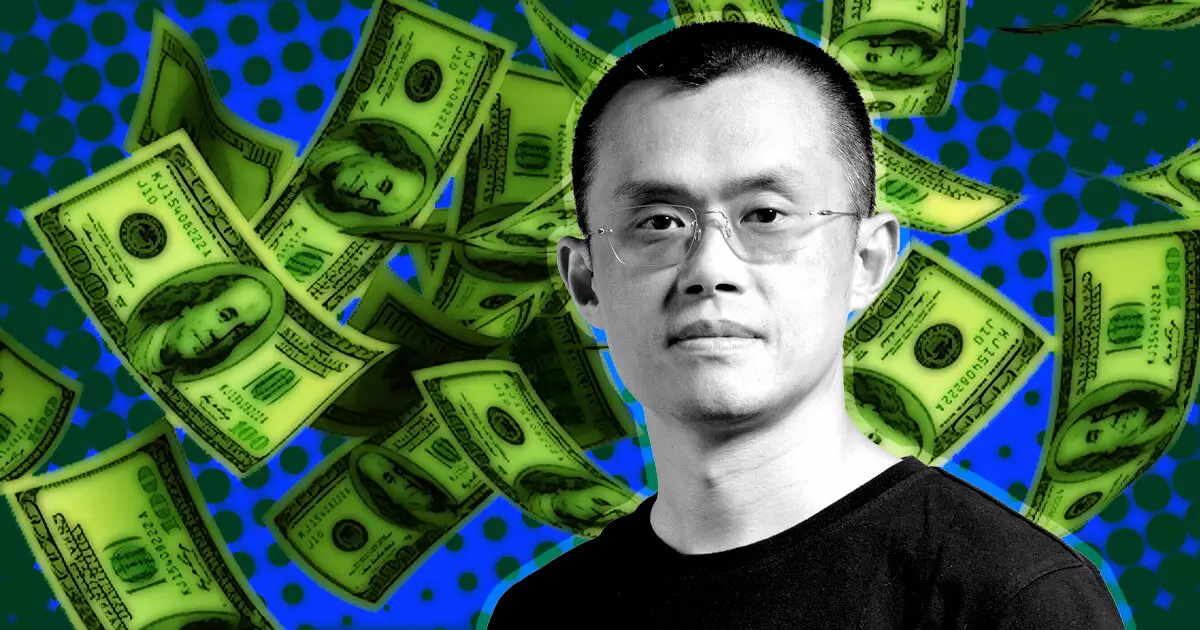

Binance CEO Changpeng Zhao has denied allegations made by the US Securities and Exchange Commission (SEC) that one of his holding firms received $12 billion in US customer funds. Responding to a Coindesk article that cited a court filing as its source, Zhao stated that “this is simply false” and that Binance.US had only around $2 billion in user funds. He went on to say that the value of Binance.US’s user deposits would only have fluctuated slightly due to crypto prices and user withdrawals and that “all user funds are accounted for, and never left the Binance.US platform” unless users had made withdrawals.

A Binance representative told Coindesk that the funds mentioned in the case were “strictly corporate funds and not user assets.” However, this statement is thought to refer to Binance Holdings accounts that held $12 billion between 2020 and 2022, rather than an admission of fund transfers. Other parts of the SEC filing appear to support the allegations made against Binance.

SEC unable to determine why Zhao-controlled entity acted as “pass through” account

According to the SEC filing, Merit Peak, one of Zhao’s holding companies, received $11 billion of Binance.com user funds via Key Vision Development Limited from 2019 to 2021. The $12 billion estimate appears to come from Merit Peak receiving an additional $1.2 billion from BAM Trading, another Binance.US-related company. However, the SEC says that Merit Peak mingled the roughly $12 billion of funds with funds from other sources, which amounted to $22 billion in total.

The SEC has been unable to determine why a Zhao-controlled entity that was supposedly trading on the Binance using Zhao’s personal funds would have acted as a “pass through” account for billions of dollars of Binance Platforms customers. The SEC’s court filing cites a separate document from its own accountant, which provides the same numbers but does not identify the source of those funds as Binance.US customer funds.

In summary, Binance CEO Changpeng Zhao has denied SEC allegations that one of his holding firms received $12 billion in US customer funds. While a Binance representative has stated that the funds mentioned in the case were “strictly corporate funds,” the SEC’s filing suggests that Merit Peak mingled $12 billion of Binance.com user funds with funds from other sources. The SEC has yet to determine why a Zhao-controlled entity acted as a “pass through” account for billions of dollars of Binance Platforms customers.