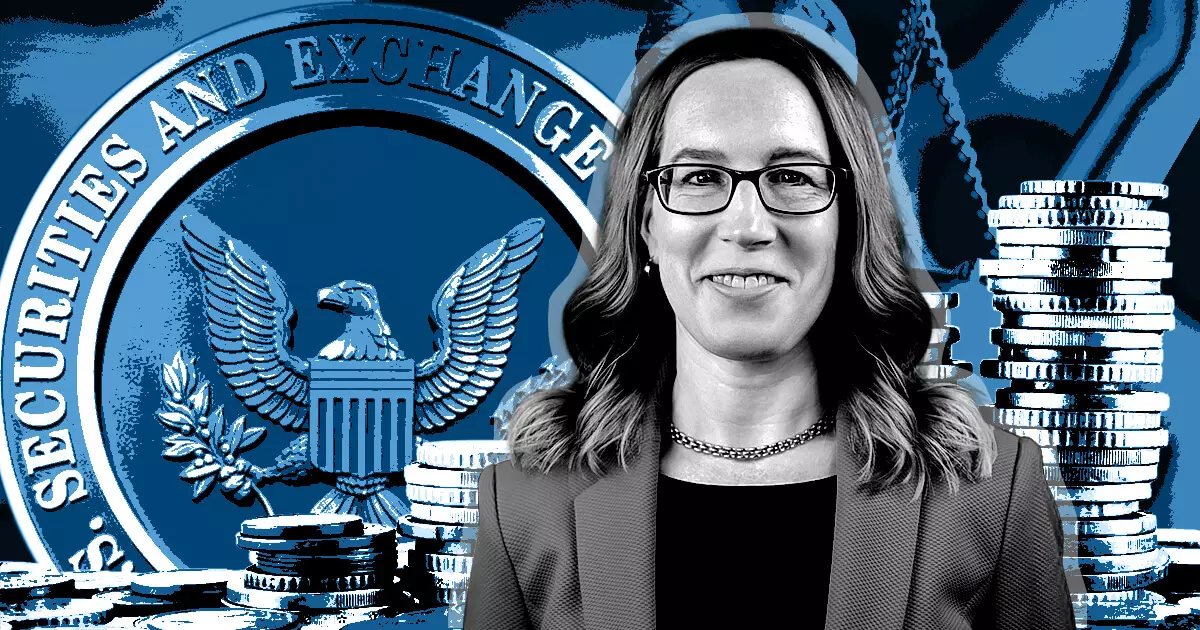

Recently, Hester Peirce, a commissioner for the U.S. Securities and Exchange Commission (SEC), voiced her dissent against the agency’s case against LBRY. This case involved LBRY Inc., the company behind the LBRY blockchain and content-sharing network, which ultimately decided not to appeal its loss and instead shut down. Peirce questioned the value of the SEC’s actions and emphasized the arbitrary nature of their regulation. In this article, we will critically analyze the SEC’s case against LBRY and evaluate the consequences of their actions.

The first point of contention is the outcome of the case and its impact on LBRY. Despite building a functioning blockchain with a real-world application, LBRY decided to shut down and enter receivership to pay off its debts, which included the SEC. Peirce raises a valid concern when she questions whether this outcome truly benefits investors and the market. It seems counterproductive for the SEC to contribute to the demise of a company with a promising project.

Peirce highlights the SEC’s regulation by enforcement approach towards the crypto sector, describing it as arbitrary and emphasizing the real-life consequences of such actions. It is crucial to note that the SEC did not allege fraud against LBRY, unlike many other projects. LBRY successfully maintained a functional blockchain and an operational, popular content-sharing platform. Despite this, the SEC took an extremely hardline approach, initially seeking $44 million in penalties and demanding LBRY burn all tokens in their possession. These remedies alone were deemed insufficient by the agency to ensure future compliance with registration rules.

Peirce also critiques the lack of clarity in the SEC’s regulations for token projects. She contends that there is no clear path for companies like LBRY to register their functional token offerings. Peirce’s argument raises significant concerns about the SEC’s approach, as it seems unfair to penalize companies operating in a gray area due to the lack of clear guidelines. This ambiguity in regulations inhibits innovation and discourages companies from pursuing blockchain projects.

One of the most critical points made by Peirce is the disproportionate response by the SEC. She argues that the SEC’s aggressive tactics in this case were excessive compared to the potential harm faced by investors. Instead of pursuing a scorched earth strategy, the SEC should have focused on creating a clear regulatory framework for token projects to adhere to. This excessive response not only hinders blockchain experiments but also diverts time and resources away from more productive regulatory efforts.

Despite the outcome of the case, it’s essential to note that the judge did not rule on the security status of the LBRY token (LBC) or secondary sales of LBRY. This allows room for speculation about the future of the LBRY blockchain, as it may continue to operate in some capacity. However, the lack of clarification regarding these crucial aspects of the case highlights the shortcomings of the SEC’s actions and their failure to provide clear guidance for the industry.

The SEC’s case against LBRY raises significant concerns about the agency’s regulation of the crypto sector. Hester Peirce’s dissent sheds light on the arbitrary nature of the SEC’s actions and the lack of clarity in their regulations. The excessive response by the SEC and the subsequent demise of LBRY only serve to discourage future blockchain experimentation and stifle innovation. Moving forward, it is imperative for the SEC to reconsider its approach and prioritize the development of a clear and fair regulatory framework for token projects.