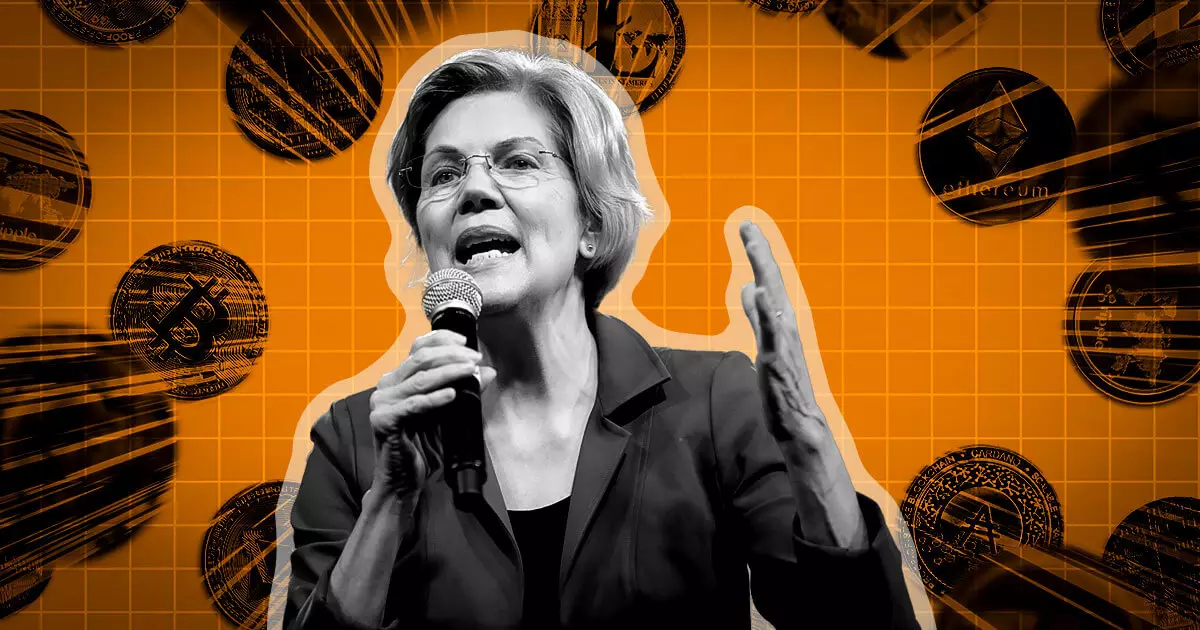

In a recent letter to Treasury Secretary Janet Yellen and IRS Commissioner Daniel Werfel, US Senators, led by Elizabeth Warren, have called for prompt action in implementing new tax reporting requirements for digital asset brokers. This letter refers to the Infrastructure Investment and Jobs Act (IIJA), a bipartisan measure enacted almost two years ago that aimed to address the estimated $50 billion crypto tax gap and streamline the process for taxpayers reporting crypto income. Despite the law being enacted nearly two years ago, the Senators are concerned that the Treasury and the IRS have yet to publish proposed rules, in order to meet the congressionally-mandated deadline of January 1, 2024.

The Urgent Need for Robust Tax Reporting Rules

The senators have expressed their concerns about the potential failure of these agencies to meet the deadlines for implementing the final rules. Prompt action is necessary to ensure that robust tax reporting rules are enforced for cryptocurrency brokers. The IIJA was first passed when the US faced a $1 trillion tax gap, with the cryptocurrency sector contributing to this issue. The anonymous nature of crypto transactions poses a significant detection problem, enabling tax evasion and other illegal activities, as highlighted in a May 2021 Treasury report. Therefore, the senators’ demand for the swift implementation of robust tax reporting rules gains further significance.

The Implications of the New Rules

The new rules introduced by the IIJA will have profound implications for the crypto ecosystem. They require third-party brokers facilitating crypto transactions to report information related to the user’s crypto sales, gains or losses, and certain large transactions to the IRS and the users themselves. The senators argue that this move aims to simplify the tax filing process for crypto users and enable the IRS to utilize its resources more effectively to combat large-scale tax evasion. Additionally, the implementation of these rules is projected to generate an estimated $1.5 billion in tax revenue in 2024 alone and nearly $28 billion over the next eight years.

The Consequences of Delayed Implementation

The Senators’ letter emphasizes the urgency of implementing these rules, warning that failing to do so by December 31, 2023, could result in a loss of an estimated $1.5 billion in tax revenue in 2024. This development occurs in the context of Wall Street banks supporting Elizabeth Warren’s Digital Asset Anti-Money Laundering Act, which aims to impose bank-like standards and requirements on crypto businesses. It is evident that the regulatory landscape for the crypto industry in the US is becoming increasingly stringent, with a growing focus on traceability, oversight, and visibility.

US Senators, led by Elizabeth Warren, are demanding prompt action on implementing new tax reporting requirements for digital asset brokers. The implementation of these rules is essential to address the estimated crypto tax gap and streamline the reporting process for taxpayers. The new rules carry profound implications for the crypto ecosystem, projected to generate significant tax revenue. Delaying the implementation of these rules could result in substantial financial losses. As the regulatory landscape for the crypto industry becomes stricter, it is clear that traceability, oversight, and visibility are gaining importance. Swift action is required to ensure robust tax reporting rules are enforced for cryptocurrency brokers in order to combat tax evasion effectively.