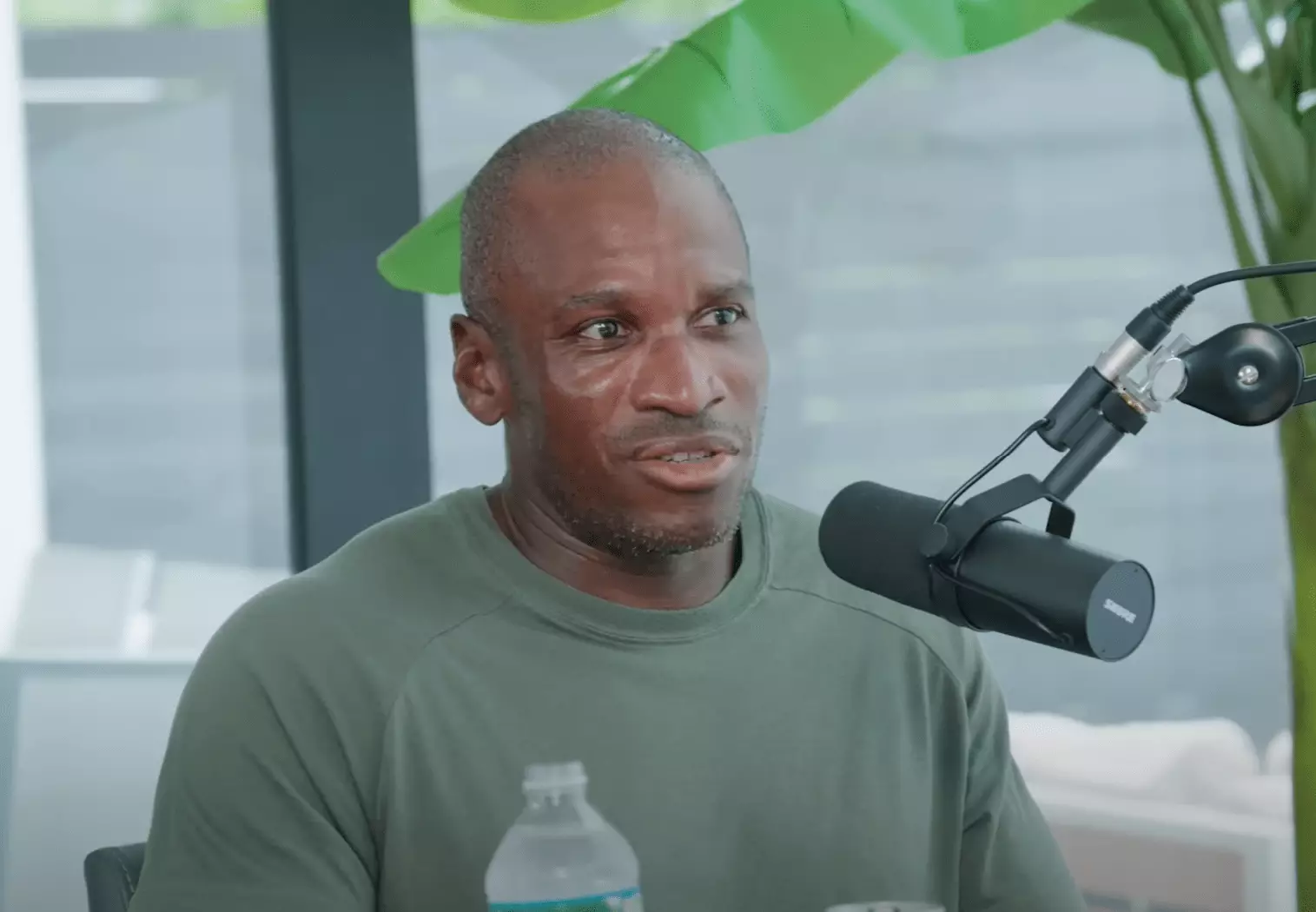

Arthur Hayes, known for his unapologetic candor and sharp financial insights, has recently shared a compelling analysis of Bitcoin’s potential market trajectory in his essay, “The Ugly.” As the co-founder and former CEO of BitMEX, his expertise in cryptocurrencies positions him as a critical voice in today’s complex financial environment. Hayes presents a foreboding sentiment: that a significant short-term pullback in Bitcoin’s price could be imminent, albeit with the prospect of substantial long-term gains. This duality reflects the intricate dance that cryptocurrency investors must navigate in an unstable economic backdrop.

In his essay, Hayes draws a vivid analogy, likening financial analysis to backcountry skiing on a dormant volcano. Just as a whisper of impending danger necessitates caution in the wilderness, so too does he caution against the current financial climate. Hayes recalls the anxious atmosphere preceding the cryptocurrency market collapse of 2021 and 2022, prompted by subtle shifts in monetary conditions that invoked similar forewarnings. His sensory approach to market analysis underscores the importance of intuition in trading—an aspect often overlooked by data-centric predictions.

Hayes’ analysis hinges on factors such as central bank balance sheets, banking credit ratios, and the intricate relationships between treasury yields, stock performance, and Bitcoin valuations. These interconnected indices create a precarious framework within which cryptocurrencies operate, leading him to propose that Bitcoin’s price could recede to between $70,000 and $75,000 before making a robust rebound towards $250,000 by the close of the year.

Hayes outlines a pragmatic investment strategy that balances risk and opportunity. His firm, Maelstrom, remains preferentially positioned in USDe stablecoins, enabling them to purchase Bitcoin if prices dip below the anticipated threshold. This approach illustrates a dual commitment to safeguarding capital and seizing future buying opportunities when market conditions permit. Such strategies resonate with prudent investing principles, where preserving liquidity during downturns fosters resilience and enables strategic acquisitions during market corrections.

Pointedly, Hayes anticipates a potential 30% decline as a reasonable expectation, yet he remains open to bullish possibilities. By stating, “if Bitcoin trades through $110,000 on strong volume with expanding perp open interest, then I’ll throw in the towel and buy back risk higher,” he demonstrates flexibility in his strategy, emphasizing the need for traders to adapt to market movements while maintaining a clear vision of their risk tolerance.

Hayes attributes much of the turmoil in the cryptocurrency and stock markets to the actions of major central banks. He observes a tightening of money creation policies among the Federal Reserve, the People’s Bank of China, and the Bank of Japan, with significant implications for speculative capital flows. The rising yields on 10-year treasuries pose further challenges, as an increase to the 5% to 6% range could create headwinds for both equities and cryptocurrencies, including Bitcoin.

In an intricate political landscape, Hayes points out tensions stemming from the Federal Reserve’s interactions with fluctuating U.S. administrations. The lingering adversarial dynamic between the Fed and Trump’s policy strategies could ignite a financial crisis that necessitates vague policy shifts from the central bank. When faced with potential market turmoil, Hayes posits that the Fed may have little choice but to revive expansive monetary policies to stabilize the economy. This perspective speaks to the unpredictability of market responses to political pressures and the necessity for investors to remain vigilant.

Despite Bitcoin’s reputation as an alternative asset, Hayes highlights its increasing correlation with traditional risk assets. This trend poses perplexities for investors who historically viewed Bitcoin as a unique store of value, separate from conventional financial instruments. He provides compelling data to illustrate the rising correlation between Bitcoin and the Nasdaq 100, indicating that in the short term, Bitcoin may respond more to liquidity changes than to its intrinsic attributes.

Hayes views Bitcoin as a leading indicator; a downturn in equity markets could trigger a swift decline in Bitcoin’s price, well before traditional assets retract. However, he believes that once markets stabilize and central banks inject liquidity back into the system, Bitcoin would rebound strongly, showcasing its resilience and potential for recovery.

In his closing reflections, Hayes underscores that successful trading is not merely a matter of right or wrong predictions but rather involves a deep understanding of perceived probabilities. His emphasis on this principle showcases a sophisticated approach to risk management where the goal is to maximize expected value while navigating market uncertainties, such as the anticipated “Armageddon” in the altcoin market should volatility strike.

Ultimately, Hayes’ insights not only speak to Bitcoin specifically but also encapsulate broader investment philosophies in the cryptocurrency space. By maintaining a balanced perspective, investors can emerge from episodic market volatility poised for growth, reinforcing the notion that vigilance and strategy are key in an ever-evolving marketplace. As Bitcoin hovers around $102,530, the road ahead may be fraught with uncertainty, but opportunities for informed and thoughtful investing abound.