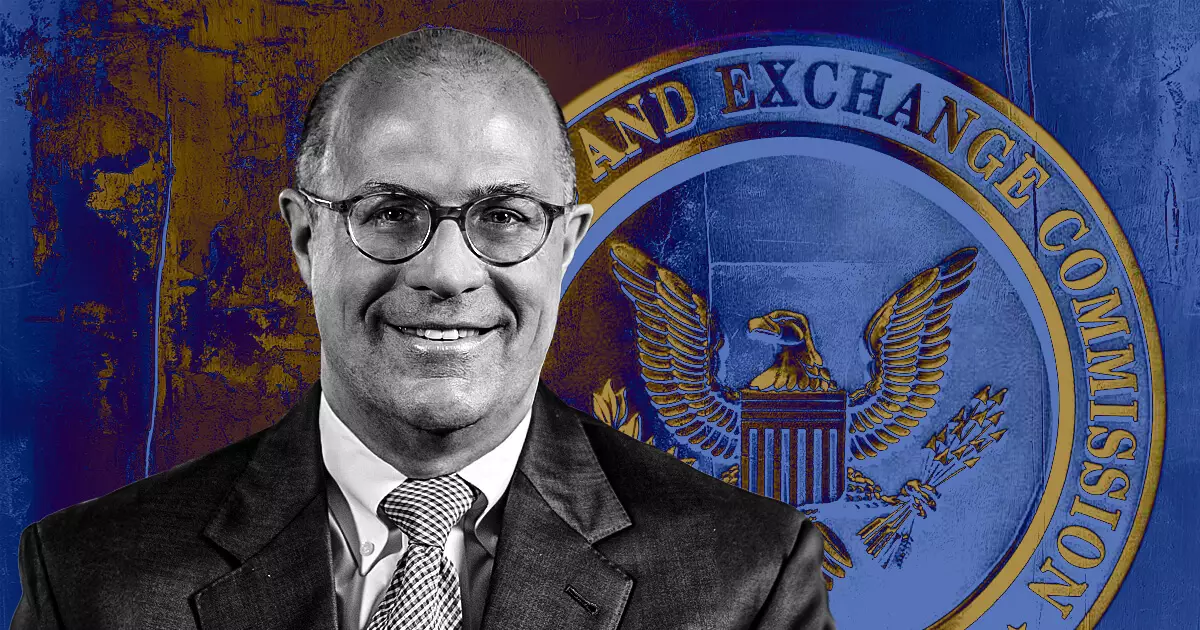

Christopher Giancarlo, the former Chair of the Commodity Futures Trading Commission (CFTC), has made headlines recently by dismissing rumors regarding his potential appointment as the next Chair of the U.S. Securities and Exchange Commission (SEC). Additionally, Giancarlo refuted claims about his interest in a role associated with cryptocurrency in the U.S. Treasury Department, emphasizing his discontent with the regulatory complications left behind by current SEC Chair Gary Gensler. Giancarlo mentioned that he previously tackled and resolved issues from Gensler’s tenure at the CFTC, indicating a reluctance to endure a similar experience at the SEC.

While Giancarlo did not delve into specifics, his reference to a ‘mess’ implies frustration with the SEC’s contentious regulatory approach towards the cryptocurrency sector, often characterized as “regulation by enforcement.” This perspective is shared by other voices within the regulatory community, as one SEC Commissioner termed this approach a “disaster.” The implications of such regulatory strategies create uncertainty for stakeholders in the cryptocurrency space and could potentially stifle innovation in this rapidly evolving sector.

Having served as the CFTC chair since August 2017, Giancarlo has earned the nickname ‘Crypto Dad’ for his supportive outlook on cryptocurrencies, a stance he publicly articulated in 2018. His assertion that “cryptocurrencies are here to stay” marked a significant departure from more skeptical views within the federal regulatory landscape. His later publication of an autobiography included a defense of digital assets and a reflection on the need for balanced regulatory oversight. Currently, Giancarlo plays an advisory role at the U.S. Digital Chamber of Commerce, advocating for sensible regulations in the blockchain space.

Amidst this backdrop of industry skepticism regarding regulatory clarity, Gary Gensler has sought to reinforce the SEC’s aggressive regulatory posture. In a recent address at the Practising Law Institute’s annual securities regulation conference, Gensler clarified that while Bitcoin may not be classified as a security, the vast majority of digital assets fall under the umbrella of security regulations, necessitating oversight to safeguard investors. His stance accentuates the regulator’s mission to minimize significant investor harm, especially in light of recent failures among underregulated digital assets.

However, the SEC’s approach has drawn ire from many within the cryptocurrency ecosystem, with critics labeling the commission’s actions as overly punitive and lacking clear guidelines for compliance. The wave of lawsuits targeting prominent exchanges like Kraken, Binance, and Coinbase under Gensler’s leadership has sparked debates surrounding the balance between investor protection and fostering a thriving innovation hub for blockchain technology.

In this complicated regulatory landscape, the contrast between Giancarlo’s pro-crypto sentiment and Gensler’s regulatory zeal underscores a pressing need for dialogue on establishing a balanced framework that can nurture the burgeoning cryptocurrency sector while safeguarding investors effectively.