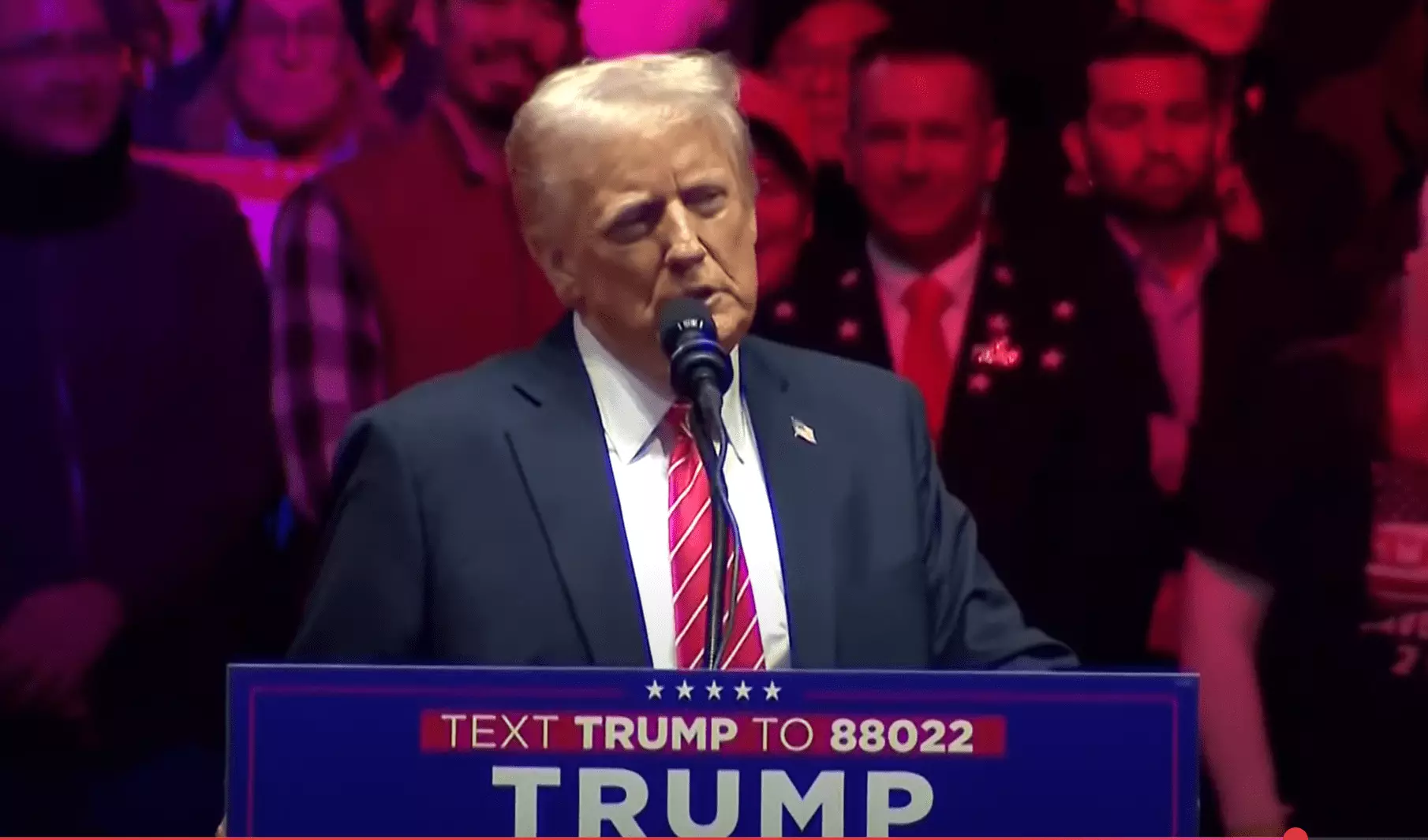

In the fast-paced world of cryptocurrency, few moments elicit as much excitement and speculation as significant market swings. Recently, Bitcoin achieved an astonishing peak of $109,558 during early Asian trading, coinciding with President Donald Trump’s inauguration day. This surge has raised intriguing discussions about the potential establishment of a Strategic Bitcoin Reserve (SBR), potentially set into motion by an executive order soon after Trump took office. Observers have noted that the market conditions and heightened speculation reflect a unique intersection of politics and cryptocurrency economics.

Following Trump’s inauguration, the conversation around a formal U.S. Bitcoin reserve has gained momentum, aided by predictions circulated on platforms like Polymarket. In recent days, the odds that such a reserve might be founded within Trump’s administration heightened to 59%. This notable increase in speculation is crucial, as it suggests that investors not only respond to market trends but also to the announcement of significant political initiatives that could reshape the landscape of digital assets in America.

Prior to becoming President, Trump had hinted at the possibility of converting seized Bitcoin into a government reserve. While these ideas remained largely in the realm of speculation, rumors surrounding the administration’s intentions have operated like a catalyst, driving price momentum in the crypto market. The intertwining of political actions with financial markets underscores the depth of trust in crypto assets and the influence of political figures in steering their value.

Meetings That Matter: Influential Figures and Their Roles

The weekend leading up to the inauguration was marked by notable meetings involving key figures within the Bitcoin community and Trump’s administration. Senators John Barrasso and Cynthia Lummis, both vocal advocates for cryptocurrency, highlighted their discussions with Trump about Bitcoin’s future. Lummis has been particularly proactive, working on a legislative proposal termed the “Bitcoin Bill,” which aims to purchase one million Bitcoin for the U.S. government. Such initiatives highlight not only a growing acceptance of cryptocurrency in political circles but also a broader strategic vision for the U.S. to potentially lead in the global digital currency arena.

Moreover, the engagement of prominent figures within the crypto world, such as MicroStrategy Chairman Michael Saylor, signals an era where lobbying for Bitcoin’s official status is not merely limited to informal discussions but is becoming part of a formal engagement model. Saylor’s interactions with influencers close to Trump further assert the burgeoning acceptance of Bitcoin among political elites, reinforcing its legitimacy.

As the Trump administration settles in, the crypto community is bracing itself for a series of developments that could redefine the U.S.’s approach to cryptocurrency. Fred Thiel, CEO of a major Bitcoin mining company, was recently spotted engaging with defense officials, a sign of increasing recognition of the economic implications of Bitcoin mining and its strategic importance. Market analysts have cautioned, however, that while the excitement could buoy Bitcoin’s price, the inherent volatility of the crypto market means that shifts in sentiment can happen rapidly, often leading to dramatic fluctuations in valuations.

As Charles Edwards from Capriole Investments observed, the recent aggressive market movements indicate a possible bullish trend ahead, particularly after a pattern of rapid sell-offs followed by recoveries. His insight highlights the complex psychological elements at play within the cryptocurrency space—investors are not only reacting to quantitative metrics but are also influenced by the qualitative aspects of news cycles and political developments.

As we look toward the future of Bitcoin under a potentially pro-crypto administration, it is important to recognize that while the landscape appears optimistic, uncertainty looms large. The interplay of political initiative and market behavior means that investor sentiment can pivot on a dime. There is a palpable sense of expectation, and for good reason; should the rumored developments actualize, they could herald a new era of acceptance for Bitcoin in mainstream financial practices.

Consequently, while Bitcoin’s recent price surge can be attributed to the coinciding political events and proposed initiatives, the resilience of its market will ultimately depend on sustained investor confidence amidst ongoing volatility. The question remains: will the potential establishment of a Strategic Bitcoin Reserve give rise to a more stable and structured environment for cryptocurrency, reaffirming Bitcoin’s place in the global economy? Only time will reveal the answers, but the upcoming days will undoubtedly be pivotal in charting the future of digital assets.