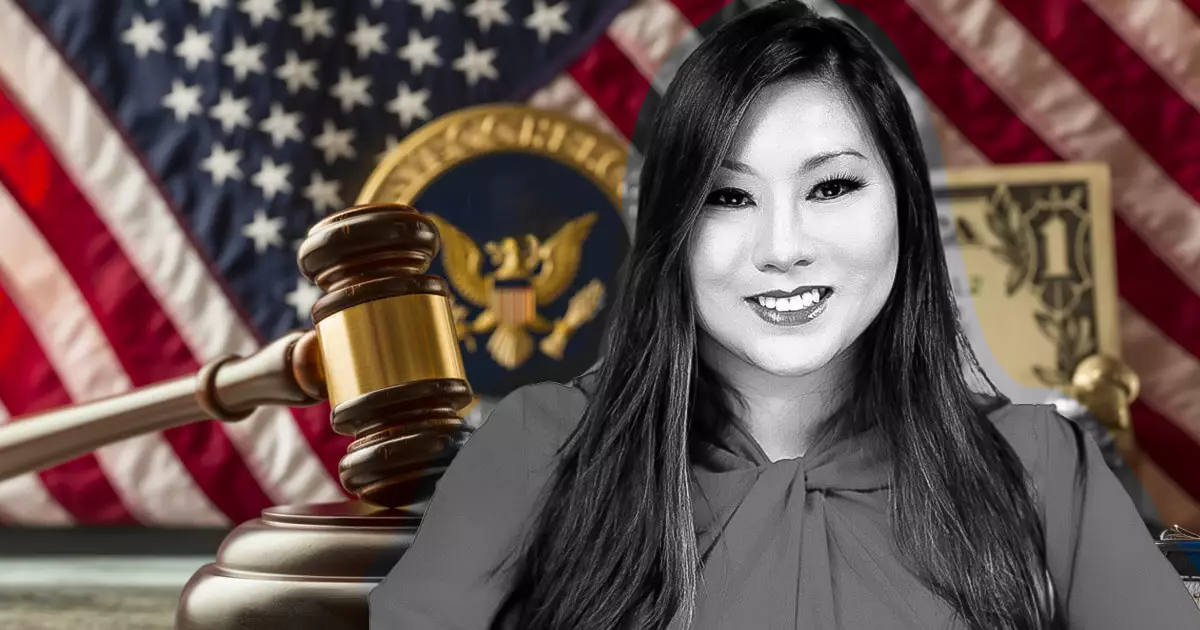

The recent selection of Caroline Pham as the acting chairwoman of the Commodity Futures Trading Commission (CFTC) marks a significant shift in leadership at a critical regulatory agency. As reported by Bloomberg News, Pham, a junior commissioner appointed by former President Joe Biden in 2021, has garnered attention for her progressive approach to regulation, particularly in the rapidly evolving landscape of cryptocurrencies. This appointment, although not officially announced, was confirmed by the commission’s vote, indicating a degree of bipartisan support that is often rare in such politically charged environments.

Pham’s tenure at the CFTC has been characterized by her commitment to establishing regulatory frameworks that balance innovation with oversight. She has been a vocal proponent of “regulatory sandboxes,” an initiative that allows companies to experiment with their products in a controlled environment without facing the full weight of compliance requirements. This method encourages innovation while ensuring that potential risks are managed. Such approaches could be instrumental in nurturing a robust crypto market in the U.S., particularly given the complex regulatory challenges that surround emerging technologies.

During a recent address at the Cato Institute, Pham outlined her vision for a government-backed pilot program aimed at the development of compliant digital asset markets and tokenization. Her focus on collaboration among regulators and industry stakeholders is noteworthy; it emphasizes the necessity of creating clear guidelines for risk management and fraud prevention. By fostering synergy between public and private sectors, Pham’s strategy could lay the groundwork for a more secure and efficient market, ultimately enhancing liquidity and promoting competition.

Despite Pham’s innovative ideas, she faces significant challenges. The rapidly changing crypto landscape demands regulators who are not only knowledgeable but also agile in their approach to policy development. The potential for the U.S. to lag behind international counterparts in establishing comprehensive crypto regulations is a growing concern. With countries like the UK and several jurisdictions in Asia advancing detailed regulatory frameworks, Pham’s leadership will need to pivot toward urgency and proactive engagement in international discussions.

Furthermore, as the acting chair of an agency under the Trump administration, Pham’s role will be scrutinized not only for her policies but also for how they align with the broader governmental approach to technology and finance. Balancing the Trump administration’s likely deregulatory leanings with the need for consumer protection and fraud prevention poses a complex dilemma for any CFTC leader.

Caroline Pham’s appointment is a pivotal moment for the CFTC as it navigates the intersections of innovation, regulation, and market integrity. Her advocacy for transparency and effective regulation is essential in a time where the market faces increasing scrutiny and potential regulatory backlash. If successful, Pham could position the United States as a frontrunner in responsible crypto innovation, ensuring that the country harnesses technology’s benefits while safeguarding against its inherent risks. The coming months will reveal how Pham’s vision transforms the CFTC and impacts the broader crypto ecosystem.