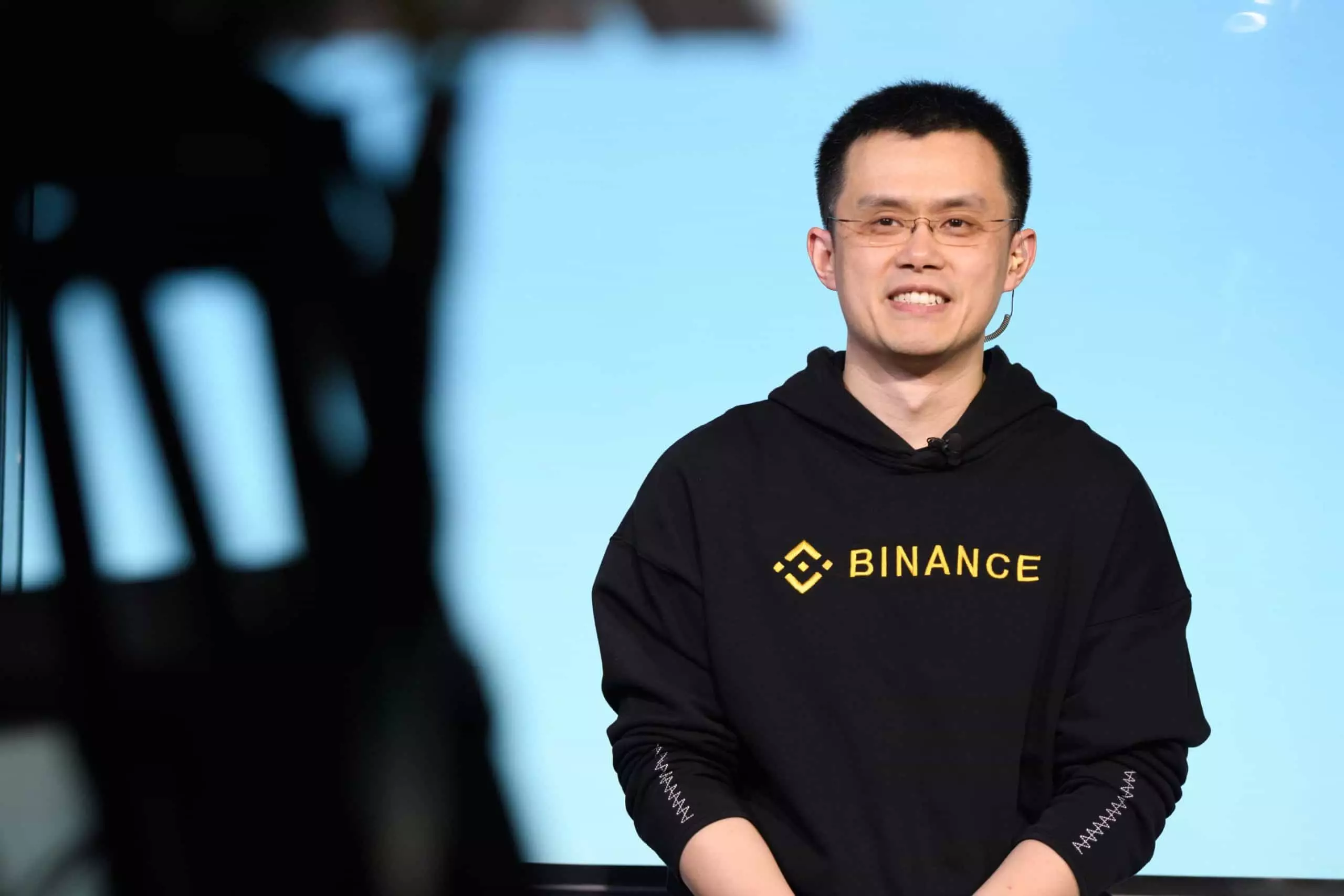

Changpeng Zhao (CZ), the CEO of Binance, recently shed light on why the company dedicates time and resources to support cryptocurrencies and blockchains beyond its own developments. While CZ expressed optimism about the BNB Chain ecosystem, he emphasized that he personally advocates for Bitcoin (BTC).

During an Ask Me Anything (AMA) session on Twitter, a participant expressed concerns about the promotion of the “Binance Blockchain” by the company itself, suggesting that many cryptocurrency users view it as a “shitcoin.” In response, CZ clarified that Binance prefers to maintain the independence and decentralization of its various child networks, which include BNB Beacon Chain, BNB Smart Chain, and an upcoming “greenfield” chain.

CZ acknowledged that anything associated with Binance is often unjustly accused of being too centralized. He explained that Binance is caught in a dilemma, as they could provide more support to these networks or allow them to operate autonomously. However, in order to address these concerns, Binance aims to treat all blockchains equally and promote their independence.

The decentralization of Binance’s blockchains faced scrutiny last year when Binance Smart Chain (BSC) was hacked, resulting in a loss of $600 million in BNB. The network collaborated with approximately twelve service providers to freeze the blockchain and prevent further losses. CZ expressed gratitude towards these providers for their prompt response.

Despite the criticism, CZ reiterated Binance’s commitment to treating all blockchains impartially from the perspective of its exchange business. While emphasizing their support for Ethereum and Bitcoin, CZ also voiced his strong advocacy for BNB, Binance’s native exchange token.

Earlier in the discussion, CZ highlighted the global utilization of blockchain technology for fundraising and as a safe haven asset. He estimated that hundreds of millions of individuals are dedicated users of blockchain technology, particularly for Bitcoin and other top crypto assets. This observation aligns with the increased demand for Bitcoin, which surged in March when panic withdrawals occurred in major regional banks in the United States. This suggests that Bitcoin is gaining recognition as an insurance policy against macroeconomic failures. Furthermore, the correlation between Bitcoin and stocks reached a two-year low in June, indicating its potential as a diversified investment.

In a recent announcement, Binance confirmed its plans to establish nodes to support Bitcoin’s layer 2 lightning network. These nodes will facilitate faster and cheaper BTC withdrawals from the Binance exchange.

CZ’s insights emphasize the importance of supporting various cryptocurrencies and blockchains, including those beyond Binance’s own developments. By promoting independence and decentralization, Binance aims to address concerns about centralization and ensure equal treatment of all blockchains. The growing recognition of Bitcoin as a safe haven asset and the increasing demand for decentralized solutions further highlight the significance of supporting cryptocurrencies and blockchain technology.