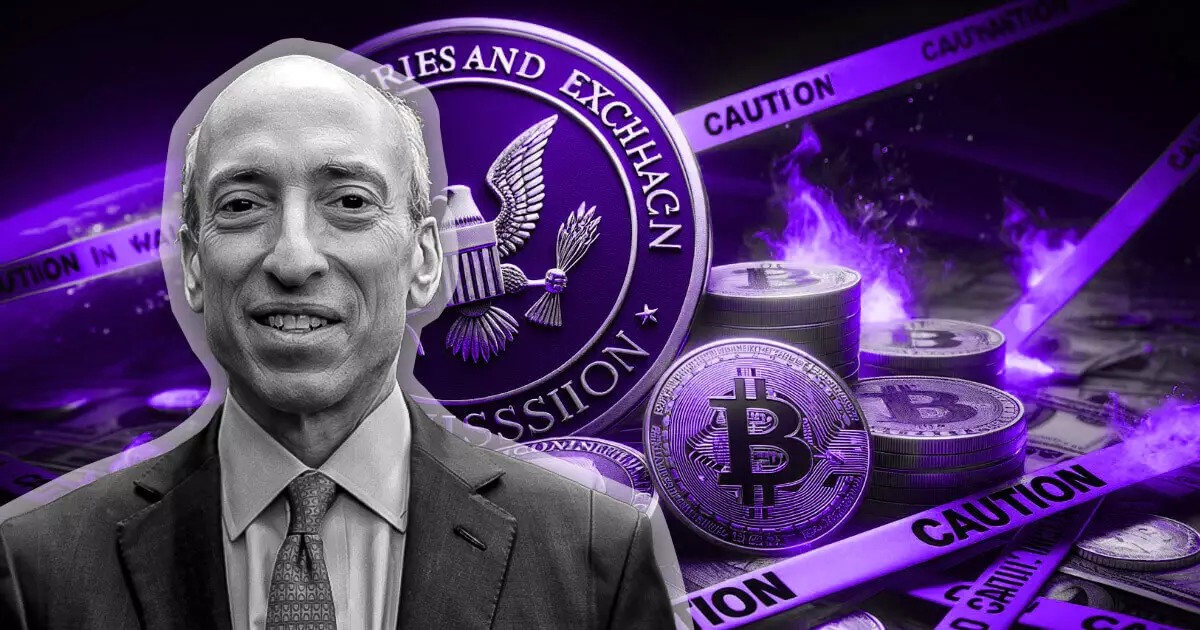

In a critical statement that pronounced Bitcoin’s status with clarity, Gary Gensler, the Chair of the US Securities and Exchange Commission (SEC), emphasized that Bitcoin is not considered a security. This distinction is pivotal amid the heightened scrutiny that resonates through the cryptocurrency landscape. In an interview aired on CNBC’s Squawk Box on September 26, Gensler confirmed the SEC’s longstanding position that categorizes Bitcoin as a commodity in accordance with US law, reiterating a stance that has remained consistent under his leadership and that of his predecessor.

This confirmation emerges at a pivotal time for Bitcoin, especially following the SEC’s approval of several spot Bitcoin exchange-traded funds (ETFs). These developments have opened avenues for Bitcoin to be traded on major US exchanges, such as Nasdaq, signaling a growing acceptance of the cryptocurrency in mainstream financial markets. However, Gensler simultaneously pointed to the broader cryptocurrency ecosystem with a critical lens, suggesting that many players within the market appear to disregard existing regulations, thereby contributing to chaos and uncertainty. He stated, “There are rules in place, but many have chosen to ignore them,” underscoring a fundamental challenge in the regulatory framework.

Ethereum: The Uncertain Future

Contrasting sharply with Bitcoin, the regulatory status of Ethereum remains shrouded in ambiguity. As the second-largest cryptocurrency, Ethereum occupies a precarious position as the SEC has not yet defined it squarely as either a security or a non-security. This lack of clarity casts a long shadow over projects built on the Ethereum blockchain, fueling uncertainty and apprehension among developers and investors alike. While Ethereum-based ETFs have received the nod from the SEC, investigations into entities within the Ethereum ecosystem, like Consensys and Uniswap, indicate that scrutiny is tight and decisions are yet to be made about its regulatory classification.

The regulatory approach towards Ethereum has sparked notable dissent among policymakers. Lawmakers in the House of Representatives have openly criticized Gensler for what they perceive as a murky regulatory environment that fosters confusion, particularly through his introduction of terms such as “crypto asset security.” Such language has left many in the industry dazed, and frustration was palpable during recent congressional hearings, as legislators expressed concerns over the SEC’s apparent tendency to stymie innovation rather than facilitate it.

The Call for Stronger Regulatory Frameworks

Despite the rumblings of discontent among legislators and some SEC commissioners, Gensler champions the notion that a robust regulatory framework is imperative for the sustainability of the cryptocurrency industry. He asserts that the foundation of trust with investors is crucial, stating, “This field will not long persist if you can’t build that investor trust in the markets.” Drawing parallels to traditional industries, Gensler likens the establishment of regulations—akin to traffic lights and stop signs—to necessary enhancements that guide growth.

As Bitcoin enjoys defined regulatory clarity, Ethereum lingers in a state of uncertainty. This dichotomy illustrates the necessity for a comprehensive and coherent regulatory approach that supports innovation while ensuring the protection of investors. The SEC’s contrasting perspectives raise essential questions about the future of cryptocurrency regulation in the U.S., and the path forward requires careful navigation to foster an environment where both trust and innovation can thrive. The ongoing regulatory evolution remains closely monitored as stakeholders await clearer guidelines that could reshape the cryptocurrency landscape entirely.