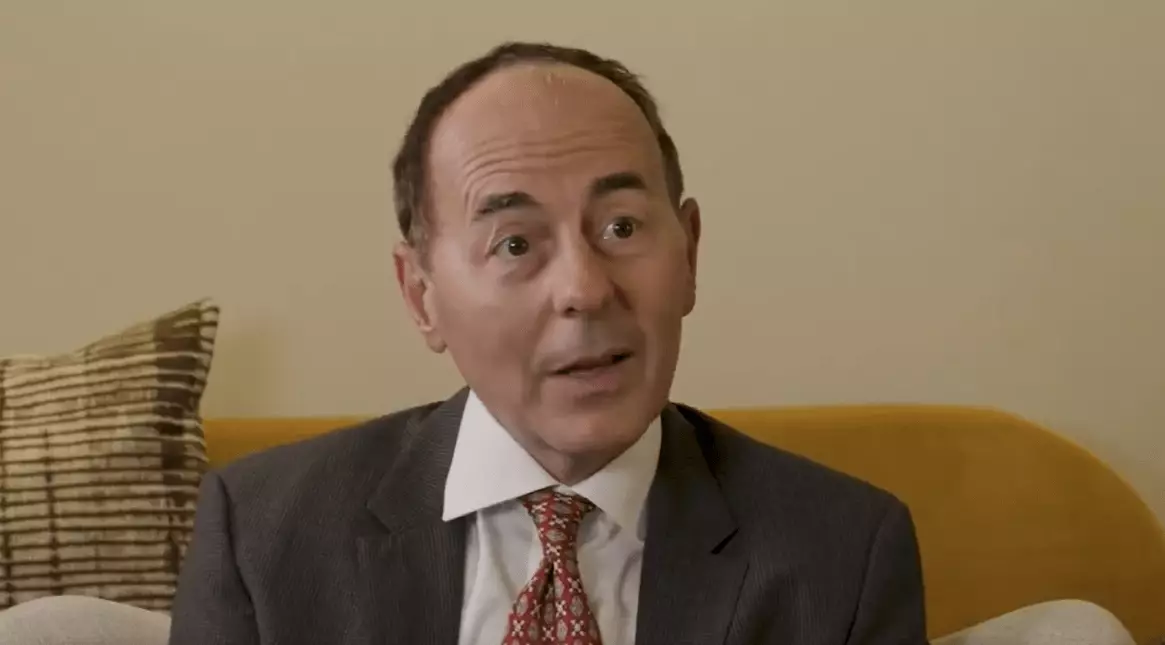

In a recent discussion with Mario Nawfal, Jan van Eck, the CEO of the $118 billion asset management firm VanEck, provided a tempered forecast regarding Bitcoin’s future price movements. Unlike the overly optimistic predictions circulating in some financial circles, van Eck projected a more measured target of $150,000 to $180,000 for this upcoming crypto bull run. He grounded this price prediction within the established Bitcoin halving cycles, which historically have played a critical role in influencing Bitcoin’s valuation. Van Eck shunned the extremely high $400,000 estimates, positing that such levels might only be reached in a subsequent cycle. He hypothesized that the next cycle could see Bitcoin attain a valuation roughly equivalent to half the market cap of gold, an intriguing benchmark that could speak volumes about Bitcoin’s long-term positioning in the asset hierarchy.

Van Eck’s more sober analysis serves as a reminder that while Bitcoin has considerable potential, its growth trajectory is not immune to market realities. Making a bold claim that Bitcoin’s future price might hinge largely on fluctuating gold prices provides a unique narrative twist that blends traditional asset analysis with cryptocurrency speculation. It also emphasizes the fundamental ideological battle over Bitcoin’s perceived value and legitimacy as an asset class.

Moving beyond cryptocurrencies, van Eck identified the US fiscal deficit as an “elephant in the room,” capturing growing concern among financial analysts regarding the sustainability of current federal expenditure trends. He expressed alarm at the notion that America’s fiscal policy has become so excessive that it could theoretically lead to insolvency if it were a private entity. This characterizes an increasingly precarious situation whereby the sheer volume of spending might soon become untenable.

Van Eck outlined two prevailing sentiments on fiscal policy within American political discourse. The first opinion, represented by lobbyists, claims that substantial cuts to spending are unrealistic, essentially placing the nation on an unsustainable growth trajectory. Conversely, the radical “extreme disruptors” perspective suggests introducing extensive spending cuts, citing potential eliminations of obsolete programs. The suggested $500 billion reduction — attributed to Vivek Ramaswamy — raises both eyebrows and questions about the political will to rein in deficits significantly.

Though van Eck acknowledged that such measures would not entirely eradicate the massive $1.8 trillion deficit from last year, he presented them as vital steps toward achieving a more balanced fiscal state. Such discussions underscore the complexities surrounding the US economy and the myriad factors that could dramatically shape both the fiscal landscape and investor sentiment.

The financial markets have continued to reflect a blend of reactions to recent political shifts, a phenomenon that van Eck aptly captured in his observations regarding President Trump’s electoral impact. Despite the decisive win for one party, uncertainty about fiscal policies lingers, casting shadows over market predictions. Van Eck noted the initial adverse reaction in precious metals like gold, presenting a paradox where political clarity surprisingly translated into market caution rather than exuberance. This highlights an essential characteristic of modern financial markets: the intricate web of expectations and perceptions can significantly influence asset prices, independent of fundamental realities.

Meanwhile, geopolitical tensions, particularly surrounding the Ukraine-Russia conflict, introduce another layer of unpredictability. Van Eck rightly critiqued the difficulties in developing investment strategies in such turbulent circumstances, as markets were often swayed by the latest headlines that could tilt the balance either way. By proposing the idea of doing “absolutely nothing,” he advocates for a methodical approach often favored by seasoned investors, who might prefer to stay on the sidelines during unpredictable geopolitical events rather than risk misguided investments.

The dialogue around Bitcoin wouldn’t be complete without addressing the regulatory landscape scrutinizing its future. Van Eck pointed out that the current investment climate is considerably conditioned by regulatory frameworks, especially within the United States, which has been slow to embrace change compared to regions like Asia. Notably, recent shifts in regulatory attitudes have ignited a renewed interest in Bitcoin among institutional investors.

The excitement is palpable, as van Eck expressed his own faith in Bitcoin’s maturation akin to the growth phases of a teenager. He welcomed the influx of new investors, viewing it as a catalyst for Bitcoin’s development and wider acceptance. Yet, he remains cautious about the holding patterns of wealth management firms, observing a reluctance to fully embrace this new asset class.

Furthermore, van Eck addressed Bitcoin’s correlation with traditional stocks, particularly the NASDAQ, expressing legitimate concern over the intertwined nature of these asset classes. A high correlation means that Bitcoin behaves similarly to established technology stocks, potentially undermining its exclusivity as a portfolio diversifier. Nevertheless, van Eck expressed hope that Bitcoin’s unique position could eventually allow it to decouple from such traditional financial trends, returning to its role as a standalone asset.

While the future of Bitcoin remains uncertain amidst various macroeconomic factors, one must remain grounded in a pragmatic understanding of market dynamics, fiscal policies, and geopolitical fluctuations. The journey ahead, as van Eck compellingly posits, will require astute navigation through a complex array of challenges and opportunities.