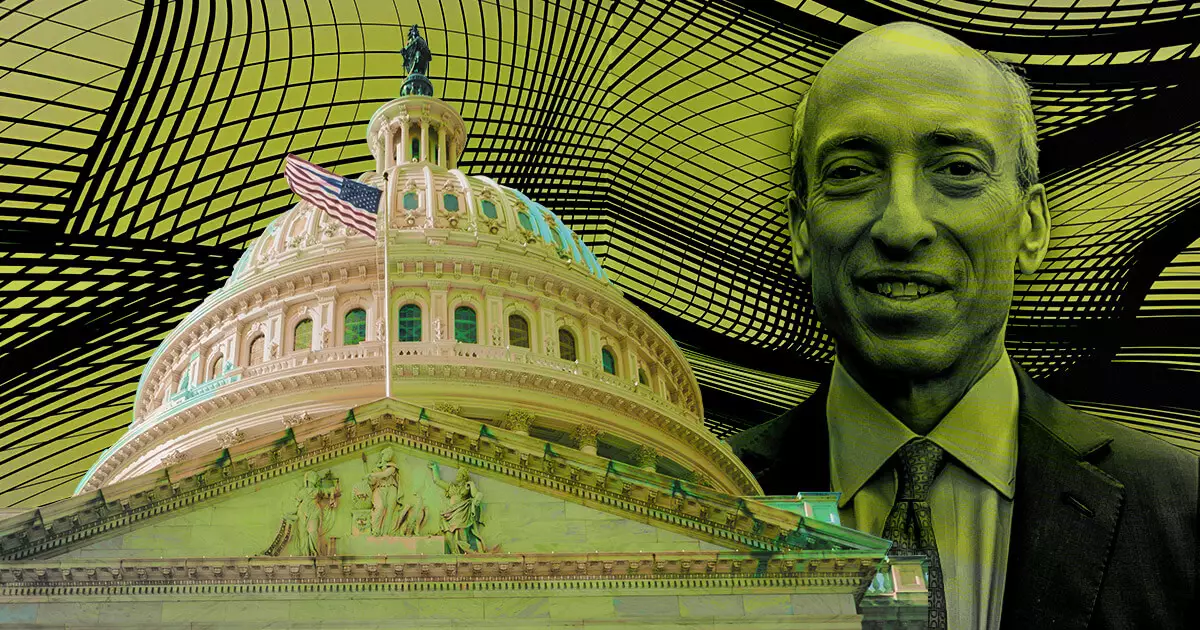

In a bold and unprecedented move, U.S. Congressman Warren Davidson, alongside House Majority Whip Tom Emmer, has taken a strong stance against SEC Chair Gary Gensler. Citing alleged corruption and abuses of power, Davidson advocates for Gensler’s removal in 2024. This development arises from mounting tensions between the SEC and the digital asset sector throughout 2023, with Davidson highlighting concerns over Gensler’s enforcement-first regulatory approach. To address these issues, Davidson introduced the SEC Stabilization Act earlier this year, which proposes crucial reforms and restructuring within the SEC.

The SEC Stabilization Act has been proposed as a means to restructure the SEC and remove Gensler from his position. The Act emphasizes a “long series of abuses” under Gensler’s leadership, signaling a need for change and stronger oversight. One of the primary objectives of the proposed restructuring is to add a sixth commissioner and an Executive Director to oversee day-to-day operations. By separating these responsibilities, the Act aims to distribute power within the SEC more evenly, preventing a single political party from holding more than three commissioner seats. This safeguarding measure seeks to protect U.S. capital markets from potential political agendas.

The push to remove Gensler as SEC Chair stems from concerns about his enforcement-first regulatory approach. Critics argue that this approach has strained the relationship between the SEC and the digital asset industry. U.S. capital markets, as emphasized by Davidson, must be shielded from what he describes as a “tyrannical Chairman.” There is a pressing need for reform and the removal of Gensler to ensure fair and consistent oversight of American investors and the industry without any political maneuvering.

Congressman Davidson’s sentiments have garnered support, including the endorsement of House Majority Whip Tom Emmer. Emmer underlines the importance of clear and consistent oversight, prioritizing the interests of American investors and the industry over political considerations. Beyond the legislative efforts, various supporters have taken to social media to voice their support for Gensler’s removal and the passage of the SEC Stabilization Act. Tweets advocating for change highlight the goal of ending the accredited investor rule, arguing that it preserves the interests of a privileged class. Others accuse Gensler’s SEC of favoring Wall Street over Main Street, further endorsing Davidson’s bill as an essential means of holding the SEC accountable.

The proposed SEC Stabilization Act and the broader call for Gensler’s removal signify a critical turning point in the ongoing dialogue surrounding regulatory approaches and accountability within the U.S. financial regulatory framework. The push for reform, led by Congressman Davidson and supported by Emmer, seeks to address the alleged corruption and abuses of power within the SEC. By proposing restructuring measures and an increased focus on oversight, the Act aims to restore confidence in U.S. capital markets, protecting the interests of American investors and the digital asset industry as a whole.

The efforts to remove SEC Chair Gary Gensler reflect a call for reform and accountability within the financial regulatory landscape. The proposed SEC Stabilization Act and the concerns raised by Congressman Davidson and his supporters underscore the need for change and stronger oversight. As the dialogue continues to unfold, the future of the SEC and its leadership remains uncertain, but there is no doubt that these developments have had a significant impact on the ongoing conversation about regulatory approaches and the future of the U.S. financial system.