The ongoing legal confrontation between the U.S. Securities and Exchange Commission (SEC) and Ripple Labs has entered a new chapter, compelling both supporters and skeptics of the cryptocurrency to reassess the implications of this case. On October 2, 2024, the SEC announced its intention to appeal a recent ruling from a federal court that provided a seemingly favorable outcome for Ripple. Despite mixed results, the SEC’s decision to contest the court’s district ruling raises critical questions about regulatory approaches to cryptocurrency, investor protections, and the delineation between securities and non-securities.

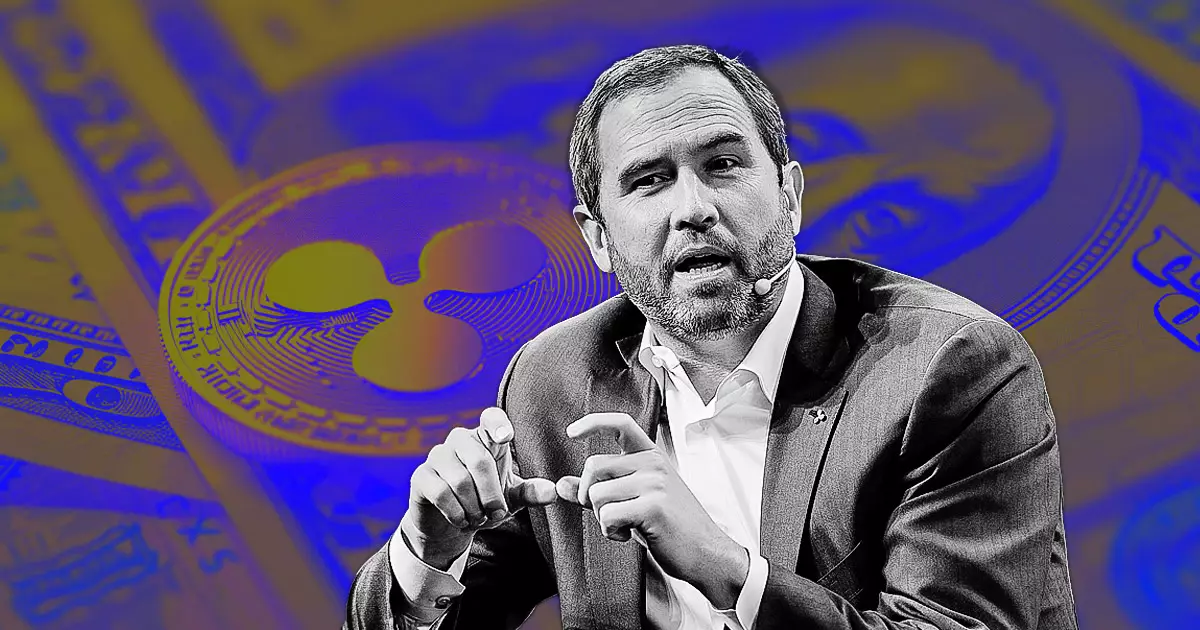

Ripple was embroiled in controversy after being accused of conducting a $1.3 billion unregistered securities sale through its cryptocurrency, XRP. This lawsuit, initiated in December 2020, has evolved into a landmark case that will likely set precedents in the ever-evolving landscape of digital currencies. Ripple’s CEO, Brad Garlinghouse, and Chief Legal Officer Stuart Alderoty have expressed their disappointment over the SEC’s appeal, emphasizing their commitment to continue defending their case in court.

A key ruling made by U.S. District Judge Analisa Torres in August served as a double-edged sword. On one hand, it concluded that Ripple’s programmatic sales of XRP to retail investors did not breach securities laws, which was celebrated as a significant win for the broader cryptocurrency sector. On the other hand, the judgment highlighted that Ripple’s direct sales of XRP to institutional investors—amounting to $728 million—were in violation of securities regulations, resulting in a penalty of $125 million.

This mixed outcome reflects the nuanced legal environment surrounding cryptocurrencies, making it clear that while some elements may align with legal standards, others do not. While the $125 million fine fell short of the higher $2 billion figure the SEC had initially sought, it undeniably serves as a reminder of the regulatory scrutiny that cryptocurrency projects must anticipate. The SEC’s appeal signifies its persistent stance that eclipses the partial victories Ripple achieved, posing essential inquiries about the regulatory framework guiding digital assets.

The ramifications of this continued legal battle have not gone unnoticed in the cryptocurrency market. Following news of the appeal, XRP’s value saw a sharp decline, plummeting approximately 9%, dropping its trading value below $0.54. The swift downturn of XRP’s price after the announcement emphasizes the deep-rooted connection between regulatory developments and market sentiment. Investors are likely becoming increasingly wary as they assess the SEC’s commitment to pursuing this legal journey, despite the judge’s prior sanctions favoring Ripple on significant counts.

Garlinghouse’s sentiments point toward a growing frustration with ongoing regulatory actions. He labeled the SEC’s behavior as an expenditure of taxpayer money on a case that has already determined crucial aspects in Ripple’s favor. He maintains that the primary issue—XRP’s classification—has been effectively resolved within the bounds of existing law, irrespective of the SEC’s intended appeal.

The SEC’s appeal suggests a need for further scrutiny regarding how regulatory agencies interpret and administer laws concerning cryptocurrency. Observers are left questioning whether the SEC’s relentless pursuit of this appeal is reflective of a broader strategy aimed at regulating the burgeoning crypto industry, or simply an effort to assert agency authority amid a rapidly changing market landscape. The SEC’s actions can be perceived as both a necessity for upholding security laws and a potentially overwhelming force that stifles innovation within the industry.

Moreover, Alderoty’s remarks concerning the absence of “victims or losses” in the case place another layer of complexity on the discussion surrounding investor protections. This raises essential debates about the balance between consumer safeguards and fostering an environment conducive to enterprise development—an equilibrium that the cryptocurrency industry urgently seeks.

The SEC’s appeal represents not only the continuation of a pivotal legal clash but also serves as an indicator of the regulatory challenges that lie ahead for all cryptocurrency companies. As this case unfolds, stakeholders will be closely monitoring the implications on both Ripple and the wider crypto market, hopeful for a resolution that encourages innovation while ensuring appropriate oversight.