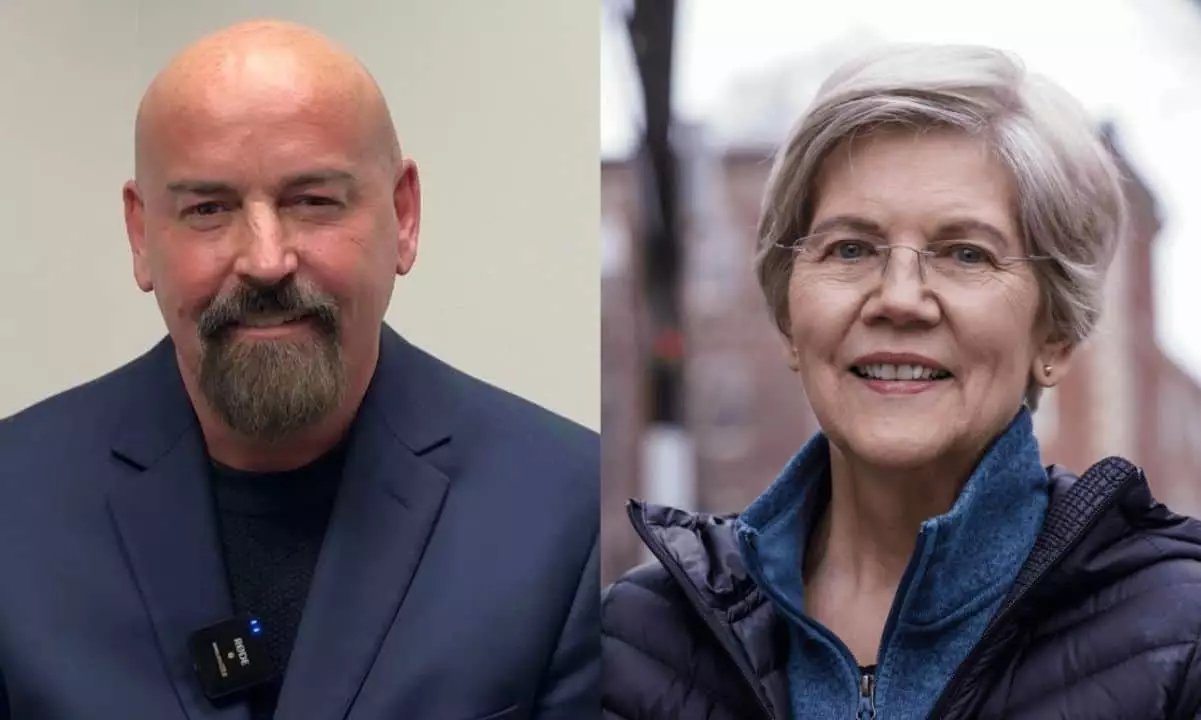

The recent debate in Massachusetts between incumbent Senator Elizabeth Warren and her pro-crypto opponent, John Deaton, serves as a compelling microcosm of the broader national dialogue surrounding digital assets. With tensions running high, this exchange was not only about contrasting campaign platforms but also represented the ideological struggle over the future of finance. The incorporation of cryptocurrencies raises vital questions about regulation, economic innovation, and accessibility, which were front and center during their discourse.

Warren, known for her critical stance toward digital currencies, has made it clear that her primary concern lies within the realm of consumer protection. Her call for an “anti-crypto army” underscores her belief that unregulated digital assets pose risks not just to individual investors but to the overall financial stability of the U.S. economy. In contrast, Deaton, a vocal advocate for cryptocurrency, argues that these innovations provide essential alternatives for those marginalized by traditional financial institutions. This debate makes evident the deep divide not just between two candidates but also among constituents who are increasingly polarized on this issue.

One of the most striking exchanges during the debate involved Deaton’s personal anecdote regarding his mother’s struggles with predatory banking practices. By recounting her experience, he positioned cryptocurrency as a tool for financial liberation, one that has the power to democratize financial services and provide the unbanked with opportunities previously inaccessible to them. This viewpoint resonates with many who see cryptocurrency as a means to greater financial independence, challenging Warren’s emphasis on consumer risk and the need for stringent regulations.

Deaton’s critique of Warren’s focus raises significant questions about whether her policies address the immediate challenges facing many Massachusetts residents, such as inflation and rising living costs. His jab—“I wish Senator Warren attacked inflation the way she attacks crypto”—speaks to a sentiment felt by many: that lawmakers may misplace their priorities in favor of political narratives rather than tangible economic relief. This criticism not only highlights a disconnect between the senator’s policy focus and the real concerns of her constituents but also showcases Deaton’s tactic of framing himself as an advocate for the “everyday person.”

The debate took a fiery turn as Warren accused Deaton of being too closely aligned with the crypto industry, insinuating that his motivations were compromised by financial interests. By stating that a significant portion of Deaton’s campaign funds stem from this sector, she painted him as beholden to the very forces that she argues jeopardize consumer safety. This tactic of questioning the opponent’s integrity in terms of financial backing is common in political debates, but it also raises ethical queries about campaign finance as a whole.

Deaton didn’t shy away from responding, defending himself by bringing attention to Warren’s own connections with corporate PACs. In doing so, he reframed the conversation, suggesting that skeptics of cryptocurrency may also harbor interests that do not align with average voters. His involvement in the Ripple v. SEC case and subsequent financial implications for forward-thinking Democrats served to bolster his credibility, framing him as a champion for the underdog in a space traditionally dominated by large financial institutions.

While Deaton presented a more libertarian view on cryptocurrency, arguing against proposed restrictions on self-custody of Bitcoin, Warren maintained that she is not outright against digital currencies but advocates for their regulation akin to banks to safeguard consumer interests. This brings to light a critical paradox: how to foster innovation without sacrificing consumer safety.

Warren’s insistence on regulatory frameworks that would apply to cryptocurrencies ignites a much larger conversation about the role of government in financial sectors undergoing rapid technological evolution. Deaton contends that excessive regulations “benefit the financial elite, not the everyday person,” a sentiment that encapsulates a growing frustration among those who feel ignored by policymakers. Ultimately, the debate is reflective of a change in the financial landscape, where traditional paradigms are being challenged by decentralized technologies.

As the Massachusetts Senate race unfolds, the implications of this debate extend far beyond the electoral stakes. As politicians navigate the complex terrain of cryptocurrency regulation and consumer protection, they must consider how their policies will impact not just their campaigns, but the future of financial accessibility for millions of Americans. The clash between Warren’s protective instincts and Deaton’s advocacy for innovation encapsulates the critical challenges presented by emerging financial technologies, making this a notable moment in the ongoing saga of American finance.