In recent days, the Bitcoin price has experienced a retracement and is now targeting the $40,000 mark. However, amid this price movement, crypto traders have turned their attention to a new stake-to-mine Bitcoin alternative called Bitcoin Minetrix. This alternative has gained significant attention, with its ICO raising over $4 million. As the leading cryptocurrency continues to show strength, market participants eagerly await the approval of a spot Bitcoin ETF, which is expected to trigger even greater gains.

The Bitcoin price has seen a positive upward trend, currently trading at $37,422, marking a 4.2% increase in the past 24 hours. With a remarkable 123% year-to-date gain, Bitcoin has outperformed all other asset classes. The market is highly optimistic about the potential approval of a spot Bitcoin ETF by the US Securities and Exchange Commission (SEC), which could further drive the price of Bitcoin to multiples of $100k. This anticipation has sparked a surge in demand for Bitcoin-related coins as investors seek alternative investment propositions to capitalize on the bull run.

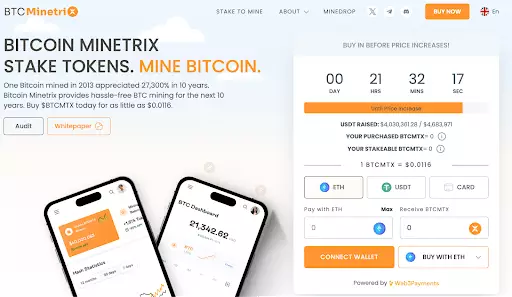

Bitcoin Minetrix ($BTCMTX) has emerged as a one-of-a-kind crypto asset that captures the attention of investors. This cloud mining token, built on the Ethereum blockchain, allows users to stake the $BTCMTX native token and receive cloud credits to mine Bitcoin. Its unique approach offers several advantages compared to the dominant cloud mining model, including ease of use, low entry cost, and protection against scammers. The increasing demand for Bitcoin Minetrix is evident through its presale, where it has raised over $4 million.

The entrance of BlackRock, the world’s largest fund manager with $8.54 trillion in assets under management, into the Bitcoin market has further solidified the asset class’s credibility. The company’s CEO, Larry Fink, who was previously skeptical about Bitcoin, now acknowledges its value as digital gold. BlackRock’s application to launch a spot Bitcoin ETF has significant implications, potentially attracting billions of dollars into the cryptocurrency space. This approval would also provide a regulated pathway for financial advisors and pension fund managers to invest clients’ funds in Bitcoin and Ethereum.

The Seismic Impact of a Spot Bitcoin ETF

The launch of a spot Bitcoin ETF in the largest capital market, the United States, could have a seismic impact on the cryptocurrency market. Currently, the equity and fixed-income ETF sector in the US is valued at $7 trillion, with the total equity market valued at $44 trillion. The approval of a spot Bitcoin ETF would increase the asset class’s credibility and attract a substantial inflow of capital. The launch is particularly significant because the current number of Bitcoin wallet addresses valued at over $1 million stands at approximately 80,000. As the Bitcoin price rises, this number is expected to increase, attracting more high net worth individuals and increasing mining industry investments.

As new money flows into the Bitcoin market, alternative cryptocurrencies gain attention as potential investment opportunities. Bitcoin Minetrix, with its unique offering of capital and income growth, stands out as a promising candidate among Bitcoin alternatives. By owning the $BTCMTX coin, investors can benefit from both the upside potential of Bitcoin’s investment story and the mining rewards associated with the ecosystem. Unlike traditional mining, Bitcoin Minetrix’s tokenized cloud miners do not face any capital outlay expenses for mining rigs, making it a highly profitable venture.

The Supply Shock Thesis and Exchange Balances

An interesting observation related to the Bitcoin market is the supply shock thesis, supported by the decreasing balances of Bitcoin on exchanges. Currently, Bitcoin balances on exchanges have reached a five-year low, suggesting a potential shortage of available supply. This dynamic adds further fuel to the expectation of the Bitcoin price increasing due to limited supply.

The Bitcoin market is experiencing a retracement as traders set their sights on the $40,000 target. Meanwhile, the demand for Bitcoin Minetrix continues to soar, capturing the attention of investors with its tokenized cloud mining model. The anticipation of a spot Bitcoin ETF approval by the SEC only heightens the optimism surrounding Bitcoin and its various investment opportunities. As the market evolves, the landscape for Bitcoin alternatives becomes increasingly promising, providing investors with additional avenues to capitalize on the ongoing bull cycle.