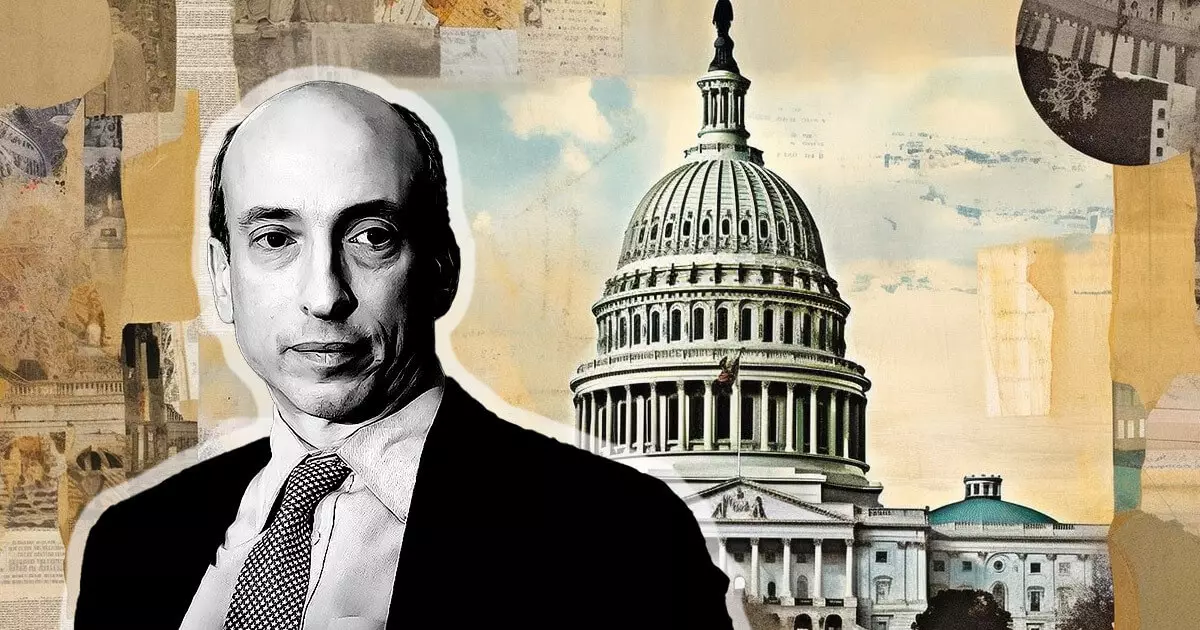

The Blockchain Association is urging SEC chair Gary Gensler to recuse himself from regulatory proceedings, claiming that his statements display a “clear bias” against the cryptocurrency industry. Senior counsel Marisa Coppel argues that Gensler’s assertion that all cryptocurrencies, except for Bitcoin, should be classified as securities demonstrates a prejudgment of the facts without proper assessment of the evidence. Coppel goes as far as to suggest that Gensler’s ultimate goal is to make cryptocurrencies illegal in the United States. She supports her claim by highlighting the SEC’s recent enforcement action against Coinbase, a well-established crypto company, despite the industry’s repeated requests for guidance and clarity. According to Coppel, the SEC has forsaken its role as a rulemaking body and instead opted for an aggressive enforcement approach.

SEC’s Abandonment of Clarity and Guidance

Coppel argues that the SEC’s refusal to provide the digital assets industry with the necessary clarity regarding securities laws and their application to various products and services within the sector is evidence of its failure to fulfill its responsibilities. Instead of offering guidance, the regulator has chosen to prioritize enforcement. Coppel contends that such biased behavior and neglect of due process make it impossible for the agency to effectively oversee the digital assets industry.

Alleged Violation of Due Process by Gensler

Coppel asserts that the SEC’s initiation of enforcement action against Coinbase constitutes a violation of due process by Gary Gensler. She specifically highlights the Wells process, which dictates that a company targeted by an enforcement action must be informed of the alleged violation and given an opportunity to respond. According to Coppel, it is crucial for the SEC Commissioners, who ultimately decide whether enforcement action will be pursued, to make an unbiased decision. However, she argues that Gensler’s premature judgment that all cryptocurrencies, except for Bitcoin, are securities suggests a predisposition, contradicting the requirement for impartiality in initiating enforcement action. Therefore, Coppel maintains that Gensler cannot maintain a neutral position when voting on whether the regulator should pursue enforcement action, and his involvement in the Coinbase case is a violation of due process.

Coppel refers to legal precedents such as American Cyanamid Co. v. FTC and Cinderella Career & Finishing Schs., Inc. v. FTC to support her argument against the SEC Chair. These cases established that agency officials must recuse themselves if they have already formed a judgment on the facts of a case.

The Blockchain Association is urging SEC Chair Gary Gensler to recuse himself from regulatory proceedings due to his alleged bias against the cryptocurrency industry. Senior counsel Marisa Coppel argues that Gensler’s statements and actions indicate a prejudgment of the facts and a failure to provide the industry with the necessary clarity and guidance. Coppel further claims that Gensler’s involvement in the enforcement action against Coinbase violates due process. The Association supports its arguments by referencing legal precedents. The outcome of this call for recusal remains uncertain, but it raises questions about the impartiality and fairness of regulatory proceedings related to cryptocurrencies.