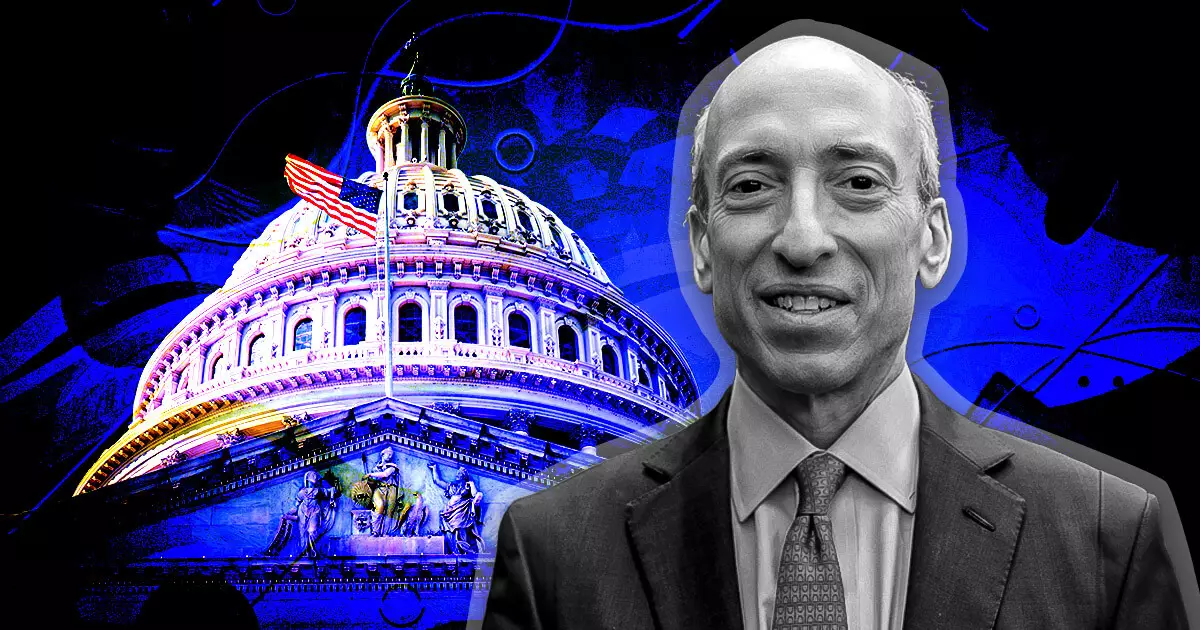

The Securities and Exchange Commission (SEC) Chairman Gary Gensler is no stranger to controversy. As he prepares to testify before Congress this September, the debates surrounding his approach to digital asset regulation have intensified. With lawmakers expressing concerns over the lack of clear guidelines and Gensler’s aggressive enforcement, the future of cryptocurrency regulation in the United States remains uncertain.

According to Fox Business correspondent Eleanor Terrett, Chairman Gensler is set to testify before the Senate Banking Committee on September 12th and the House Financial Services Committee on September 27th. These scheduled appearances come after a series of criticisms and accusations from lawmakers, particularly Republicans. The spotlight is on Gensler as he defends his regulatory approach and clarifies his stance on digital assets.

One of the main sources of criticism towards Gensler is his push for firms to register with the SEC. Lawmakers, including Rep. Patrick McHenry, argue that Gensler’s approach is overly aggressive, especially given the absence of explicit cryptocurrency guidelines. The House Committee on Financial Services went as far as to call Gensler’s push for registration a “willful misrepresentation” of a non-existent process. These criticisms have intensified the ongoing debate on the necessity of clear regulatory guidelines for digital assets.

Despite the backlash, Chairman Gensler remains firm in his stance that most cryptocurrencies should be classified as securities and regulated accordingly. During his previous testimony before the House Financial Services Committee, Gensler accused crypto firms of noncompliance with existing securities laws and emphasized the need for these entities to register with the SEC. His unwavering position has only fueled further debate and divided opinion on the appropriate regulatory framework for digital assets.

Amidst the ongoing debate, the regulatory approval of Prometheum Ember Capital LLC as a distinct broker-dealer for digital assets has come under scrutiny. Seen by some as an attempt to showcase the adequacy of existing regulations, the approval has raised concerns and demands for transparency. The connections between Prometheum and Chinese entities, as well as differing views on regulation, have further amplified calls for closer examination by lawmakers.

As Chairman Gensler prepares to testify before Congress, the debates surrounding digital asset regulation in the United States are reaching a boiling point. Critics argue that Gensler’s aggressive approach lacks clear guidelines, while others support his efforts to enforce existing securities laws. With the future of cryptocurrency regulation hanging in the balance, the outcome of these upcoming testimonies may have far-reaching implications for the industry as a whole. Only time will tell how the United States will navigate this complex and evolving landscape of digital assets.