The current global economic environment is fraught with uncertainty, largely driven by deteriorating trade relations between superpowers like the United States and China. This precarious situation has seeped into various asset classes, with cryptocurrencies facing unique pressures. Ethereum, one of the most significant players in the crypto market, finds itself at an important crossroads. The latest announcement of a temporary tariff hiatus by President Trump didn’t assuage fears; instead, it underscored the fragility of the situation. A mere 90-day pause won’t effectively resolve the deep-seated issues causing market jitters. Without a doubt, it leaves all risk assets—including Ethereum—exposed to further volatility.

Market participants often use Ethereum as a bellwether for the cryptocurrency sector. The combination of weak market performance and rising pessimism among investors has seen ETH fall significantly from its once-stable $2,000 support level. The enduring tensions in global trade, coupled with rising domestic pressures, have made even the most voracious bulls timid.

The Technical Landscape: Analyzing MVRV Bands

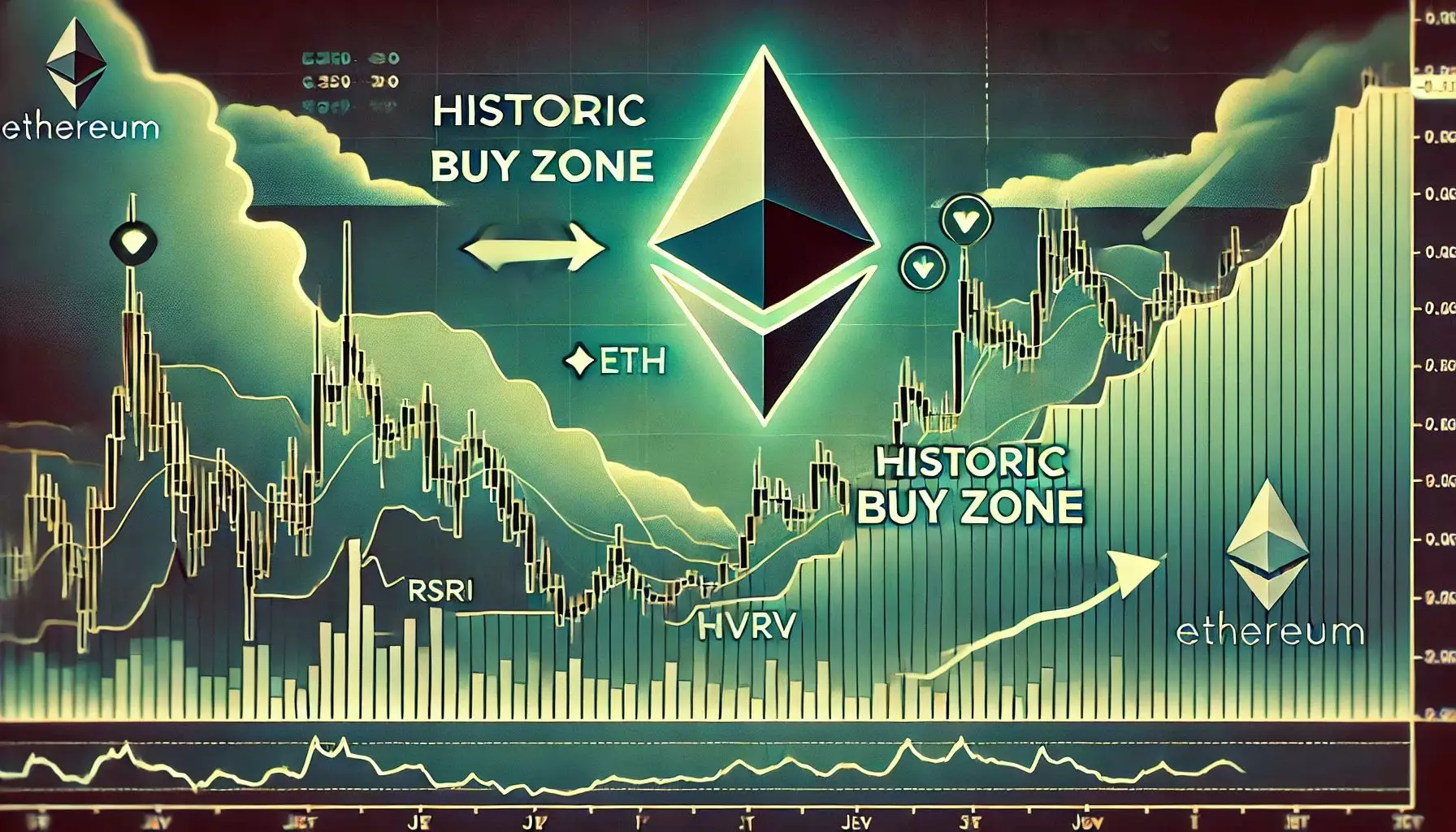

In the complex realm of crypto trading, understanding technical indicators is crucial. Analysts have pointed out that Ethereum’s price currently oscillates near a critical area known as the lower MVRV (Market Value to Realized Value) price band. This metric often suggests undervaluation, becoming a magnet for savvy long-term investors seeking to buy low during periods of extreme market pessimism. Ali Martinez, a respected crypto analyst, has emphasized the historical significance of this trading zone, where previous downturns have often given way to major rebounds.

At present, ETH is hovering around $1,610, navigating through a tight trading range between $1,550 and $1,630. This consolidation phase can be viewed as a precursor to impending volatility. The juxtaposition of technical signals like the MVRV band with the macroeconomic landscape paints a dismal picture—yet it also provides an intriguing buy-opportunity for those willing to experiment amidst chaos.

Bulls vs. Bears: The Psychological Battlezone

In trading, psychology plays as much of a role as technical analysis. The thresholds at $1,700 and $2,000 serve as psychological barriers, deterring bulls from acting decisively and transforming what was once support into formidable resistance. It’s in these moments of psychological angst that many investors choose to abandon their positions altogether, exacerbating downward price pressures.

For Ethereum, to regain momentum and assert itself as a leader in the crypto space, it must breach the $2,000 mark decisively. Each failure to do so only intensifies bearish sentiment and pushes casual investors towards safer havens, exacerbating Ethereum’s struggles. Should the price tumble below $1,550, it would further confirm a lack of confidence, accelerating sell-offs and deepening the current slump.

Long-Term Investment vs. Short-Term Trading

Ethereum’s current scenario is an enigma, posing as both a risky gamble and an enticing opportunity. Conservative market participants may find themselves tucked away in established assets, but those with a propensity for risk may view the price drop as a chance to accumulate. After all, investing during downturns has led to substantial gains for those who have historically timed the market well.

Yet, for those who wish to engage in the short-term trading game, the atmosphere lacks sound odds. The volatility in Ethereum’s price indicates a high-stakes environment where uncertainty could swiftly metamorphose into directionless chaos. Therefore, while longer-term strategists may eye accumulation opportunities, short-term traders should prepare for a precarious ride filled with rapid swings in price.

A Market of Caution and Curiosity

As we navigate through these turbulent waters of economic strife, Ethereum stands at a critical tipping point. What happens next could either fetch a resurgence or sink it further into despair. The intersection of technical analytics, global economic conditions, and trader psychology creates a canvas of complex possibilities.

Despite a climate of caution, opportunities to build wealth still exist, albeit they require diligent monitoring of both market trends and macroeconomic shifts. Investors must remain vigilant, as the very same volatility that inspires fear can also precipitate substantial financial gain. In this climate of uncertainty, critical decisions—fueled by discerning analysis rather than emotional reactions—will ultimately determine Ethereum’s fate in the rapidly shifting landscape of global finance.