In recent months, Bitcoin has become a focal point for investors, attracting significant media attention due to its erratic behavior and notable price fluctuations. In December and January, the leading cryptocurrency soared past the $100,000 mark, achieving unprecedented all-time highs. However, this meteoric rise was soon followed by a period of turbulent trading, marked by dramatic shifts within a narrow price range between $92,000 and $106,000. Unfortunately, this stability was short-lived, culminating in a sharp decline that saw Bitcoin briefly dip below the crucial $80,000 threshold.

Market Influences and Selling Pressure

The downturn in Bitcoin’s value coincided with increased selling pressure, particularly as larger investors—often referred to as “whales”—began to liquidate their holdings. This trend raised eyebrows, especially as overall network activity and hash rates experienced a decline. Compounding the situation, a broader global market retreat was observed. This downturn was evident not just within the cryptocurrency sphere but also manifested in traditional markets, where entities like the NASDAQ Composite index faced significant losses, plunging by 3.5%. Meanwhile, gold futures slipped by nearly 3%, and consumer spending in the United States saw its first decrease in two years, indicating a potential economic reset.

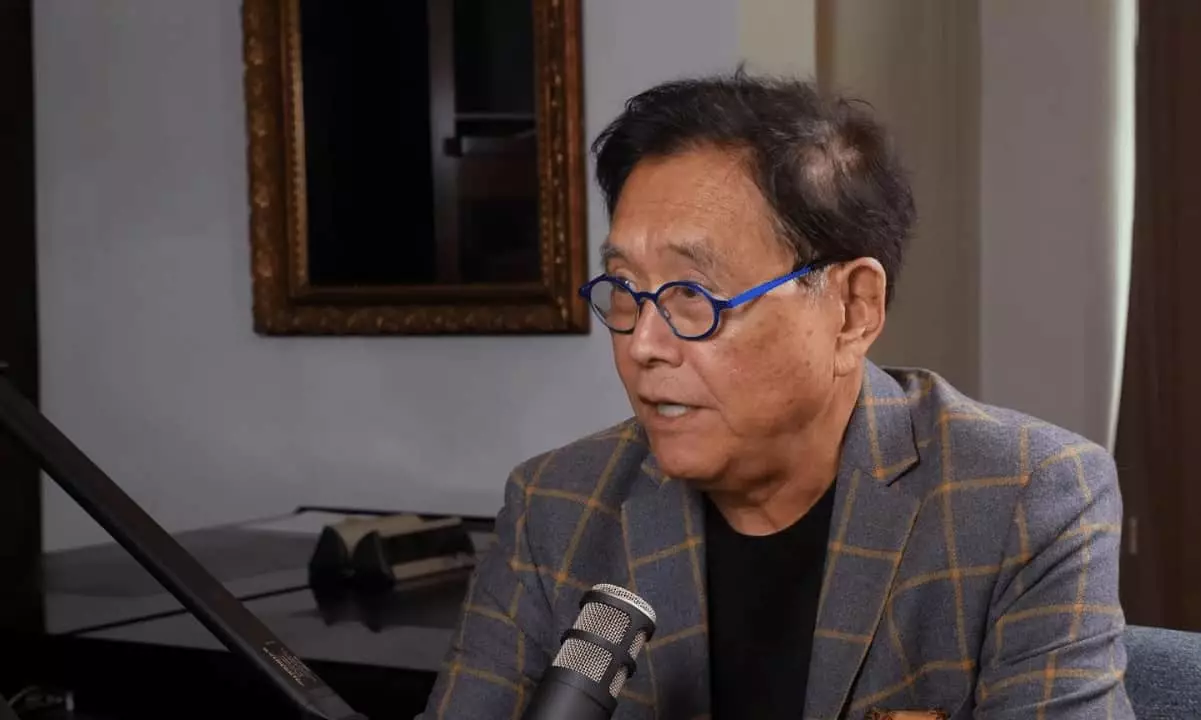

Despite the bearish sentiment enveloping the market, not all analysts share a pessimistic outlook regarding Bitcoin’s future. Investors like Robert Kiyosaki maintain a bullish stance, suggesting that Bitcoin remains a robust investment option. Kiyosaki’s viewpoint resonates with several blockchain analysts, including BitMEX founder Arthur Hayes, who anticipate a potential recovery for the crypto markets. Hayes recently predicted a final plunge back to approximately $80,000, a phase he believes is necessary to cleanse the market of excess sellers. Notably, following Hayes’ projection, market activity saw a rebound, with Bitcoin rapidly recovering to over $86,000 within days, suggesting a renewed appetite among investors.

As Bitcoin’s price began to recover, trading volume surged consistent with increased interest from investors eager to “buy the dip.” This sentiment rapidly spread across social media, signifying a shift in market psychology. The idea that Bitcoin represents a solid investment opportunity was echoed by Kiyosaki, who proclaimed that BTC was effectively on sale. He emphasized that the core issue lies not with Bitcoin itself but rather with systemic flaws in the monetary framework, critiquing traditional banking practices.

Concluding Thoughts

Bitcoin’s recent turbulent ride has been significantly influenced by external economic factors and internal market dynamics. While many investors may feel apprehensive due to falling prices and increased volatility, historical patterns suggest that Bitcoin has the potential for recovery and resilience. By adapting to changing market conditions and maintaining a long-term investment perspective, stakeholders can navigate this complex landscape while supporting the notion that cryptocurrencies are here to stay.