In a striking move, Gemini, a prominent player in the cryptocurrency exchange market, has officially declared its boycott of hiring graduates and interns from the Massachusetts Institute of Technology (MIT). This decision stems from MIT’s recent decision to re-affiliate itself with Gary Gensler, former Chair of the U.S. Securities and Exchange Commission (SEC). This action has sparked a wave of discussions about the broader implications for the cryptocurrency industry and the relationship between academia and regulatory frameworks.

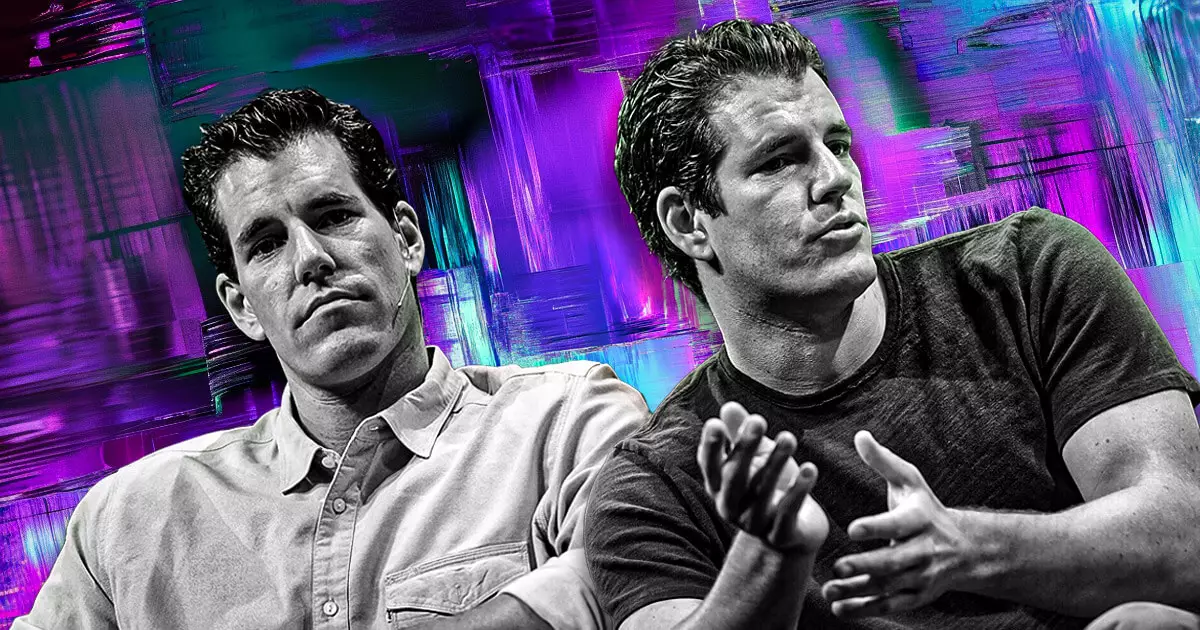

On January 29, 2023, Tyler Winklevoss, co-founder of Gemini, made headlines by announcing the firm’s refusal to engage with MIT talent while it remains connected with Gensler. His assertion on social media signaled a firm stand against what many in the crypto community perceive as an antagonistic relationship with regulatory authorities. Gensler’s track record at the SEC, where he enforced stringent regulations that many argue stifled innovation, casts a long shadow over his return to academia, particularly within a field as dynamic as fintech.

Backlash from Industry Leaders

Notably, Tyler’s sentiments were echoed by his twin brother, Cameron Winklevoss, who regarded Gensler’s return to MIT as a significant misjudgment. Calling him an “expert in failed public policies,” Cameron’s remarks resonate with many within the cryptocurrency space who view such affiliations as detrimental to innovation. By labeling Gensler’s policies as failures, the Winklevoss twins position themselves as figures advocating for a more nurturing environment for fintech innovations—one that should be unencumbered by bureaucratic overreach.

MIT’s New Direction and Its Implications

MIT’s decision to welcome Gensler back as a Professor of Practice at the Sloan School of Management is not without its challenges. Gensler is expected to lead initiatives in artificial intelligence, finance, and public policy, including co-leading a program at the university’s Computer Science and Artificial Intelligence Laboratory. However, the decision is met with skepticism from industry insiders who see Gensler’s historical stance as a conflict with the innovative spirit that MIT is known for fostering.

The repercussions of Gemini’s decision extend beyond its internal hiring practices. Influential figures in the cryptocurrency arena, such as Matt Huang, co-founder of Paradigm, have urged MIT-associated professionals to unite and reconsider their ties to the institution, hinting at possible collective action. Caitlin Long, CEO of Custodia Bank, further questioned the potential of an emerging trend where financial organizations may distance themselves from universities that are perceived as welcoming individuals with histories of anti-innovation regulations.

As the crypto landscape evolves amidst regulatory scrutiny, Gemini’s stance may signal a larger movement within the industry, emphasizing the need for a collaborative and open environment conducive to innovation. The question remains whether this will lead to broader consequences for institutions like MIT as they navigate their relationships with former regulators. The tension between regulatory compliance and innovation in the world of cryptocurrency is palpable, marking a pivotal moment for both the industry and academic institutions intertwined with its future.