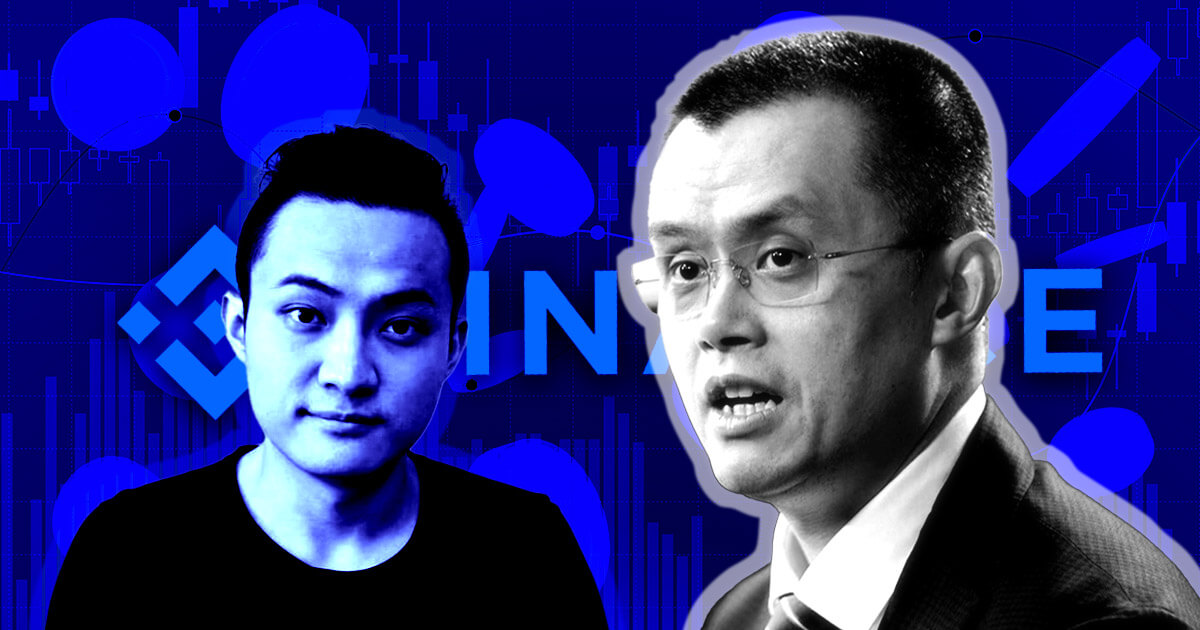

Binance CEO Changpeng ‘CZ’ Zhao has announced that crypto entrepreneur Justin Sun will be prevented from farming Sui tokens with his $56.1 million deposit of True USD (TUSD) on the exchange. Sun’s deposit to Binance was made on May 1, leading many to speculate that he was attempting to farm SUI tokens through the LaunchPool of the exchange. CZ allayed community concerns, stating that if Sun attempted to farm tokens, Binance would take action against him. CZ further explained that the LaunchPool is not just for whales, but for retail users as well.

Binance LaunchPool Attracts Over $558 Million in Staked Tokens

Binance’s Sui LaunchPool has attracted a lot of attention from investors, with users staking TUSD and BNB to farm SUI tokens over a two-day period. As of press time, $558.8 million TUSD and 9.2 million BNB tokens were staked in the pool. While Sun claimed that the transfer of funds was made by Tron DAO Venture in its role as a cooperative market maker for TUSD, it appears that part of the funds have been staked on SUI LaunchPool. Sun admitted that the mistake was made by colleagues who did not understand the purpose of the funds. However, some are skeptical of Sun’s explanation, believing that he is only backtracking after being publicly called out. Sun is known for making profitable trades, such as capitalizing on the USDC depeg to earn around $3 million.

In conclusion, Binance has taken action to prevent Justin Sun from farming SUI tokens with his deposit of TUSD on the exchange. Despite Sun’s claim that the transfer was made by Tron DAO Venture for the purpose of increasing liquidity, it seems that part of the funds were mistakenly staked on the SUI LaunchPool. While some are skeptical of Sun’s explanation, the LaunchPool has attracted a significant amount of staked tokens, with over $558 million in TUSD and BNB.