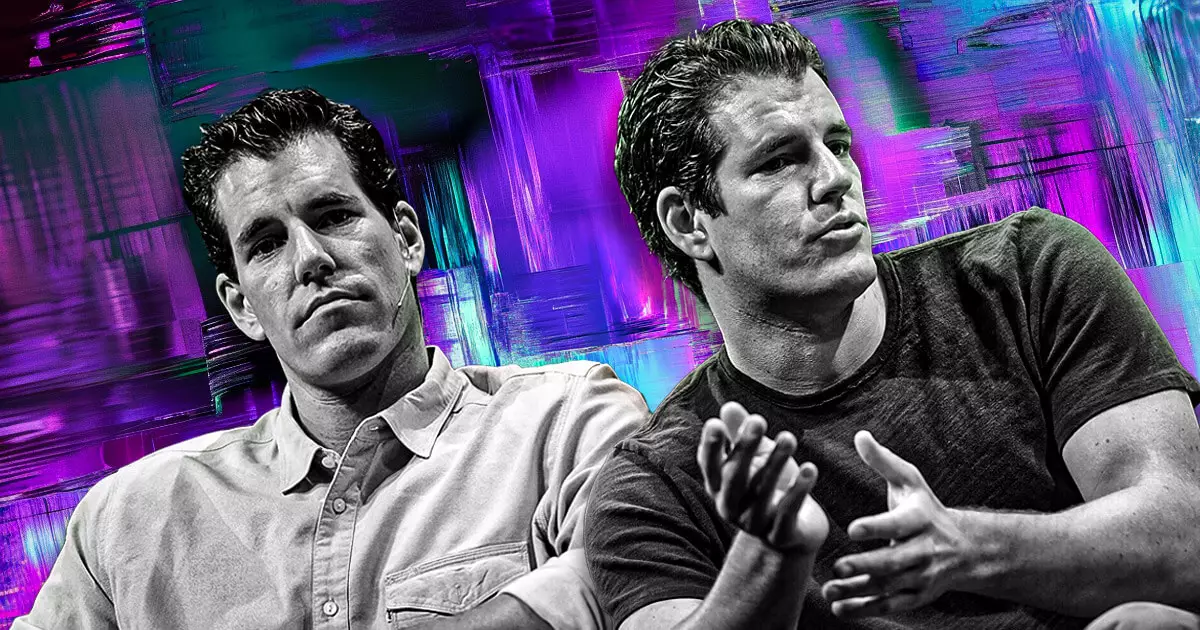

Gemini, the cryptocurrency exchange co-founded by Cameron and Tyler Winklevoss, is reportedly considering an initial public offering (IPO) later this year. According to Bloomberg News, this move is under discussion with potential advisers, although no conclusive decision has arrived at this juncture. This exploration into going public is part of a broader trend among cryptocurrency firms looking to establish more legitimacy and secure financial backing amid a tumultuous regulatory landscape.

The potential for an IPO isn’t solely a tactical business maneuver; it is also reflective of the larger political environment surrounding cryptocurrencies. James Seyffart, an ETF analyst at Bloomberg, has noted that an increasing number of crypto corporations may gravitate towards public listings, partially due to the pro-crypto stance of former President Trump’s administration. The Winklevoss twins’ recent financial contributions to Trump’s campaign, including a Bitcoin donation that exceeded limits set by the Federal Election Commission, suggest a positively aligned interest between major players in the crypto space and government entities.

Gemini’s contemplation for a public listing comes at a time when other significant players in the crypto industry, such as Bullish Global—backed by billionaire investor Peter Thiel—are also weighing IPO opportunities. This trend can be partly attributed to the ongoing regulatory backlash faced by many exchanges. Gemini, while seeking to pivot its business strategy, has been entangled in legal disputes, including a $5 million settlement with the Commodity Futures Trading Commission (CFTC) over allegations of misleading regulators for the launch of the first U.S.-regulated Bitcoin futures contract. These legal hurdles illustrate the challenges crypto firms continue to battle.

Amid persistent regulatory pressures in certain jurisdictions, Gemini recently opted to withdraw from the Canadian market, joining several other cryptocurrency firms like Bybit and Binance in this retreat. The company’s strategy, however, has also included expansion efforts abroad, highlighted by their acquisition of a license to operate in Singapore. This move aligns with Singapore’s increasingly favorable regulatory position toward digital currencies, painting a stark contrast to the tightening regulations seen in other countries.

The decision to pursue an IPO signifies Gemini’s attempt to not only raise capital but also to elevate its profile in the mainstream financial ecosystem. As the cryptocurrency industry matures, the shift toward public listings indicates a desire for greater transparency and compliance with regulatory expectations. With various companies, including major players like OKX, Upbit, Ripple, and Coinbase, also exploring opportunities in more welcoming markets like Singapore, it is clear that adaptability and strategy will be crucial for survival and growth in this ever-evolving landscape. The outcomes of these endeavors could ultimately reshape the future of cryptocurrency trading platforms, making their progress essential for broader market acceptance.