In a recent filing by the Securities and Exchange Commission (SEC), it has been alleged that the co-founders of the Terra blockchain project had planned to create fraudulent transactions during the development of the project. This revelation has raised significant concerns about the integrity and trustworthiness of the blockchain industry. The SEC claims that Terraform Labs, the company behind the project, partnered with a payments app called Chai with the intention of settling transactions on-chain. However, it is alleged that the leaders of Terraform Labs “faked Chai payments onto the Terraform blockchain” instead of carrying out the transactions traditionally.

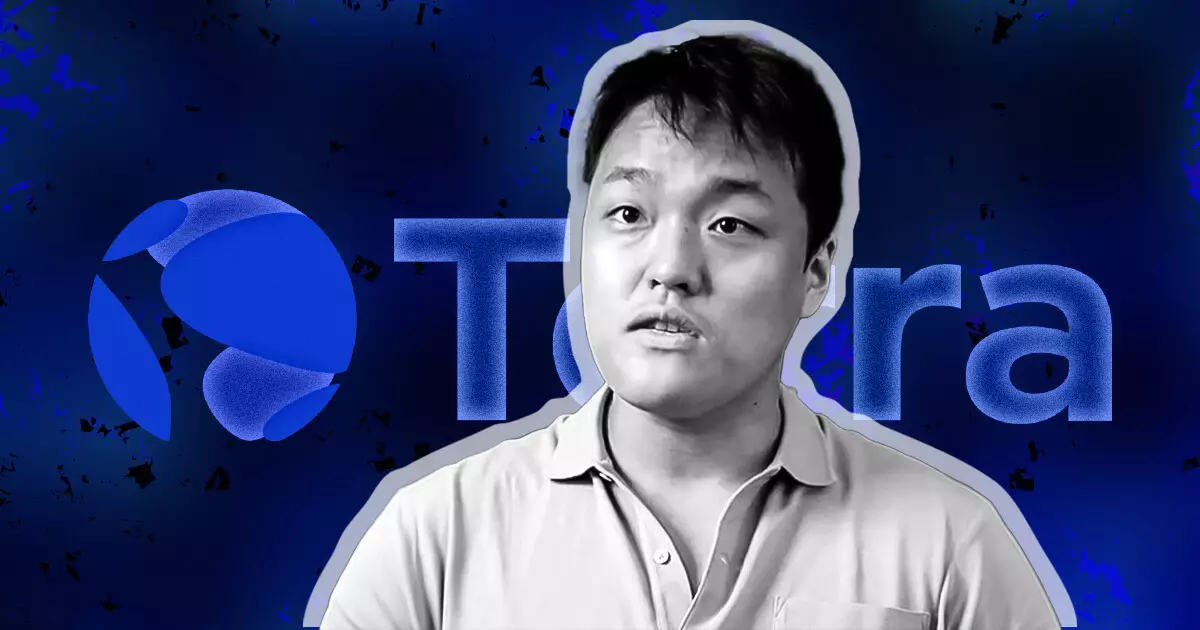

According to chat logs dating back to 2019, Terraform Labs co-founders Do Kwon and Daniel Shin discussed how falsified transactions could support their activities. Shin raised concerns about end users discovering that the activity had been falsified, but Kwon seemed unfazed by this criticism. He replied, “All the power to those who can prove it’s fake because I will try my best to make it indiscernible.” Kwon even proposed creating fake transactions that look real to generate fees, with the intention of winding it down as Chai grows. The extent to which these conversations translated into actual falsified data remains unclear as the Terraform Labs and Chai partnership ended in 2020.

The consequences of this alleged deception are significant. The SEC argues that investors bought “hundreds of millions of dollars” worth of LUNA and other tokens under the belief that Chai transactions were carried out on Terra’s blockchain. This misleading information has potentially resulted in significant financial harm to unsuspecting investors. The SEC included the chat logs as part of its filing to depose Kwon and obtain his testimony in a securities case. However, Kwon’s recent prison sentence in Montenegro for forgery of travel documents has complicated the SEC’s request for extradition to the United States.

In response to the SEC’s request, defense lawyers have challenged the feasibility of extraditing Kwon from Montenegro, claiming it is impossible due to his recent imprisonment. Additionally, the defense lawyers argue that the chat logs discussed transactions related to staking rather than the Chai partnership. This legal dispute highlights the complexity of the case and raises questions about the accuracy of the SEC’s allegations. However, it is crucial to thoroughly investigate the matter and determine whether there is any truth to the accusations made against Terraform Labs and its co-founders.

Allegations of fraudulent transactions within the Terra blockchain project have broader implications for the blockchain industry as a whole. The industry has been striving to gain mainstream adoption and build trust among investors and users. Incidents like these erode that trust and reinforce skepticism about the reliability and transparency of blockchain technology. It is essential for regulators and industry participants to take decisive action against any fraudulent behavior to protect the integrity of the blockchain ecosystem.

This case serves as a reminder of the importance of accountability and transparency. Blockchain projects must prioritize ethics and compliance to prevent fraudulent activities. Startups and established companies alike should implement robust internal controls and adhere to regulatory guidelines. Furthermore, investors should conduct thorough due diligence before investing their hard-earned money into any blockchain project. By increasing accountability and transparency throughout the industry, incidents like the alleged fraud in the Terra blockchain project can be minimized, and trust can be restored.

The allegations of planned fraudulent transactions within the Terra blockchain project are deeply concerning. The impact on investor trust and the reputation of the blockchain industry cannot be understated. It is crucial for regulatory bodies to conduct a thorough investigation to uncover the truth and hold those responsible accountable. The result of this case will have far-reaching consequences for the future of blockchain technology and its acceptance in mainstream finance.