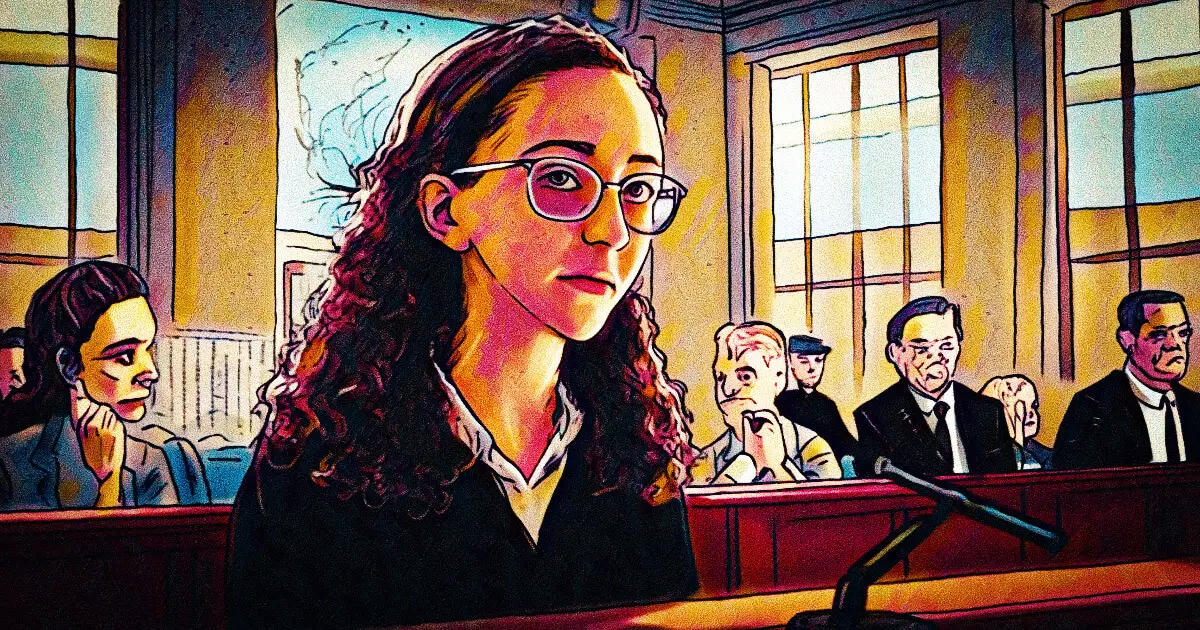

Caroline Ellison, once at the helm of Alameda Research and linked personally to the infamous Sam Bankman-Fried (SBF), has been sentenced to two years in prison, alongside an order to forfeit a staggering $11 billion. This decision, delivered by the court on September 24, signifies the gravity of her involvement in the downfall of FTX—once a titan in the cryptocurrency exchange sector. Ellison’s request for leniency, primarily based on her cooperation during SBF’s trial, has sparked conversations regarding accountability and justice in the morally ambiguous crypto landscape.

Ellison’s legal defense hinged on her cooperation with federal investigators, which they claimed was pivotal in unraveling the complex financial misdeeds that culminated in FTX’s bankruptcy. Her return from the Bahamas, where she sought refuge following the collapse, illustrated a willingness to confront the consequences of her actions; yet it proved insufficient to absolve her from prison time. Ellison testified for nearly three days against SBF, shedding light on the operational mismanagement within both FTX and Alameda, painting a wider picture of internal chaos that contributed to the exchange’s catastrophic fall.

John Ray, the current CEO of FTX presiding over its bankruptcy, acknowledged in court documents the substantial assistance provided by Ellison, underlining its importance for asset recovery efforts. Despite her cooperation being characterized as a crucial foundation for the criminal case against SBF, the court chose to impose a sentence that still reflected a significant punishment.

In the pursuit of a reduced sentence, Ellison’s lawyers presented a narrative focusing on her previously unblemished record. They submitted character testimonials that painted her as a person of integrity who was led astray by SBF’s manipulative tactics. This narrative aimed to humanize Ellison, suggesting that her moral compass was compromised by her complex relationship with the disgraced entrepreneur. However, such arguments raise ethical questions about personal responsibility in the face of wrongdoing, especially within a corporate framework.

Ellison’s decision to enter a plea agreement back in December 2022 illustrates the difficult choices individuals face when entangled in legal battles driven by corporate failure. Her testimony served as a linchpin in the prosecution’s strategy to secure a conviction against SBF, but the consequences of her actions remain severe, illustrating a challenging dichotomy between cooperation and personal accountability.

As the dust settles on the FTX debacle, the ramifications of Ellison’s sentencing resonate throughout the cryptocurrency world. FTX’s meteoric rise and catastrophic collapse have opened a Pandora’s box of inquiries into corporate governance and ethics within this rapidly evolving sector. Alongside Ellison, other executives are also facing the law’s scrutiny, highlighting a systemic issue that extends beyond individual actors.

Ellison’s case serves as a pivotal example of the intersections between personal choices, corporate governance, and the ongoing challenge of ensuring accountability in the fast-moving world of cryptocurrency. As the legal repercussions continue to unfold, stakeholders eagerly await how these events will reshape the industry’s regulatory landscape, potentially ushering in reforms aimed at preventing similar tragedies in the future.