million in the second year. These funds would be allocated towards staffing, administrative costs, and IT infrastructure. Behnam suggested that user fees collected from registrants could help offset the requested budget. Additionally, he echoed Senator Cory Booker’s concerns regarding the urgency of expanding the CFTC’s authority, warning that failure to do so could perpetuate fraud and market manipulation affecting individuals nationwide.

Overall, Behnam’s testimony underscores the need for proactive regulatory measures in the rapidly evolving crypto landscape. By positioning the CFTC as a potential primary regulator for digital assets, Behnam aims to enhance market integrity, safeguard investor interests, and combat illicit activities in the crypto space. Collaboration between regulatory agencies, adequate funding, and a sense of urgency are crucial elements in addressing the challenges posed by the growing digital asset ecosystem.