In a recent hearing, Judge Katherine Polk Failla criticized Coinbase’s attempt to subpoena SEC chair Gary Gensler in the ongoing case against the firm. She pointed out that the request included Gensler’s statements before he became SEC chair in 2021. Coinbase’s argument for seeking Gensler’s earliest comments was based on the need to confirm whether he used personal devices or email accounts to discuss crypto or communicate with market participants. However, Judge Failla deemed Coinbase’s arguments as “speculative” and not persuasive enough to justify such a request. Despite acknowledging Coinbase’s concerns, she emphasized the difficulty in obtaining Gensler’s pre-chair statements.

SEC lawyer Jorge Tenreiro went further to label Coinbase’s subpoena request as “incredibly intrusive” against a public official. He stressed that the proceedings should focus on the SEC’s actions and not on Gensler’s personal communications. Tenreiro also made it clear that Gensler is neither a fact witness nor an expert witness on the law in this case. He urged the court to quash Coinbase’s subpoena request, aligning with Judge Failla’s views on the disproportionate burden of inquiry into Gensler’s pre-chair statements.

Coinbase’s lawyers referenced the SEC’s case against Ripple, where the court ordered the discovery of multiple custodians, including then-SEC chair Jay Clayton. However, Tenreiro responded by highlighting the SEC’s attempt to limit Ripple’s access to certain information, including by prohibiting the search of SEC staff’s personal devices. This comparison sheds light on the complexities surrounding subpoena requests in cases involving government officials and regulatory bodies.

In June, Coinbase sought documents and communications related to Gensler’s public comments on digital assets, platforms, and staking as a service from May 2021 to September 2023. The request also encompassed Gensler’s pre-chair communications, adding to the scope of information Coinbase was pursuing. Additionally, Coinbase filed 33 other requests for documents and communications related to the SEC, showcasing the extent of its demands in the case.

Following Coinbase’s request, the SEC moved to quash the subpoena against Gensler in a personal capacity on June 28. However, Coinbase argued that Gensler’s personal communications were relevant to its defense, particularly concerning the fair notice defense. The implications of Gensler’s past statements on Coinbase’s expectations of SEC actions were critical to its legal strategy, according to Coinbase’s response on July 3.

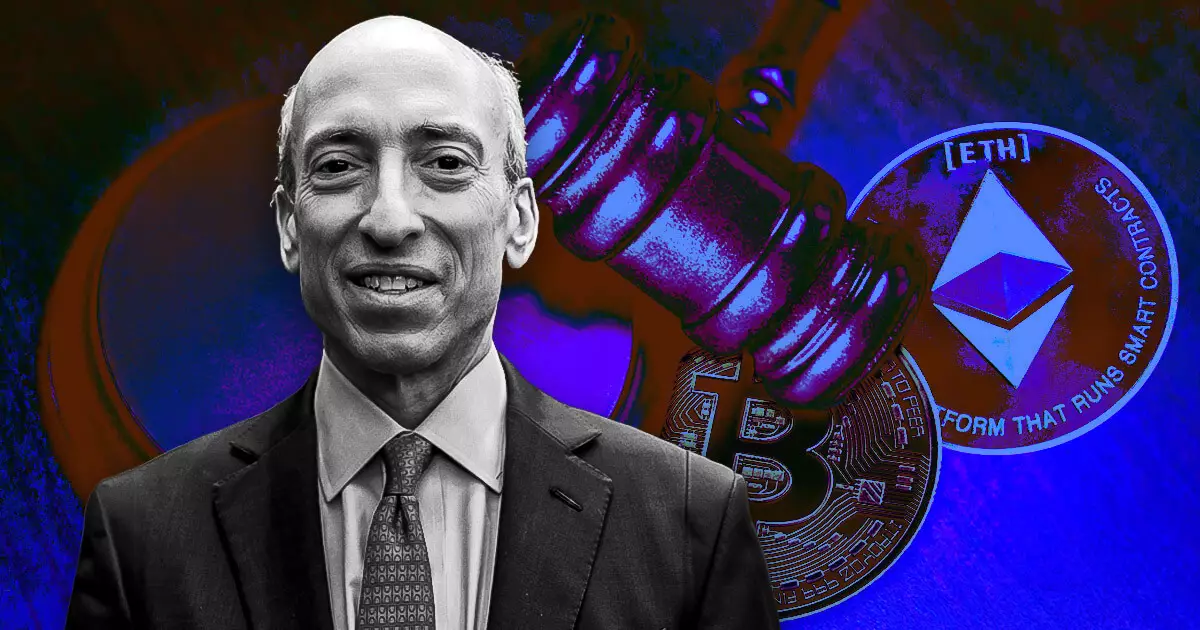

The SEC initiated the lawsuit against Coinbase in June 2023, alleging that the firm operated as an unregistered exchange, broker, and clearing agency. Furthermore, the regulator accused Coinbase of engaging in unregistered offerings and sales of securities through its staking-as-a-service offering. The lawsuit underscored the regulatory challenges facing cryptocurrency firms and the importance of compliance with securities laws.

Overall, the attempt to subpoena an SEC chair like Gary Gensler has generated significant legal scrutiny and debate. As the case progresses, it raises broader questions about the boundaries of information disclosure in regulatory investigations and the responsibilities of companies in the cryptocurrency space. The judge’s criticism, the SEC’s response, and Coinbase’s arguments all contribute to the complexity of navigating legal challenges in the evolving landscape of finance and technology.