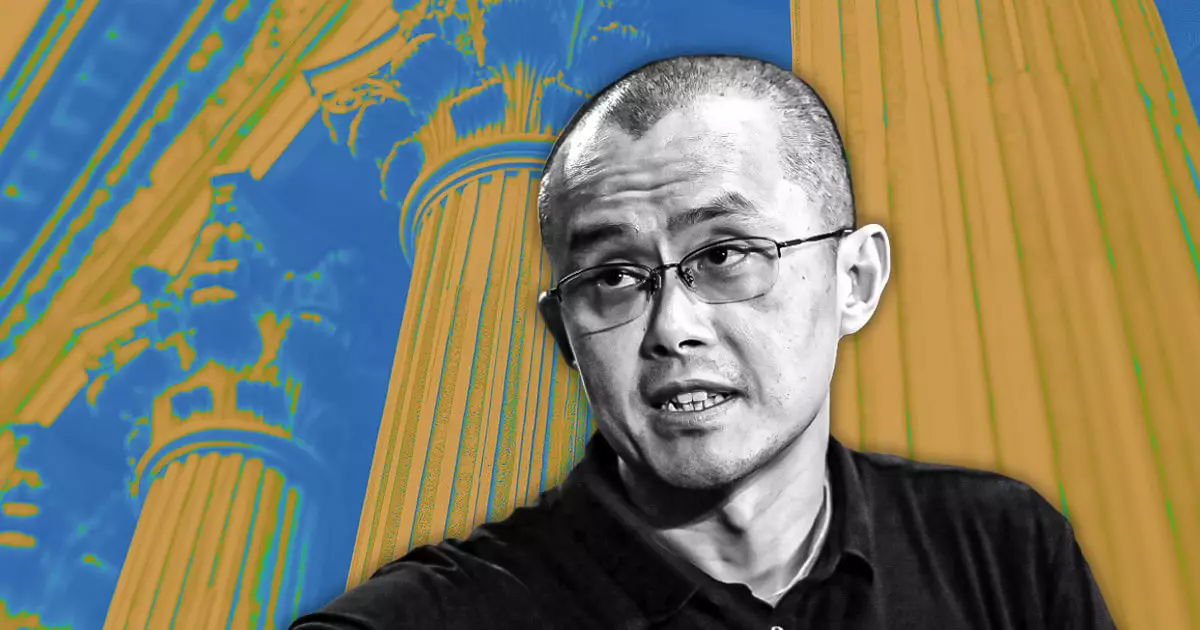

Changpeng Zhao, commonly known as CZ, the founder and erstwhile CEO of Binance, has recently dismissed rumors suggesting that the crypto exchange might be up for sale. This acknowledgment came in response to public speculation that arose after notable decreases in the exchange’s cryptocurrency reserves, which some interpreted as a signal of impending divestment. CZ took to social media on February 17 to clarify that these rumors stemmed from “misinformation spread by a competitor,” labeling the claims as unfounded and part of a negative campaign against Binance.

His outright denial of plans for a complete sale, however, came with a caveat: the prospect of a minority stake acquisition may be considered in the future. CZ conveyed that interest from leading investors has historically been strong, raising the possibility of allowing partial ownership—limited to single-digit percentages. This approach could hinge on strategic movements within the highly volatile crypto marketplace, which is marked by rapid change and increasing competition.

The initial rumors regarding the alleged sale gained traction after users observed notable fluctuations in Binance’s asset holdings, leading to anxiety about the exchange’s financial viability. In reaction, Binance moved swiftly to assure users that these changes were merely a reorganization of its treasury accounting, and not a prelude to liquidation or asset sales. Binance emphasized that customer assets remain fully collateralized on a 1:1 basis.

The community’s unrest was exacerbated by a viral social media post in China, which insinuated that Binance was contemplating a sale amid regulatory hurdles and a growing focus on decentralized exchanges (DEXs). In contrast to these claims, Binance reaffirmed its commitment to the centralized exchange model, maintaining its position as the largest global crypto exchange by trading volume. This relationship with both CEX and DEX models suggests a complex operational landscape.

The discussion around the sale of minority stakes hints at a more profound strategy aimed at securing Binance’s financial foundation without compromising its independence. While historically the exchange has operated under a private ownership structure dominated by CZ, engaging with outside investors could signify a willingness to adapt to market dynamics and investor interests.

Given the competitive pressures from other cryptocurrency exchanges, such a strategic pivot could also enhance Binance’s resilience during turbulent market conditions. Analysts observe that this openness to dilution in ownership—while not immediately actionable—might be a tactical decision to establish a safety net against potential downturns.

Despite facing increasing regulatory scrutiny and a shifting competitive landscape, Binance remains an influential player in the cryptocurrency exchange arena, consistently processing billions in daily transactions. CZ’s recent statements not only underscore the exchange’s commitment to transparency but also reflect an adaptive, forward-thinking mindset. As the company contemplates the balance between operational independence and attracting institutional investments, keeping an ear to the ground will be essential. The coming months will reveal how Binance navigates these waters, all while retaining its place as a powerhouse in the evolving world of digital currency.