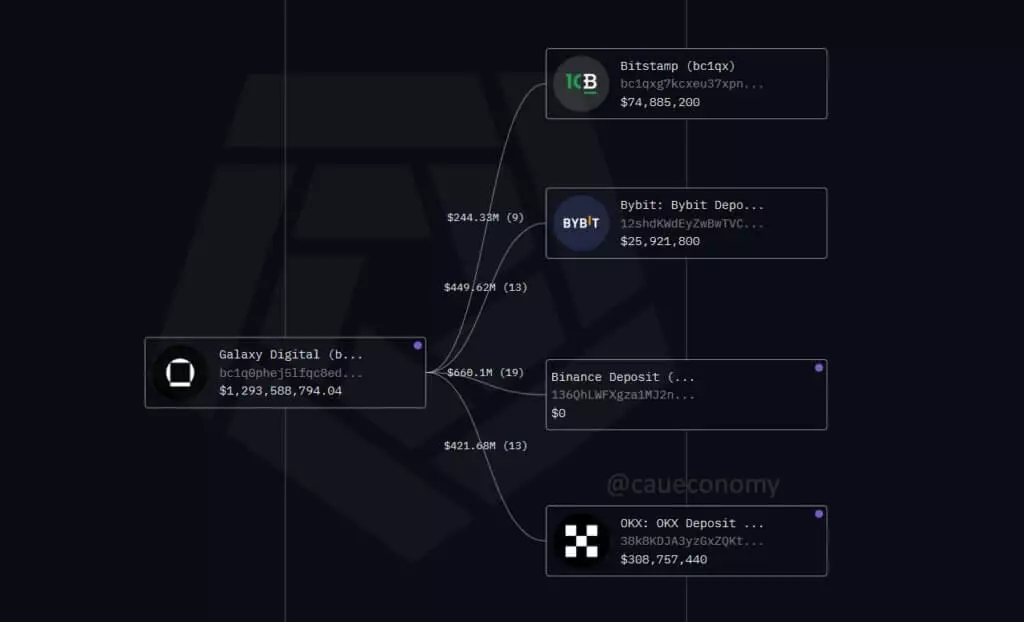

In the shadowy corridors of cryptocurrency finance, the recent transaction patterns of Galaxy Digital evoke a mix of curiosity and concern. Over the past 24 hours, more than 17,000 BTC have flowed into major exchanges—an amount exceeding $1.7 billion—fueled by deliberate internal transfers from custodial entities. Such substantial withdrawals from a prominent institutional player are far from mundane; they serve as a clarion call for market watchers attuned to signs of impending turbulence. When an elite firm like Galaxy Digital begins to unload a significant chunk of its holdings, it raises questions about the underlying motives and the potential ripple effects across the crypto ecosystem.

This mass movement, seemingly strategic in its execution, hints at underlying liquidity management and risk mitigation strategies. Given Galaxy’s reputation for handling institutional assets on behalf of clients, such notable shifts suggest a readiness—perhaps even a necessity—to liquidate. Their pattern of distributing large balances over a staggered timeline, with several transactions arriving at exchanges in quick succession, reinforces the perception that this isn’t casual repositioning but a targeted effort to distill wealth from dormant or legacy wallets. This behavior could foreshadow a broader trend among institutional investors who may view current market conditions as an opportune moment to realize gains or rebalance portfolios in response to macroeconomic uncertainty.

Market Reactions and the Fragility of the Bullish Outlook

The immediate consequence of Galaxy’s large-scale offloading is observable in Bitcoin’s price performance—a roughly 2.5% dip in the past day, bringing BTC to around $115,600. While some might interpret this as a knee-jerk reaction to the liquidity drain, it exposes a fragile market structure susceptible to amplified sell-offs. With daily trading volumes exceeding $94 billion, the market’s depth appears to be thinner than ideal for such large transactions. This thinness amplifies volatility and renders price swings more volatile and less predictable.

Crucially, on-chain analysis suggests that these sold-off bitcoins are entering exchange hot wallets in a staggered manner—a red flag for market insiders. This pattern, often associated with intention to distribute rather than hold, signals that Galaxy Digital—or entities acting on their behalf—may be positioning for further liquidations. The net outflow of 40,000 BTC over a week corroborates the hypothesis that a strategic unwind is underway, especially given that the firm’s current holdings still surpass 60,000 BTC. If more assets are to be transitioned into the open market, increased downward pressure could further erode confidence among investors, especially in a period marked by macroeconomic uncertainty and rising inflation concerns.

Institutional Strategies and the Broken Confidence Framework

From a liberal-leaning center-right perspective, these developments depict a cautious yet pragmatic approach by institutional actors. Galaxy Digital, with its reputation for prudent asset management, appears to be navigating a delicate balance—liquidating positions to meet client demands or hedge risk while maintaining a significant residual position of over 60,000 BTC. Their strategic disposal, especially in the face of rising volatility and federal inflation fears, underscores a broader trend of institutions prioritizing risk mitigation amidst turbulent markets.

While some analysts brand this as a damaging sign of capitulation, it may very well reflect an intelligent repositioning—shifting from a long-term hold to more flexible reserve strategies. This approach aligns with a nuanced understanding of market dynamics, favoring liquidity and stabilization over blind hodling. Such behavior, if sustained, could redefine institutional engagement with cryptocurrencies—transforming it from unwavering custodianship to cautious, strategic participation that emphasizes risk management over speculative fervor. As these large transactions continue to unfold, market participants and regulators alike should watch carefully: a pattern of systematic unwinding might portend a short-term dip, but, in the long run, it could signal healthier sector-wide resilience and adaptability.