Greetings Verse Community,

We are excited to bring you another proposal for the Verse Ecosystem.

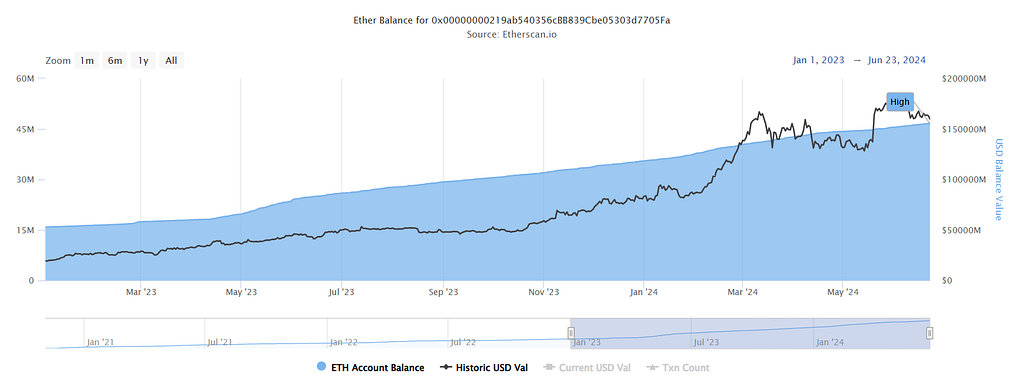

The U.S. Securities and Exchange Commission (SEC) recently approved eight spot exchange-traded funds (ETFs) backed by ETH, Ethereum’s native cryptocurrency. This has accelerated the interest in Ethereum from institutional and retail investors alike.

In particular, the interest in ETH Staking has in the past months, and we anticipate this trend to continue into the future due to:

- Ethereum’s strong track record of delivering network upgrades

- Presence of large projects and brands on the chain

- Increasing number of Layer 2s and Layer 3s building on Ethereum

For well-funded users with multiples of 32 ETH (US$109k at the time of writing) or experienced DeFi users, participating in ETH Staking is not an issue: Simply deposit 32 ETH with a validator or use a pooled staking protocol.

However, the barrier to entry is immensely higher for new crypto users — and these are the users that we serve in the and .

This proposal aims to address the question: How may we make ETH Staking easy, fun, and rewarding for the new crypto user?

Proposal

- We are proposing to set up a pooled ETH liquid staking vault for users to deposit any amount of ETH to earn staking rewards.

- This feature will be available on and within the Earn feature of the self-custodial wallet app.

- After depositing ETH, users will receive vstETH(“Verse staked ETH”) liquid staking tokens which represent their stake. vstETH will be integrated within the Verse Ecosystem and within the so that users can, for example:

– trade vstETH on the Verse DEX

– stake vstETH in Verse Farms for additional rewards

– spend vstETH on Verse dApps (eg. Verse Scratcher)

– send and receive vstETH

Pros:

- If executed successfully, this feature will simplify the ETH Staking experience for new crypto users in the mobile app and Verse Ecosystem

- vstETH, as our liquid staking token, will retain users within the Verse Ecosystem

- If executed in a timely manner, this feature will put us in a strong position alongside the ETH Staking narrative.

Cons:

- Resources could be deployed to other projects instead

- The ETH Staking feature may not bring in new users or engage existing users as expected

Voting Options

Option 1: Yes, proceed

Option 2: No, do not proceed

Each option brings its own set of strengths and considerations. The community’s choice will depend on the benefits and risks associated with each option. It’s an exciting opportunity to shape the future of the Verse Ecosystem, and we look forward to the community’s active participation in making this decision.

Now, it’s up to you, the Verse community, to decide!

Voting Period: July 23–29.

👉👈

The voting period for this proposal will commence on 23 July at 2:00 UTC and will conclude on 29 July at 2:00 UTC. During this time, we encourage all members of the Verse community to express their preferences and actively contribute to this significant decision.

Don’t have VERSE yet?

You need VERSE to vote on Verse Proposals. You can get VERSE in the , on our , , or on

Discussion

To share your sharing thoughts, suggestions, and feedback regarding the proposal, please join the conversation in the Verse Lounge, our verified community Telegram group. Visit to connect and contribute to the dialogue.

Your involvement is crucial in determining the direction of the Verse Ecosystem. We appreciate your dedication to the Verse community and look forward to hearing from you!

Thank you for being an integral part of the Verse journey. Together, let’s create something extraordinary!

was originally published in on Medium, where people are continuing the conversation by highlighting and responding to this story.