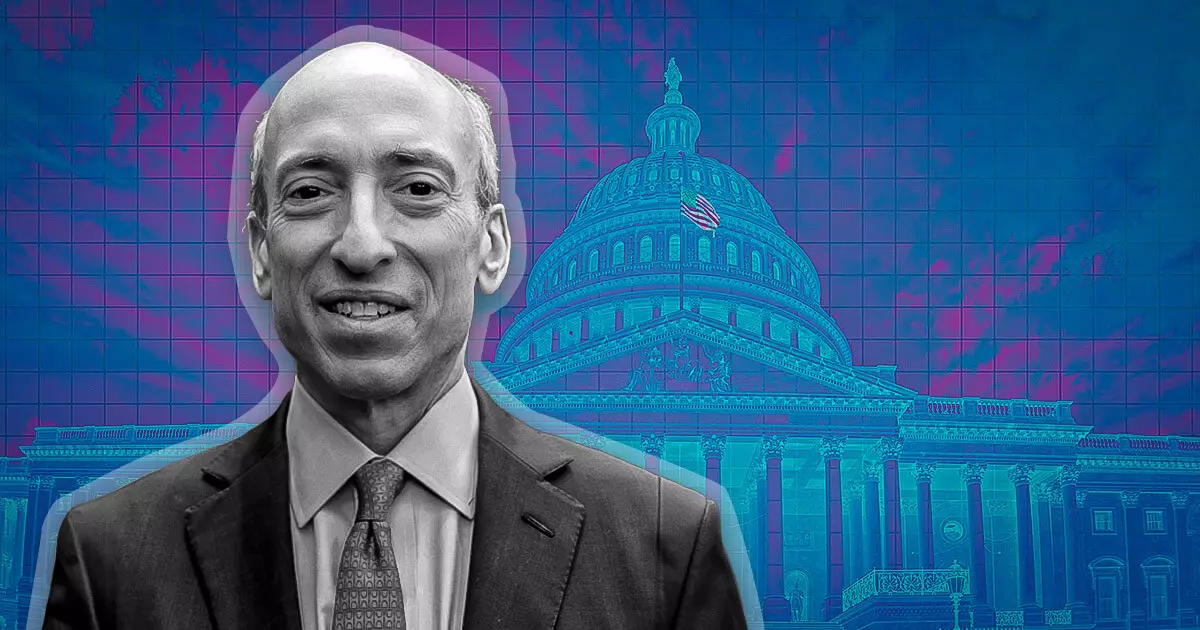

The landscape of cryptocurrency regulation in the United States has become increasingly contentious, marked by criticisms directed at the U.S. Securities and Exchange Commission (SEC) and its chairman, Gary Gensler. Former Olympic athlete and co-founder of the cryptocurrency exchange Gemini, Tyler Winklevoss, recently articulated strong objections to Gensler’s approach to regulation. His sentiments echo a broader dissatisfaction among industry stakeholders, who have grown weary of what they perceive as excessive governmental interference in an innovative sector. Winklevoss’s vehement indictment of Gensler raises critical questions about the implications of regulatory practices that could potentially stifle a burgeoning industry.

In a fervent post on the social media platform X, Winklevoss outlined his contention that Gensler’s regulatory decisions were not mere “good faith mistakes.” Rather, he characterized them as premeditated actions driven by a personal and political agenda. This assertion is a significant charge, implying a deliberate attempt to undermine the cryptocurrency sector for questionable motives. Winklevoss’s choice of words, such as “evil,” underscores a belief that Gensler’s decisions lack any consideration for the consequences they might have on the cryptocurrency ecosystem, including job losses and massive financial losses incurred by investors.

The core of Winklevoss’s argument suggests that Gensler’s actions have not only been detrimental but potentially destructive to the industry as a whole. By fabricating a dichotomy between regulatory responsibility and unbridled authority, Winklevoss evokes a sense of urgency about the need for accountability. Furthermore, his assertion that Gensler’s impact on the industry is “irrevocable” conveys a sense of desperation that resonates with other industry voices who fear that regulatory overreach could dismantle a sector characterized by innovation and progress.

Winklevoss’s critique is not an isolated sentiment. Recent legal actions by 18 U.S. states against the SEC also reflect growing unease regarding Gensler’s approach to crypto regulations. This multi-state lawsuit accuses the SEC of “gross government overreach,” and seemingly aligns with Winklevoss’s view that regulatory practices have crossed a line, threatening the very principles of innovation and market freedom that the cryptocurrency industry embodies. The backlash illustrates a rising sentiment among industry participants who assert that regulation should evolve hand-in-hand with technological advancements rather than stifle them.

Moreover, the political ramifications are considerable. The emergence of strong rhetoric from influential industry figures, combined with legal actions against the SEC, indicates a potential shift in the regulatory landscape. Former President Donald Trump has publicly stated his intention to dismiss Gensler if re-elected, a prospect that adds a layer of political tension to the discourse surrounding cryptocurrency regulation.

Venturing beyond personal grievances, Winklevoss raises substantive points about the necessity for thoughtful regulation within the cryptocurrency domain. Transparent, informed, and conducive regulations can foster an environment where innovation can thrive rather than falter. Gensler’s model of “regulation through enforcement” has faced scrutiny for being overly punitive and lacking clarity, potentially intimidating industry participants and investors alike.

Winklevoss’s proposition that Gensler should be barred from future positions of influence emphasizes the need for a shift in regulatory philosophy. Rather than rely on aggressive enforcement tactics, regulatory bodies must promote dialogue with industry stakeholders to create a balanced approach that recognizes both the potential risks and benefits of cryptocurrency technologies.

As the crypto industry grapples with regulatory complexities, the discourse surrounding Gary Gensler’s tenure at the SEC encapsulates a critical juncture for the future of cryptocurrency regulation in the United States. The perspectives of figures like Tyler Winklevoss illuminate the urgency for reform, fostering a need to rethink and recalibrate regulatory frameworks. The call for a cooperative regulatory environment that encourages innovation rather than deters it resonates strongly amid growing unease about current regulatory practices. The evolving landscape necessitates that regulators act as facilitators rather than obstacles, ensuring that the promise of cryptocurrency technology remains intact for future generations.