The cryptocurrency landscape is replete with stories of innovation, volatility, and, unfortunately, significant security breaches. The recent hack of Bybit, which saw a staggering loss of approximately $1.5 billion, has stirred considerable debate within the digital finance community. Chaotic moments like these expose vulnerabilities in not only individual platforms but also in the overarching systems that govern cryptocurrency transactions. Particularly critical was the involvement of Safe Wallet, whose infrastructure was identified as the entry point for attackers. The unfolding debate surrounding the response from Safe Wallet raises essential questions about transparency, accountability, and the reactive measures implemented in times of crisis.

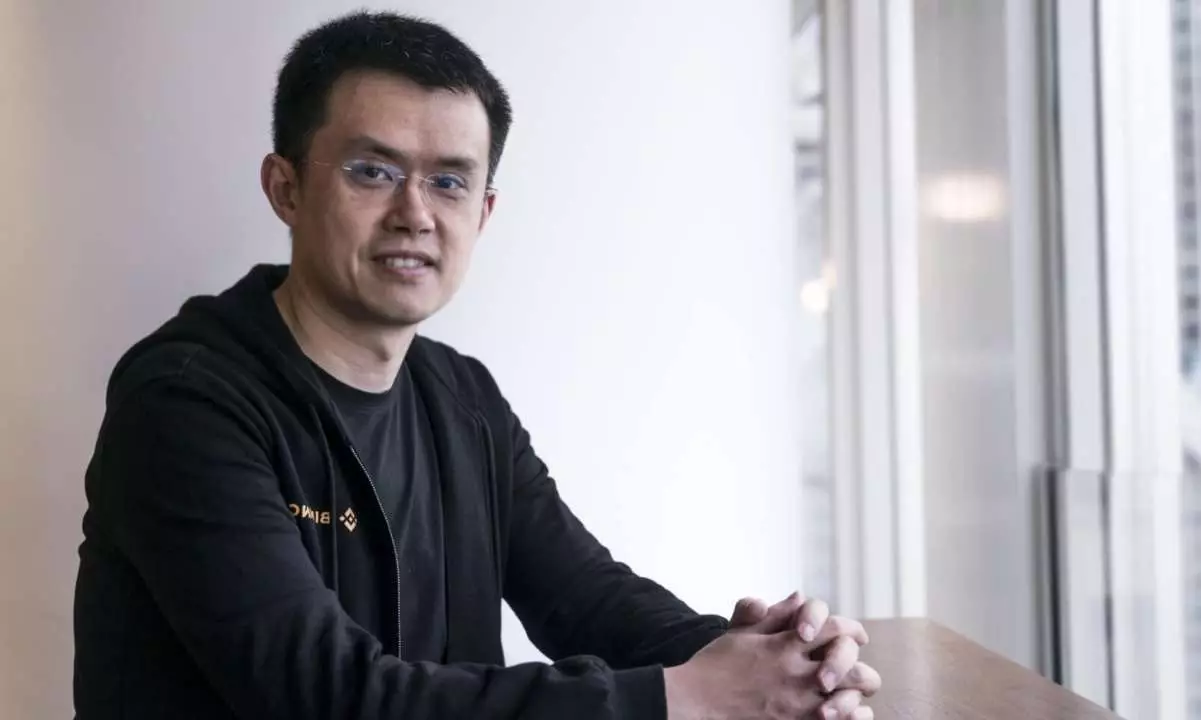

Changpeng Zhao, widely referred to as CZ, the former CEO of Binance, has been vocally critical of the insight shared by Safe Wallet following the incident. Zhao’s assessment, declaring the post-mortem as “not that great,” resonates with a growing sentiment in the cryptocurrency community regarding the necessity for clear and detailed communication in the aftermath of such calamities. Engaging in a deeper evaluation, it is apparent that CZ’s frustration stems from vague language that shrouded the specificities of the breach while leaving numerous questions unanswered.

What becomes evident is that in the high-stakes environment of cryptocurrency, the language used in public communications can carry substantial weight. The nuances of cybersecurity terms can often obscure the gravity of a situation, as safety mechanisms involve intricate details. The call for clarity from leaders like Zhao underscores a critical deficiency in crisis management practices—namely, the obligation to communicate effectively and transparently in the face of potential panic.

The forensic investigations indicated that the breach was not a result of faulty smart contracts or by exploiting the Bybit platform directly. Instead, compromised credentials of Safe Wallet developers allowed hackers unauthorized access, which meant the risk was more internal than external. This distinction prompts significant inquiry into the factors that led to such an oversight. How did attackers manage to infiltrate a developer machine? Was it through social engineering tactics, or were there system vulnerabilities that escaped detection during audits?

The details, or lack thereof, regarding the nature of the compromised machine are pivotal. The narrative surrounding how attackers executed their plans—through potentially malicious code introduced into Safe’s Amazon Web Services—illuminates a concerning trend: reliance on software without adequate checks for malicious alterations. Furthermore, the method of operation, executing transactions with what appears to be deceptive approval from signers, raises alarms about whether key security measures like Ledger verification were appropriately enforced.

Following the breach, a call for action arose within the cryptocurrency industry to reinforce security protocols. Safe Wallet’s response, bolstering its infrastructure and ensuring that credentials were changed, lays the groundwork for a more resilient system. However, there are broader implications for the sector. If prominent companies like Safe Wallet can fall victim to breaches of this magnitude, what does it mean for smaller platforms lacking robust security frameworks and resources?

The hack’s aftermath has catalyzed a reassessment of the protocols surrounding digital wallets, particularly in multi-signature setups. The incident not only highlights the need for enhanced security measures but also serves as a wake-up call for all crypto platforms to scrutinize their operational frameworks and consider adopting more rigorous vetting for developers and transactions.

Post-incident, Bybit has made substantial efforts to restore confidence among its client base, including securing significant levels of liquidity to meet withdrawal demands. CEO Ben Zhou’s declaration of complete asset backing serves as a beacon of assurance in a tumultuous environment. Nevertheless, such incidents have lasting repercussions on public perception, often sowing doubt that could take time to alleviate. Herein lies the dual challenge for operators: ensuring safety while simultaneously fostering trust.

While the response from Safe Wallet invokes a sense of caution regarding the communication of cybersecurity incidents, it also opens avenues for dialogue on improving industry standards. As the cryptocurrency world continues to evolve, the imperative to learn and adapt from such infrastructural vulnerabilities remains paramount to ensure both safety and trust in digital finance.