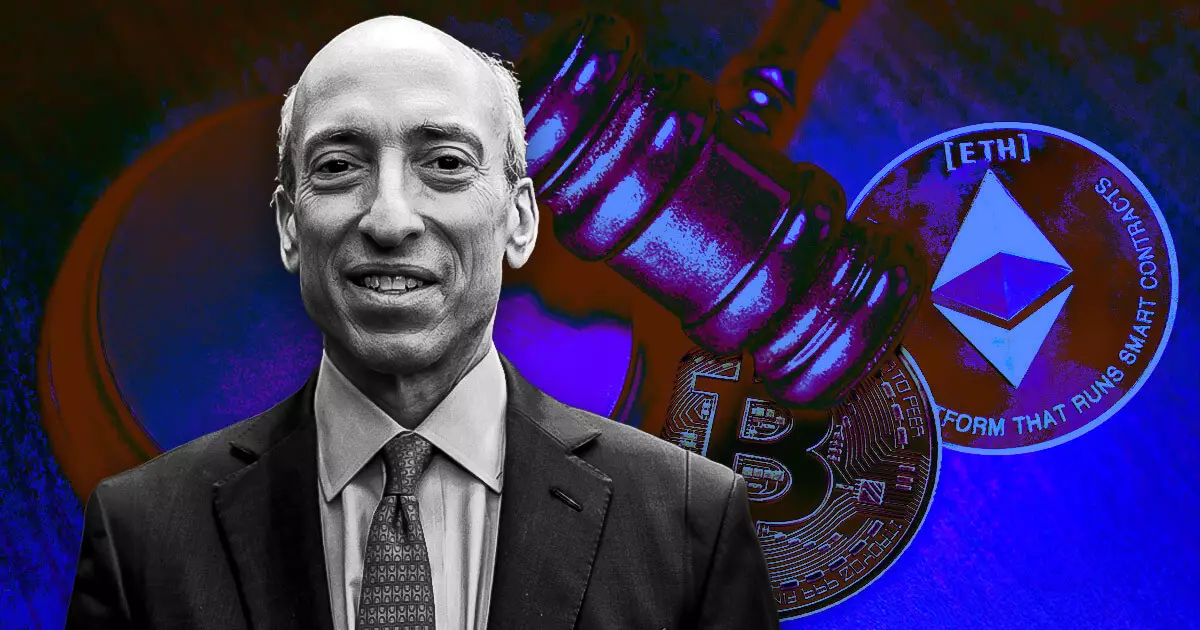

Recent reports indicate that the U.S. Securities and Exchange Commission (SEC) is poised to reject applications for two Solana (SOL) exchange-traded funds (ETFs), marking a significant moment in the evolving landscape of cryptocurrency regulation. Bloomberg ETF analyst Eric Balchunas suggests that this rejection could serve as a metaphorical “parting gift” from SEC Chair Gary Gensler to the crypto sector as he prepares for his exit from office. This news raises questions about the future of crypto-related investment vehicles and illustrates the ongoing tensions between regulatory bodies and digital asset proponents.

The insight from Eleanor Terrett at Fox News—as well as statements from stakeholders—details that sources from two Solana ETF issuers believe approval under Gensler’s leadership is unlikely. With his departure set for January 20, 2025, the optimism for a more favorable regulatory landscape hinges on the incoming SEC chair, Paul Atkins, who was confirmed by President-elect Donald Trump on November 27.

The Timing of ETF Applications

If Balchunas is correct, the expectation is that once Atkins takes office, the applicants will renew their efforts for ETF approval. However, the current environment presents hurdles that extend beyond individual leadership changes within the SEC. James Seyffart, another analyst from Bloomberg, emphasizes that Gensler had little choice in denying the Solana ETF proposals, citing regulatory misalignment. Specifically, allowing the Solana ETFs while labeling SOL as a security in numerous lawsuits would be counterproductive for the SEC’s enforcement posture.

As a consequence, until the SEC clarifies its stance on what constitutes a security in the realm of cryptocurrencies, particularly with regard to Solana, ETF filings appear to be in limbo. Seyffart predicts that the timeline for Solana ETF approvals could extend well into August 2025, representing a setback that many in the crypto community must grapple with. The inconsistency surrounding regulatory guidance can create an uncertain environment for potential investors.

The Broader Regulator Landscape

The SEC’s actions surrounding these ETFs are not isolated; they are part of a larger backdrop that includes various lawsuits and regulatory initiatives affecting the crypto industry. A notable case is the Binance lawsuit, which has implications for multiple tokens and reflects the SEC’s determination to clarify its regulatory framework. In a broader sense, settling lawsuits and establishing guidelines can pave the way for future acceptance of crypto products like ETFs.

As seen through the commentary of individuals like Gabor Gurbacs, there’s a palpable sense of anticipation for a shift in policy once the new administration at the SEC is in place. Yet, stakeholders must recognize that until foundational legal issues are resolved, the potential for effective regulation remains muted.

In essence, while the rejection of the Solana ETF applications serves to underline existing regulatory challenges, it also presents an opportunity for the new SEC chair to re-evaluate how cryptocurrencies can be integrated into traditional financial markets. Stakeholders in the crypto industry must prepare for a protracted wait as they navigate the landscape shaped by legal ambiguities and regulatory uncertainties. The key takeaway is that the path to successful crypto ETFs is laden with complexities and will require diligent efforts from all parties involved to navigate the evolving regulatory environment effectively.