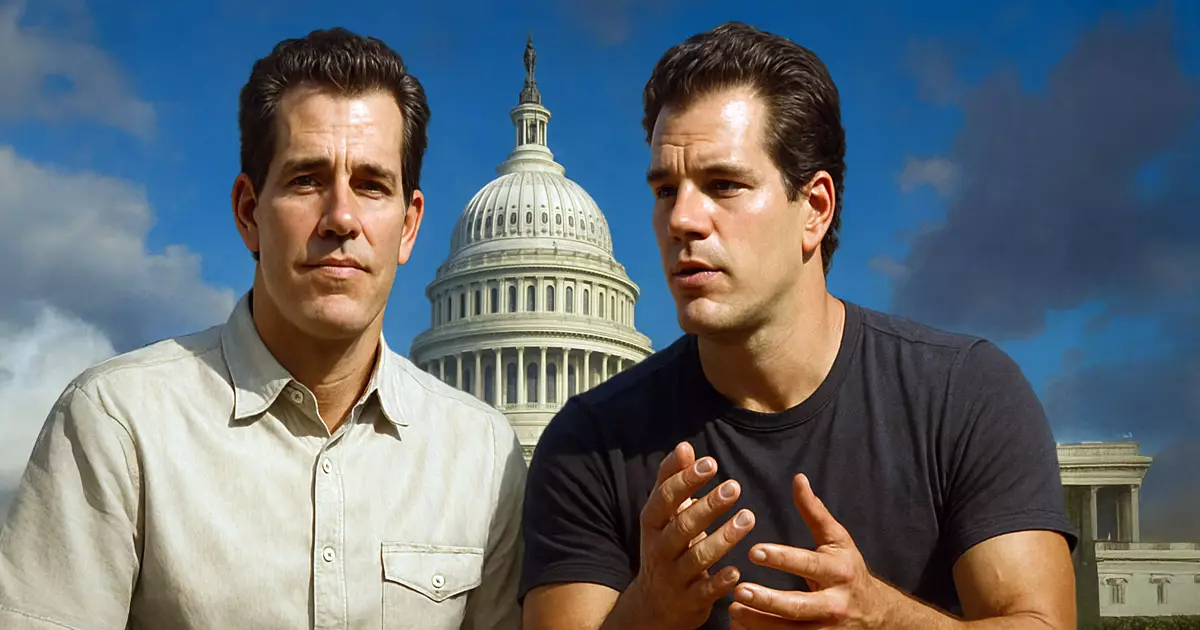

In an unprecedented move, the Winklevoss twins—famous for their early investment in Bitcoin—are leveraging their influence to shape the political landscape through substantial crypto donations. By allocating 188.4547 BTC, roughly equivalent to $21 million, to launch the Digital Freedom Fund PAC, they are not merely supporting a cause; they are attempting to redefine the foundational relationship between technology, finance, and governance. This bold financial injection exemplifies how the digital asset industry is evolving into a powerful political force, challenging entrenched regulatory structures and advocating for an aggressive, libertarian-leaning pro-crypto agenda.

The formation of this PAC signals a clear intent to sway American elections—particularly the 2026 midterms—by backing candidates sympathetic to Trump-era visions of America becoming the “crypto capital of the world.” It is a strategic effort rooted in the belief that maintaining a favorable Congressional majority is essential for safeguarding and expanding crypto-friendly policies. This maneuver highlights a broader ideological stance: that a government overly involved in digital currencies suppresses innovation, limits individual freedoms, and hinders economic growth.

Crypto as a Political Catalyst for Limited Government and Innovation

Central to the PAC’s mission is the push for legislative reforms that shield crypto entrepreneurs and protect users’ rights. The proposed “Skinny Market Structure Bill” aims to prevent regulatory overreach while enshrining fundamental rights for crypto ownership, peer-to-peer transactions, and self-custody. These initiatives reflect a libertarian approach—favoring minimal government interference and promoting a decentralized, open economy. Tyler Winklevoss’s call for a “Bitcoin and Crypto Bill of Rights” echoes a desire to formalize the individual’s control over digital assets and affirm their sovereignty in law.

This stance comes into sharp contrast with the growing trend of government-backed Central Bank Digital Currencies (CBDCs). The PAC condemns CBDCs as “totalitarian technologies,” framing them as instruments of governmental overreach meant to surveil and control citizens’ financial behaviors. Such an opposition is rooted in a belief that digital currencies should empower individuals, not provide tools for state surveillance. The overarching narrative is that crypto represents a pathway toward economic liberty, whereas CBDCs threaten to erode personal freedoms under the guise of technological progress.

Regulatory Battles and the Fight for Fair Play

The regulatory landscape is where the political clash intensifies. With endorsements of initiatives like SEC Chairman Paul Atkins’ “Project Crypto” and CFTC Acting Chair Caroline Pham’s “Crypto Sprint,” the PAC actively seeks to influence policy in favor of industry-friendly regulation. These efforts align with the broader goal of creating a regulatory environment that fosters entrepreneurial innovation without falling prey to capture by entrenched corporate interests or bureaucratic inertia.

Tyler Winklevoss’s remarks convey skepticism about how the current regulatory process favors well-funded incumbents, contrasting the costs of launching a crypto startup to the burdensome registration procedures faced by smaller or emerging firms—particularly those founded by individual entrepreneurs working from home or small garages. His push for accessible regulatory processes underscores a commitment to democratizing crypto entrepreneurship and preventing the industry from being monopolized by powerful conglomerates.

By advocating for legal protections akin to Section 230, the PAC seeks to empower software developers, protect innovation, and maintain a vibrant, competitive ecosystem. This stance reflects a belief that a thriving crypto industry is incompatible with excessive government oversight, which could stifle the very innovation that has driven crypto’s recent growth.

The Ideological Divide and Future Trajectories

This political gamble—funded by substantial crypto riches—embodies a broader ideological divide. On one side are those who see regulation as a means to legitimate and stabilize digital assets; on the other are advocates like Winklevoss who view regulation as a potential tool for censorship, control, and suppression of individual freedoms. Their approach suggests that America’s future as a crypto hub depends on resisting overregulation and embracing a vision where financial sovereignty is paramount.

While critics may see this strategy as overly optimistic or even reckless, it undeniably signals a pivotal moment in the intersection of politics and crypto. The fusion of high-level donations with aggressive policy advocacy demonstrates that this industry is no longer content to operate in the shadows; it seeks influential allies and government reforms that align with its core principles—liberty, innovation, and limited government. Whether this effort will succeed or backfire remains to be seen, but it unmistakably signifies a shift toward crypto activism as a major political force.