The US Security and Exchange Commission’s (SEC) Office of Inspector General (OIG) is conducting an investigation into financial conflicts of interest related to cryptocurrency, as brought to light by Empower Oversight. The accountability group recently disclosed that the SEC’s division is in the final stages of completing its investigation into the failures of the SEC’s Ethics Office and former official, William Hinman. This article will delve into the details of the investigation and the implications it may have on the cryptocurrency market.

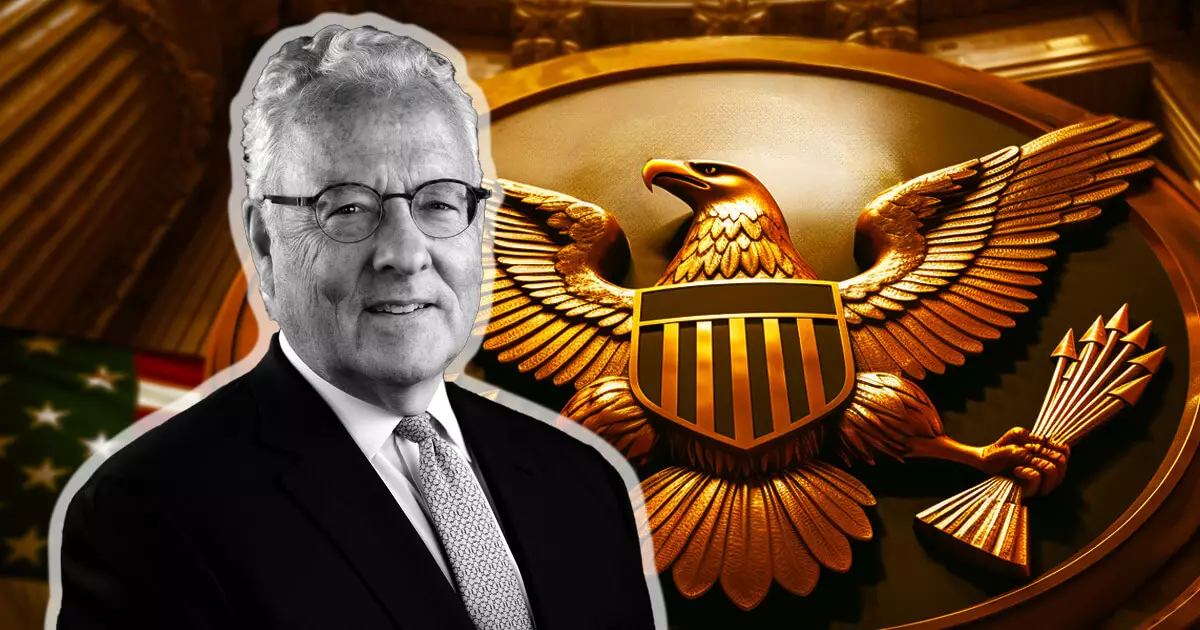

William Hinman, a former SEC official, is at the center of the investigation. Critics accuse Hinman of participating in matters where he had a financial stake, particularly in relation to his speech claiming that certain digital assets, including Ethereum, were not subject to SEC regulation as securities. This assertion received backlash from the Ripple XRP community, who argue that the speech unfairly favored Ethereum over other digital assets in the market.

Empower Oversight presented compelling evidence to support their concerns. The accountability group shared documentation indicating that key figures from Ethereum, such as co-founders Joseph Lubin and Vitalik Buterin, were involved in drafting Hinman’s controversial speech. This revelation raises questions about the impartiality and fairness of his statements. Additionally, Empower Oversight highlighted that Hinman disregarded instructions not to meet with specific individuals, including his former employer Simpson Thacher, a member of the Ethereum Enterprise Alliance (EEA). This raises concerns about potential conflicts of interest and bias in Hinman’s actions.

The investigation also shed light on Hinman’s post-SEC employment. After leaving the SEC in December 2020, Hinman rejoined Simpson Thacher as a partner. Coincidentally, that same month, the SEC filed a lawsuit against Ripple, alleging that its digital asset XRP was an unregistered security. This timing raises questions about Hinman’s potential involvement in the lawsuit and whether it was influenced by his ties to Simpson Thacher and the EEA.

Empower Oversight has demanded that the SEC provide information regarding its investigations by February 23. The group specifically referenced their previously filed Freedom of Information Act (FOIA) request in May 2023, which has allegedly been met with stonewalling and a lack of transparency. Should the SEC fail to provide the requested information, Empower Oversight has threatened to file a lawsuit against the financial regulator. This escalation highlights the seriousness of the allegations and the importance of accountability within the SEC.

The SEC’s Office of Inspector General is currently investigating cryptocurrency-related financial conflicts of interest, particularly concerning William Hinman and his contentious speech on Ethereum. Empower Oversight has presented compelling evidence suggesting potential biases and conflicts of interest surrounding Hinman’s actions. The ongoing investigation raises important questions about the impartiality of SEC officials and the need for transparency within the cryptocurrency market. As February 23 approaches, it remains to be seen how the SEC will respond to Empower Oversight’s demands and whether the accountability group will proceed with their threatened lawsuit.