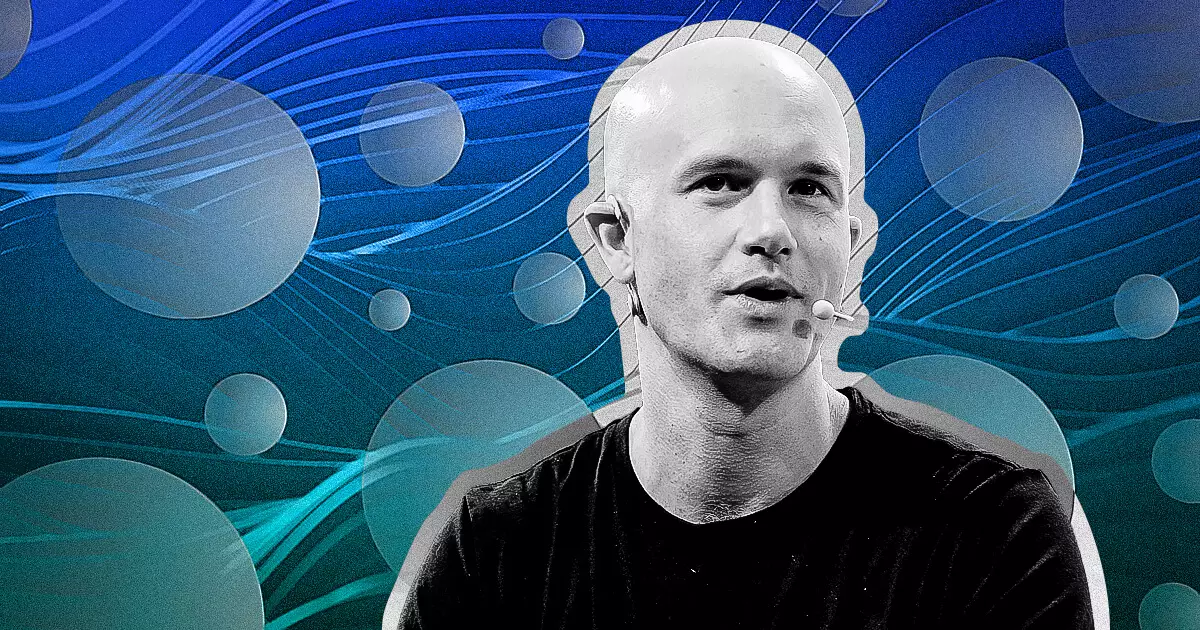

As the cryptocurrency landscape evolves at an unprecedented pace, industry leaders are recognizing the need for innovative approaches to the token listing process. Brian Armstrong, the CEO of Coinbase, has recently emphasized this need in a series of insightful comments shared via social media. With the number of new cryptocurrencies surging due to the rise of blockchain innovation, traditional evaluation methods have become increasingly inadequate. In an environment where approximately one million new tokens are generated weekly, the demands on existing systems to evaluate each new asset are unsustainable.

Armstrong’s observations highlight a fundamental challenge within the cryptocurrency space: how to effectively manage and assess the surge of new digital assets without stifling creativity and innovation. The current reliance on centralized approval processes is proving to be a bottleneck, as it becomes chronically overwhelmed by the sheer volume of emerging tokens. In light of these developments, Armstrong’s call for a reassessment of token evaluation mechanisms appears not just timely, but necessary.

In his analysis, Armstrong proposed a transformative shift towards a block-list system. This new approach would operate on the premise that a token is inherently allowable unless flagged as potentially harmful. This would represent a significant departure from the traditional model where every asset is subject to rigorous individual scrutiny before gaining entry into the marketplace. The idea is not only innovative but also practical, considering the capabilities of modern technology to leverage user feedback and automated data analysis.

By employing both community insights and advanced on-chain data scans, the system Armstrong envisions would enable quicker identification of risks or fraudulent tokens without creating excessive restrictions on legitimate innovations. This method would empower users with greater agency while simultaneously enhancing the scalability of the entire ecosystem. Inquiries surrounding token safety could be democratized, enabling users to engage more authentically with the innovation that blockchain technology fosters.

Armstrong’s insights extend beyond the technical aspects of token listings; he also underscores the critical interaction between regulatory frameworks and technological advancements. He urged regulators to recognize that existing token approval processes simply cannot keep pace with the rapid evolution of the cryptocurrency market. The outdated systems in place are, in fact, at risk of hampering the very ecosystem they aim to protect.

He calls for a collaborative approach between regulators and industry stakeholders to devise frameworks that safeguard investor interests while nurturing innovation in the crypto space. This type of cooperation is essential, as it bridges the gap between the often-conservative stance of regulation and the fast-moving nature of blockchain innovations. A reimagined regulatory landscape could serve as a catalyst for growth rather than a hindrance, allowing for both security and innovation to flourish side by side.

Moreover, Armstrong reiterated Coinbase’s ambitions to deepen the integration of decentralized exchange (DEX) support into their platform. By simplifying the distinction between centralized and decentralized trading options, Coinbase aims to create a user-friendly experience. With the intention of making decentralized trading as accessible as its centralized counterpart, Coinbase is poised to position itself at the forefront of the transition toward a more decentralized financial ecosystem.

This step indicates a broader shift within the industry where the lines between traditional and decentralized finance continue to blur. As users become more comfortable with engaging in decentralized platforms, the emphasis on security, transparency, and user empowerment will play a pivotal role in shaping future interactions within the cryptocurrency space.

Armstrong’s proposals represent a forward-thinking vision for managing the complexities of cryptocurrency’s rapid growth. By challenging entrenched systems and advocating for user empowerment, he is poised to influence not only Coinbase’s trajectory but also the broader landscape of the cryptocurrency market. As the industry grapples with these challenges, the potential adoption of innovative token handling processes and collaborative regulatory frameworks could define the next chapter in the evolution of digital currencies. The momentum established by Coinbase under Armstrong’s leadership may well set the tone for how the entire sector navigates the intricacies of rapid technological change.