The recent surge and subsequent volatility within the cryptocurrency world often seem more like manufactured hype than genuine technological advancement or sustainable economic growth. While headlines celebrate new listings, airdrops, and record-breaking valuations, a closer look reveals that much of these developments are driven by speculative frenzy rather than firm fundamentals. Projects like MegaETH, with their token sales and airdrops, attract attention but do little to substantively improve blockchain utility or user experience. The underlying question is whether these inflated valuations reflect real progress or mere attempts to capitalize on speculative sentiment.

The Danger of Overhyped Projects and Short-Lived Gains

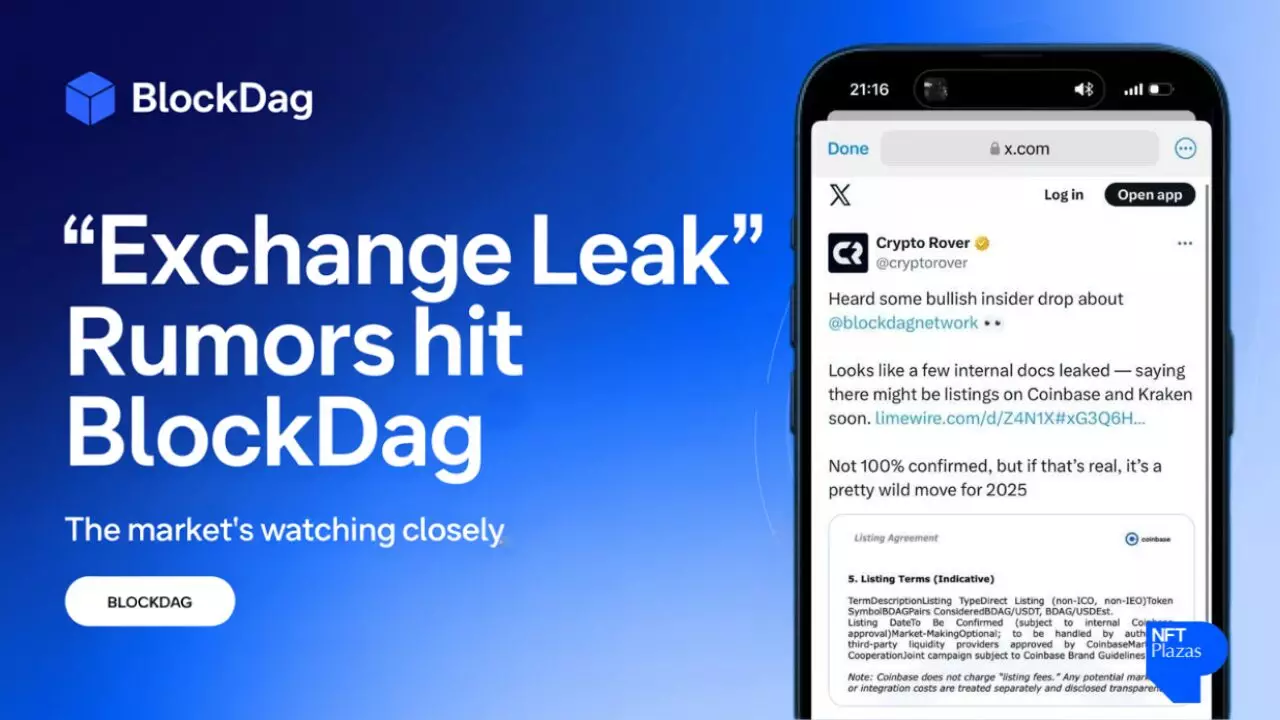

Announcements such as Binance listing new tokens like Giggle Fund (GIGGLE) and SynFutures (F) often spark temporary price surges. These moves are strategic for exchanges to attract traders, but they risk fueling an environment where price is disconnected from utility. The recent plummet of assets like KDA — which dropped over 60% after a shutdown — underscores the fragility of many projects that rely heavily on hype rather than sustainable growth models. Investors must recognize that these sudden spikes, followed by sharp declines, are typically not reflective of a project’s long-term viability. Instead, they often expose the vulnerabilities inherent in over-leveraged markets.

Monetary Policy and Its Impact on Crypto Sentiment

On the macroeconomic front, central bank policies heavily influence crypto markets. The Federal Reserve’s decision to lock in two rate cuts while leaving ambiguity for 2026 exemplifies the uncertainty that continues to pervade the financial landscape. Such policies fuel speculation and volatility in the crypto space, often leading to irrational exuberance or panic selling. While entities like Citi Bank project stablecoins reaching trillions of dollars, the true test remains whether these stablecoins can sustain their peg amid market turbulence or simply become another asset class susceptible to macroeconomic shifts.

The Promises of Innovation Falling Short of Reality

Innovation in blockchain, such as initiatives like Enso’s intent engine, Meteora’s infrastructure for Solana DeFi, or Monad’s Layer 1 solutions, promises a decentralized future. However, many of these projects are still in nascent stages or face significant hurdles before realizing their potential. The crypto narrative often glamorizes these technological advancements, but their actual adoption and practical utility remain uncertain. Projects backed by heavyweight investors like a16z, for example, Morphо, offer some validation, but the industry as a whole continues to grapple with scalability, security, and regulation issues.

The crypto industry today appears caught in a cycle of perpetual hype and disillusionment. While innovation and new financial instruments are integral, they should not overshadow the importance of prudence and critical evaluation. As central banks tighten monetary policy and markets see early signs of overextension, the illusion of endless growth begins to crack. A more skeptical, balanced approach — one that recognizes both potential and peril — is essential if the crypto ecosystem is to evolve beyond speculative bubbles into a resilient financial pillar.