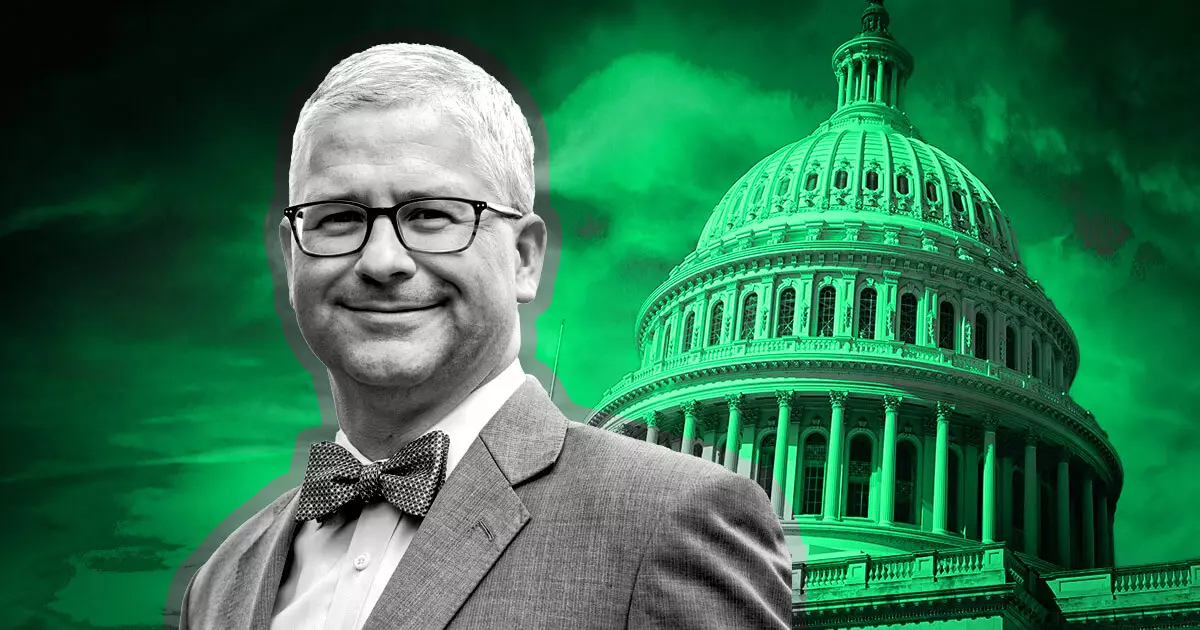

The proposed Financial Innovation and Technology for the 21st Century (FIT21) Act is set to revolutionize the regulatory landscape for the crypto industry. This legislation aims to provide clear regulatory frameworks for digital assets, addressing longstanding issues of market oversight and consumer protection. House Financial Services Committee Chairman Patrick McHenry has expressed his support for the bill, emphasizing the need for regulatory clarity in the digital asset ecosystem.

The FIT21 Act assigns regulatory jurisdiction over crypto commodities to the Commodity Futures Trading Commission (CFTC) and over crypto offered within investment contracts to the Securities and Exchange Commission (SEC). This distinction aims to establish clear lines between the two regulatory bodies, providing much-needed guidance for crypto developers and investors.

The SEC’s enforcement efforts in the crypto industry have been a topic of controversy in recent years. The FIT21 Act could address these concerns by clarifying the regulatory responsibilities of the SEC and CFTC. By delineating their roles, the bill aims to provide a clearer framework for enforcement actions and investor protection.

Regulatory Framework for Crypto Companies

In addition to separating regulators’ roles, the FIT21 Act imposes rules for companies operating in the crypto space. These rules include requirements around customer disclosure, asset safeguarding, and operational standards. By setting clear guidelines for companies to follow, the bill aims to enhance transparency and accountability within the industry.

The FIT21 Act is expected to undergo consideration by the House Committee on Rules, with a potential floor vote by the end of May. The committee will determine the rules for debate and amendment consideration, paving the way for a final decision on the bill’s passage. If approved by the House, the bill will proceed to the Senate and ultimately to the President for enactment.

The FIT21 Act represents a significant step forward for the crypto industry in terms of regulatory clarity and consumer protection. By establishing clear regulatory frameworks and delineating the roles of the SEC and CFTC, the bill aims to foster innovation and development within the digital asset ecosystem. The potential impact of this legislation on enforcement efforts and industry standards is substantial, signaling a new era of regulatory oversight for the crypto industry.