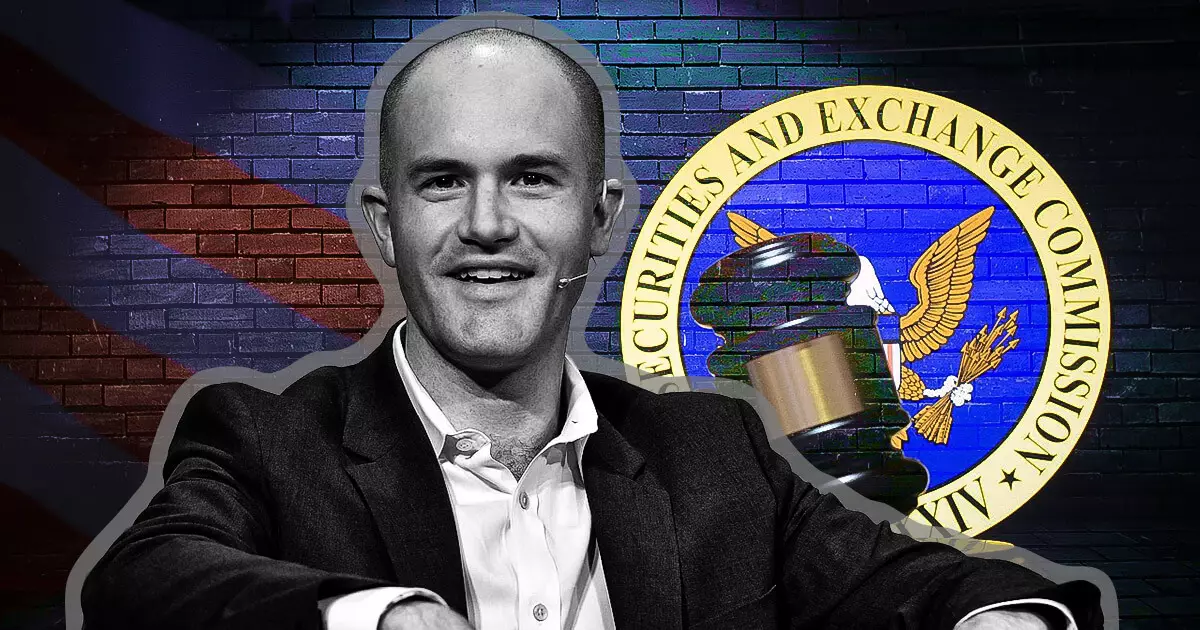

In a significant move indicative of the widening rift between cryptocurrency platforms and governmental regulators, Coinbase CEO Brian Armstrong recently announced that the company would cut ties with law firms that engage former regulatory officials linked to what he described as detrimental actions against the crypto sector. This bold declaration, communicated through social media on December 3, is a noteworthy reaction to the elevated tensions that have characterized the relationship between the crypto industry and regulatory bodies in the United States.

Armstrong’s comments were largely precipitated by the news that Gurbir S. Grewal, who previously directed the Enforcement Division at the SEC, has joined the law firm Milbank. In voicing his discontent, Armstrong named Milbank as one of the firms that would no longer be supported by Coinbase should they employ individuals he views as having played a role in what he considers to be “unlawful” actions against the crypto community. This marks a dramatic shift in how cryptocurrency platforms approach their partnerships with legal representation, signaling a strict standard for accountability among legal firms.

Armstrong’s criticism is not merely aimed at particular individuals but extends toward the entire regulatory framework exemplified by the prior administration at the SEC, under Gary Gensler. He argued that the SEC’s approaches during this time had manifested as targeted aggression toward the cryptocurrency sector, pointing to what he describes as a significant failure to provide clear regulatory guidance. According to Armstrong, this failure not only hampered innovation but also resulted in a myriad of enforcement actions that he sees as ethically questionable.

His remarks suggest that the senior partners in these firms should have a comprehensive understanding of the unique position and challenges faced by the crypto market. By accusing Grewal of ethical breaches, the Coinbase CEO emphasizes a belief that former regulators should be held to account for their actions, illustrating a demand for integrity and responsibility that extends beyond the confines of traditional regulatory practice.

Despite the intensity of his claims, Armstrong clarified that he does not endorse an absolute cancellation of individuals who have worked in regulatory roles. Instead, he called for a more discerning approach, where the crypto industry collectively avoids financially backing those he believes have actively contributed to the sector’s regulatory woes. This stance underscores a crucial turning point in which crypto firms begin advocating for their interests more forcefully by leveraging their economic power to influence the behaviors and career decisions of legal entities.

Armstrong’s message resonates with many within the broader crypto community who have felt the pressure of increasing oversight and litigation. The implications are significant: an industry that has been largely characterized by its rapid growth and innovation is now pushing back against an old-guard regulatory body that many perceive as out of touch. As Coinbase continues to navigate this challenging landscape, the broader repercussions of Armstrong’s declaration may lead to a recalibration of relationships among regulators, legal firms, and crypto businesses moving forward.

By taking a firm stance against law firms employing former regulators perceived as antagonistic toward the crypto industry, Armstrong may be spearheading a critical strategy that could reshape the legal and regulatory landscapes, potentially enabling a more favorable environment for digital innovation.