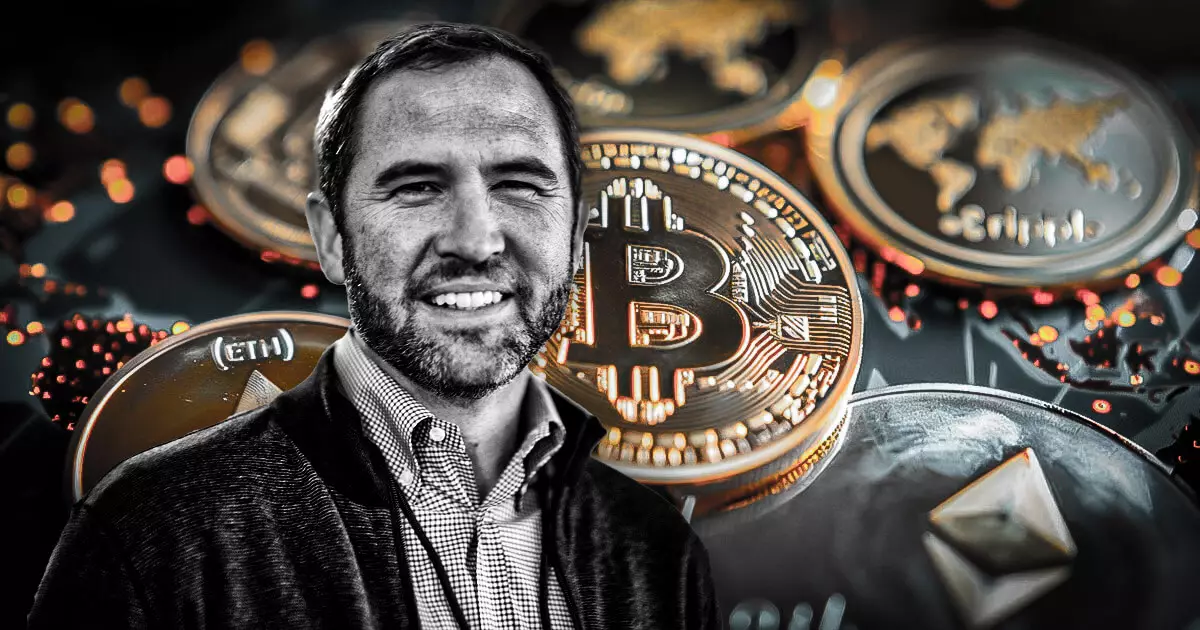

The dialogue between cryptocurrency leaders and U.S. lawmakers is gaining momentum, a development that Ripple CEO Brad Garlinghouse is keen to highlight. Following recent meetings in Washington, D.C., Garlinghouse expressed positivity regarding the potential for bipartisan efforts to establish clearer regulations in the cryptocurrency sector. These discussions, which included influential figures such as Senators Tim Scott and Chuck Schumer, epitomize a growing willingness among policymakers to consider frameworks that could foster innovation without sacrificing market stability.

Such engagements underscore an evolving dynamic in which legislators are increasingly receptive to the unique challenges and opportunities posed by digital assets. In an industry marked by volatility and ambiguity, this new attitude can provide a much-needed foundation for growth and trust among investors and issuers alike, as it signals a potential shift from a reactive to a proactive regulatory stance.

As discussions unfold, specific legislative initiatives have begun to take shape, reflecting a consensus on the urgency of establishing a robust regulatory framework. The House of Representatives is advancing the Stablecoin Transparency and Accountability for a Better Ledger Economy (STABLE) Act, which aims to impose transparency and accountability measures on stablecoin issuers. Meanwhile, the Senate’s work on the Guiding and Establishing National Innovation for US Stablecoins (GENIUS) Act further illustrates this legislative drive toward structured oversight.

These proposed measures suggest an industry stabilization approach that incorporates risk management strategies and mandatory asset reserves, ensuring that stablecoins can effectively represent a secure digital currency. However, while the direction is promising, the execution of these legislative efforts remains in flux, and stakeholders in the crypto domain must proceed with vigilance.

The initiatives within Congress are paralleled by actions from regulatory bodies, highlighting a concerted effort to create a balanced regulatory environment. Agencies like the U.S. Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) are exploring frameworks designed to promote economic growth while maintaining market integrity. Appointments of pro-crypto figures to lead such agencies signal a proactive shift to ensure that the regulatory landscape evolves alongside technological advancements.

Former SEC Commissioner Paul Atkins and Brian Quintenz of the CFTC are expected to guide their respective agencies through these complex waters, emphasizing transparency and clarity in an environment that has often been criticized for its lack thereof. This renewed focus on regulation could play a pivotal role in restoring confidence among businesses and consumers, as well as attracting foreign investment into the U.S. crypto market.

The discussions and legislative proposals currently being considered could mark the dawn of a more stable and inviting atmosphere for innovation in the cryptocurrency sector. While there are hurdles to navigate—including the ever-present specter of regulatory uncertainty—the dialogue taking place in Washington, D.C., embodies a critical juncture for the industry.

As stakeholders remain engaged and vigilant, the hope is that these efforts will culminate in a balanced regulatory framework that nurtures innovation while safeguarding market integrity. For the crypto ecosystem to thrive, the collaboration between industry leaders and lawmakers will be essential, paving the way for a future defined by both growth and accountability.